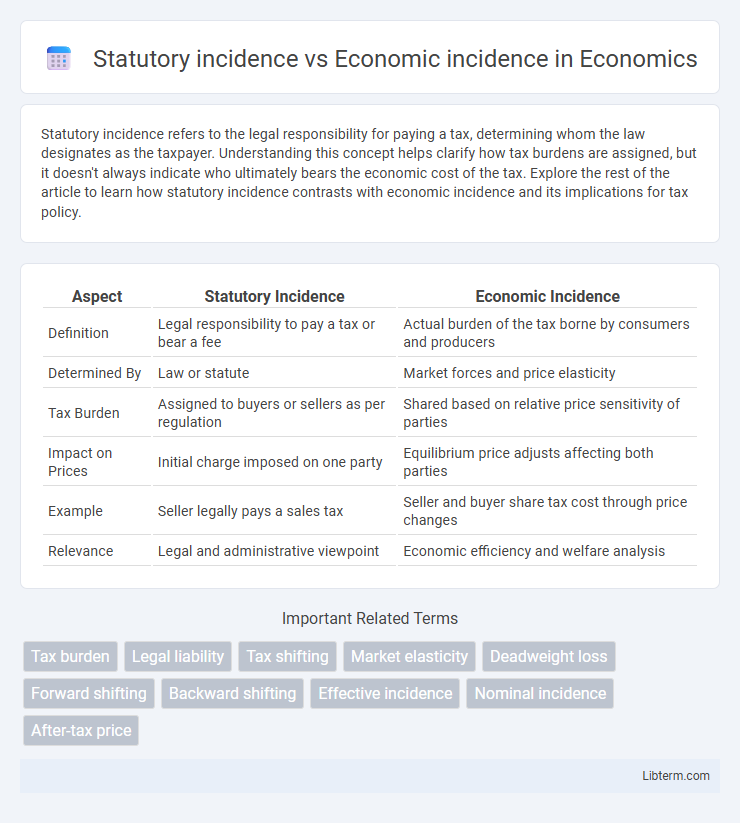

Statutory incidence refers to the legal responsibility for paying a tax, determining whom the law designates as the taxpayer. Understanding this concept helps clarify how tax burdens are assigned, but it doesn't always indicate who ultimately bears the economic cost of the tax. Explore the rest of the article to learn how statutory incidence contrasts with economic incidence and its implications for tax policy.

Table of Comparison

| Aspect | Statutory Incidence | Economic Incidence |

|---|---|---|

| Definition | Legal responsibility to pay a tax or bear a fee | Actual burden of the tax borne by consumers and producers |

| Determined By | Law or statute | Market forces and price elasticity |

| Tax Burden | Assigned to buyers or sellers as per regulation | Shared based on relative price sensitivity of parties |

| Impact on Prices | Initial charge imposed on one party | Equilibrium price adjusts affecting both parties |

| Example | Seller legally pays a sales tax | Seller and buyer share tax cost through price changes |

| Relevance | Legal and administrative viewpoint | Economic efficiency and welfare analysis |

Understanding Statutory Incidence

Statutory incidence refers to the legal assignment of tax payment responsibility, determining who is obligated to remit the tax to the government. This assignment does not necessarily coincide with the actual economic burden, as market forces can shift the cost between producers and consumers. Understanding statutory incidence is crucial for analyzing tax policy, as it reveals the formal tax obligations separate from the real distribution of economic impact.

Defining Economic Incidence

Economic incidence refers to the actual burden of a tax or financial obligation as it falls on consumers and producers, reflecting changes in prices and resource allocation beyond the legal responsibility. Unlike statutory incidence, which identifies who is legally required to pay the tax, economic incidence analyzes how the tax impacts market behavior and who ultimately bears the cost through shifts in supply and demand. Understanding economic incidence is crucial for evaluating the real effects of taxation on different economic agents and assessing policy outcomes.

Key Differences Between Statutory and Economic Incidence

Statutory incidence refers to the legal responsibility imposed by law to pay a tax, while economic incidence measures the actual burden of the tax on consumers or producers regardless of who is legally obligated. Key differences include that statutory incidence is fixed by tax legislation, whereas economic incidence depends on market elasticity and the relative price sensitivity of buyers and sellers. Understanding economic incidence reveals how tax burdens shift through the supply and demand interaction, unlike statutory incidence which only indicates nominal tax liability.

The Role of Supply and Demand Elasticity

Statutory incidence refers to the legal assignment of tax responsibility, while economic incidence measures the actual burden borne by consumers and producers. The distribution of tax burden depends heavily on the relative elasticities of supply and demand; a more inelastic side of the market bears a greater share of the tax. When demand is inelastic but supply is elastic, consumers pay more of the tax, whereas suppliers bear more when supply is inelastic and demand is elastic.

Real-World Examples of Tax Incidence

Statutory incidence refers to who is legally responsible for paying a tax, such as employers paying payroll taxes or consumers paying sales tax, while economic incidence reflects who actually bears the tax burden through price changes or income loss. In the real-world example of cigarette taxes, governments impose the statutory incidence on tobacco companies, but the economic incidence often falls on consumers as prices increase. Similarly, payroll taxes are legally paid by employers, yet workers typically bear the economic incidence through reduced wages, demonstrating the divergence between statutory and economic tax incidence in practice.

Shifting the Burden: Who Actually Pays?

Statutory incidence refers to the legal responsibility to pay a tax, while economic incidence identifies who ultimately bears the tax burden after market adjustments. The burden shifting occurs as firms and consumers respond to taxes by changing prices, wages, or output, determining the final payer of the tax cost. Elasticities of supply and demand crucially influence this incidence, with the more inelastic side of the market absorbing a greater portion of the tax burden.

Government Policy and Tax Incidence

Statutory incidence refers to the legal assignment of tax payment to a specific entity, such as consumers or producers, as determined by government policy. Economic incidence measures the actual burden of the tax on the final economic agents after market adjustments, reflecting changes in prices and behavior. Understanding the difference between statutory and economic incidence is crucial for policymakers to assess the real impact of tax laws on income distribution and market efficiency.

Implications for Businesses and Consumers

Statutory incidence determines who is legally responsible for paying a tax, while economic incidence reveals who actually bears the financial burden after market adjustments. For businesses, statutory incidence affects cash flow and administrative costs, but economic incidence impacts pricing strategies, profit margins, and competitive positioning. Consumers often experience economic incidence through higher prices or reduced product quality, influencing demand elasticity and overall market welfare.

Common Misconceptions About Tax Incidence

Many people mistakenly believe statutory incidence, or the legal responsibility to pay a tax, determines who ultimately bears the tax burden. Economic incidence reveals that the real cost falls on the party--consumers or producers--most able to adjust their behavior in response to price changes. This distinction emphasizes that tax burden shifts depend on the relative price elasticity of supply and demand, not on who is legally obligated to pay the tax.

Analyzing Tax Incidence in Public Finance

Statutory incidence refers to the legal obligation to pay a tax, while economic incidence assesses who actually bears the economic burden, factoring in market responses and price adjustments. Analyzing tax incidence in public finance involves understanding how taxes shift supply and demand, affecting consumers, producers, and resource allocation efficiency. Empirical studies often reveal that economic incidence diverges from statutory incidence due to elasticity differences in supply and demand curves.

Statutory incidence Infographic

libterm.com

libterm.com