A risk-free return refers to the guaranteed yield on an investment with virtually no chance of financial loss, often associated with government bonds or Treasury securities. This type of return is a benchmark for evaluating other investments, helping you assess potential rewards against their risks. Explore the rest of the article to deepen your understanding of how risk-free returns influence your investment strategy.

Table of Comparison

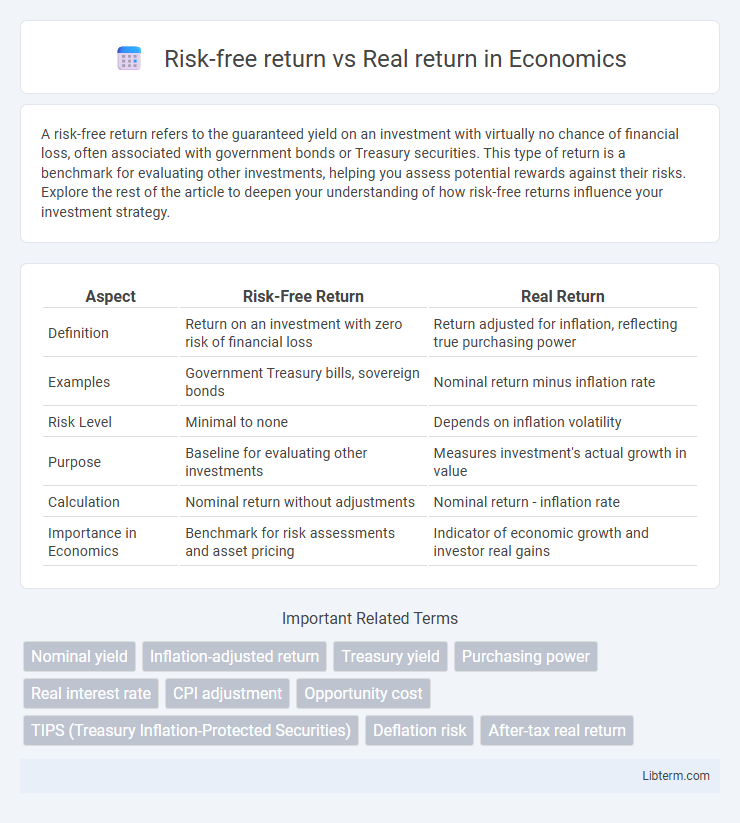

| Aspect | Risk-Free Return | Real Return |

|---|---|---|

| Definition | Return on an investment with zero risk of financial loss | Return adjusted for inflation, reflecting true purchasing power |

| Examples | Government Treasury bills, sovereign bonds | Nominal return minus inflation rate |

| Risk Level | Minimal to none | Depends on inflation volatility |

| Purpose | Baseline for evaluating other investments | Measures investment's actual growth in value |

| Calculation | Nominal return without adjustments | Nominal return - inflation rate |

| Importance in Economics | Benchmark for risk assessments and asset pricing | Indicator of economic growth and investor real gains |

Understanding Risk-Free Return

Risk-free return represents the theoretical yield on an investment with zero risk of financial loss, commonly proxied by government Treasury bills or bonds from stable countries. It serves as the baseline for evaluating investment performance by providing a benchmark unaffected by market volatility or credit risk. Understanding risk-free return is crucial for investors to accurately gauge the true profitability of assets after adjusting for inflation and market fluctuations reflected in the real return.

Defining Real Return

Real return measures the actual increase in purchasing power from an investment after adjusting for inflation, unlike the risk-free return which represents the theoretical yield of an investment with zero risk, such as government bonds. It reflects the true profitability by accounting for the erosion of value caused by rising prices over time. Investors rely on real return to assess the effectiveness of their investments in preserving and growing wealth in real terms.

Key Differences Between Risk-Free and Real Return

Risk-free return represents the guaranteed yield on an investment with zero default risk, typically measured by government bond yields such as U.S. Treasury bonds. Real return adjusts the nominal return for inflation, reflecting the actual increase in purchasing power an investor gains. The key difference lies in risk-free return being nominal and inflation-unadjusted, while real return provides an inflation-adjusted performance metric critical for evaluating true investment profitability.

Factors Affecting Risk-Free Returns

Risk-free returns are primarily influenced by government bond yields, inflation rates, and monetary policy decisions, as these determine the baseline compensation for time value and low default risk. Real returns adjust nominal returns by subtracting inflation, reflecting the actual purchasing power gained from an investment. Changes in central bank interest rates, inflation expectations, and economic stability directly impact risk-free returns, affecting investment decisions and portfolio strategies.

How Inflation Impacts Real Return

Inflation erodes the purchasing power of money, causing real returns to be lower than nominal or risk-free returns. A risk-free return, such as the yield on U.S. Treasury bills, does not account for inflation, resulting in potential loss of value when adjusted for rising prices. Investors must consider the inflation rate to accurately assess the purchasing power preserved or gained in real return calculations.

Calculating Risk-Free Return

The risk-free return is calculated by using the yield on government securities, such as U.S. Treasury bills, which are considered free of default risk. This rate represents the foundational benchmark for measuring investment performance without exposure to risk factors like inflation or credit risk. Real return is derived by adjusting the nominal risk-free return for inflation, providing a more accurate measure of purchasing power gains.

Methods to Determine Real Return

Calculating real return involves adjusting the nominal return by the inflation rate to measure the investment's true purchasing power, often using the Fisher equation: Real Return = Nominal Return - Inflation Rate. Another method includes using the Consumer Price Index (CPI) to deflate nominal returns, providing an inflation-adjusted figure essential for accurate performance assessment. Analysts may also incorporate expected inflation rates derived from Treasury Inflation-Protected Securities (TIPS) to estimate future real returns more precisely.

Importance in Investment Decision-Making

Risk-free return represents the theoretical yield on an investment with zero risk, often benchmarked by government treasury bonds, serving as a baseline for evaluating investment opportunities. Real return accounts for inflation-adjusted gains, providing a clearer measure of an investment's true purchasing power and profitability. Understanding the difference between risk-free and real returns is crucial for investors to make informed decisions, optimize portfolio allocation, and achieve long-term financial goals.

Practical Examples: Risk-Free vs Real Return

A risk-free return typically refers to the yield on government Treasury bills, such as U.S. 3-month T-bills, which currently offer around 4% annual interest with minimal default risk. In contrast, real return accounts for inflation adjustment; for example, if a T-bill yields 4% but inflation runs at 2%, the real return is approximately 2%, reflecting true purchasing power gains. Investors comparing a corporate bond's nominal yield of 6% with an inflation rate of 3% see a real return near 3%, which is riskier than a Treasury bill but potentially more profitable after inflation.

Choosing Between Risk-Free and Real Return for Your Portfolio

Choosing between risk-free return and real return for your portfolio requires evaluating your risk tolerance and investment goals. Risk-free returns, often represented by government Treasury bills, provide stability and preserve capital but typically offer lower yields than real returns. Real returns account for inflation and offer potential growth, making them essential for long-term wealth accumulation despite increased volatility.

Risk-free return Infographic

libterm.com

libterm.com