Transaction costs impact the efficiency of market exchanges by representing the fees and resources expended during buying or selling goods and services. Minimizing these costs can enhance your profitability and streamline business operations. Explore the rest of the article to understand different types of transaction costs and strategies to reduce them effectively.

Table of Comparison

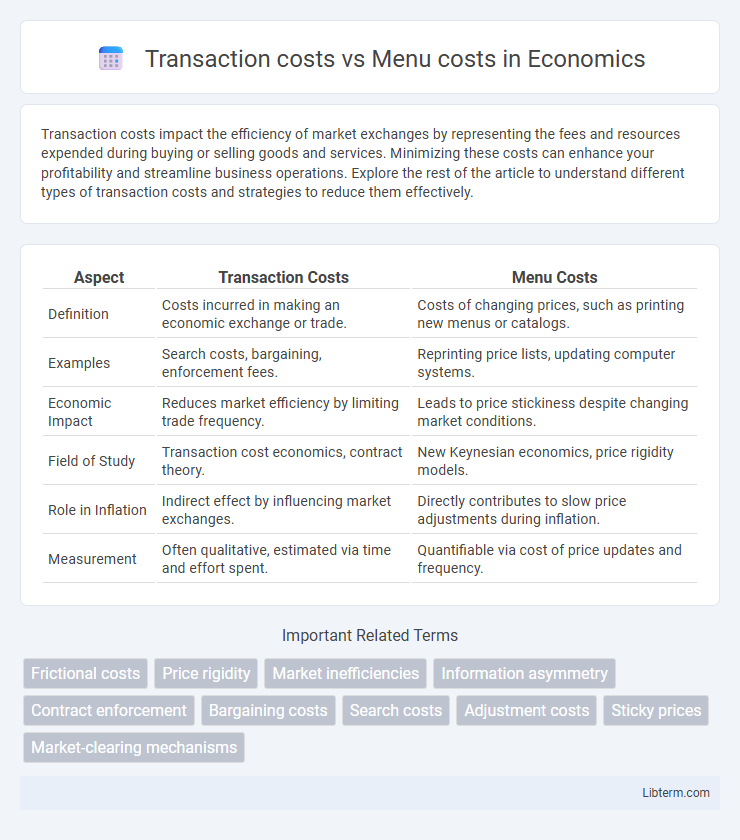

| Aspect | Transaction Costs | Menu Costs |

|---|---|---|

| Definition | Costs incurred in making an economic exchange or trade. | Costs of changing prices, such as printing new menus or catalogs. |

| Examples | Search costs, bargaining, enforcement fees. | Reprinting price lists, updating computer systems. |

| Economic Impact | Reduces market efficiency by limiting trade frequency. | Leads to price stickiness despite changing market conditions. |

| Field of Study | Transaction cost economics, contract theory. | New Keynesian economics, price rigidity models. |

| Role in Inflation | Indirect effect by influencing market exchanges. | Directly contributes to slow price adjustments during inflation. |

| Measurement | Often qualitative, estimated via time and effort spent. | Quantifiable via cost of price updates and frequency. |

Introduction to Transaction Costs and Menu Costs

Transaction costs refer to the expenses incurred when buying or selling goods and services, including search, negotiation, and enforcement costs. Menu costs are a specific type of transaction cost associated with changing prices, such as updating price lists or re-tagging items. Understanding the distinction between these costs is critical in economic theory, as transaction costs encompass a broader range of expenses impacting market efficiency, whereas menu costs mainly affect pricing strategies within firms.

Defining Transaction Costs

Transaction costs refer to the expenses incurred during the process of buying or selling goods and services, including search and information costs, bargaining costs, and enforcement costs. These costs influence economic efficiency by affecting the feasibility and frequency of exchanges in markets. In contrast, menu costs specifically represent the expenses firms face when changing prices, such as printing new menus or updating price tags.

Understanding Menu Costs: An Overview

Menu costs represent the expenses that firms incur when changing prices, such as printing new menus, updating price lists, or reprogramming electronic systems. These costs create frictions in price adjustments, influencing a company's pricing strategy and potentially leading to price stickiness in the market. Understanding menu costs is essential for analyzing inflation dynamics and the impact of monetary policy on business pricing behavior.

Key Differences Between Transaction and Menu Costs

Transaction costs refer to the expenses incurred when buying or selling goods and services, including fees, taxes, and time spent, while menu costs specifically denote the costs businesses face when changing prices, such as printing new menus or updating price tags. Transaction costs affect market efficiency and trading frequency, whereas menu costs influence price flexibility and inflation responsiveness. Understanding these distinctions helps firms optimize pricing strategies and reduces inefficiencies in both market operations and customer interactions.

Factors Influencing Transaction Costs

Transaction costs are influenced by factors such as market liquidity, the complexity of the transaction, and regulatory requirements, which affect the overall expense and time needed to complete trades or exchanges. In contrast, menu costs mainly involve the physical or administrative expenses linked to changing prices, like reprinting menus or updating price lists. Understanding these distinctions highlights how transaction costs encompass broader economic influences beyond the direct, tangible adjustments represented by menu costs.

What Drives Menu Costs in Business?

Menu costs in business are primarily driven by the expenses associated with changing prices, including the physical reprinting of menus, updating digital platforms, and communicating new pricing to customers. These costs also encompass employee time spent on price adjustments and potential customer dissatisfaction due to frequent price changes. Businesses with complex products or fluctuating input costs tend to experience higher menu costs, impacting their pricing strategies and overall profitability.

Real-World Examples: Transaction Costs vs Menu Costs

Transaction costs, such as brokerage fees and taxes involved in buying stocks, directly influence trading frequency and investment decisions, as seen in high-frequency trading firms optimizing algorithms to minimize these expenses. Menu costs refer to the expenses a business incurs when changing prices, exemplified by restaurants updating printed menus to reflect ingredient cost fluctuations or retail stores adjusting price tags during inflationary periods. Both costs impact economic behavior by affecting the willingness to trade frequently or adjust prices, with transaction costs influencing financial markets and menu costs shaping pricing strategies in brick-and-mortar retail.

Economic Impact of Transaction and Menu Costs

Transaction costs and menu costs both influence economic efficiency by affecting resource allocation and market behavior. High transaction costs reduce trade frequency and liquidity, leading to less optimal market outcomes, while menu costs discourage price adjustments, causing price stickiness and market inefficiencies. Economies with lower transaction and menu costs experience improved economic growth through enhanced market flexibility and more efficient price signals.

Strategies to Reduce Transaction and Menu Costs

Strategies to reduce transaction costs include leveraging digital payment platforms, automating accounting processes, and consolidating transactions to minimize fees. To lower menu costs, businesses can adopt dynamic pricing software, implement real-time data analytics for price adjustments, and streamline product offerings to reduce the frequency and complexity of price changes. Combining technology solutions and process optimization effectively minimizes both transaction and menu costs, enhancing overall operational efficiency.

Conclusion: Balancing Transaction and Menu Costs for Efficiency

Balancing transaction costs and menu costs is crucial for optimizing economic efficiency and minimizing total expenses in market operations. Efficient management involves reducing transaction costs without incurring excessive menu costs related to price adjustments or administrative changes. Striking the right balance supports smoother market transactions and better resource allocation, enhancing overall economic performance.

Transaction costs Infographic

libterm.com

libterm.com