Information costs refer to the expenses incurred in gathering, processing, and analyzing data necessary for making informed decisions. These costs can impact business strategies, market efficiency, and consumer behavior by influencing how much information is accessible and reliable. Explore the rest of this article to understand how managing information costs can improve your decision-making process.

Table of Comparison

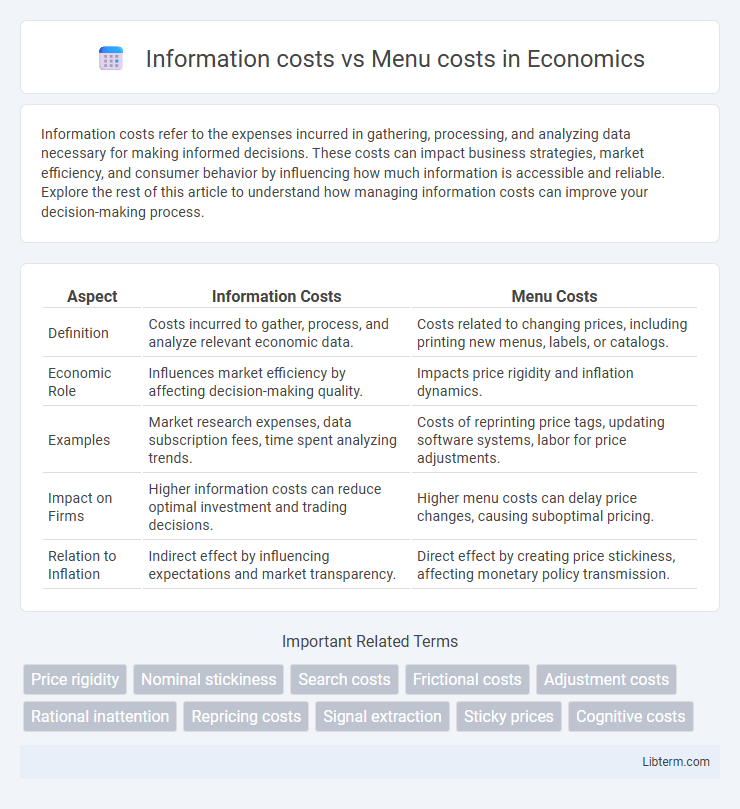

| Aspect | Information Costs | Menu Costs |

|---|---|---|

| Definition | Costs incurred to gather, process, and analyze relevant economic data. | Costs related to changing prices, including printing new menus, labels, or catalogs. |

| Economic Role | Influences market efficiency by affecting decision-making quality. | Impacts price rigidity and inflation dynamics. |

| Examples | Market research expenses, data subscription fees, time spent analyzing trends. | Costs of reprinting price tags, updating software systems, labor for price adjustments. |

| Impact on Firms | Higher information costs can reduce optimal investment and trading decisions. | Higher menu costs can delay price changes, causing suboptimal pricing. |

| Relation to Inflation | Indirect effect by influencing expectations and market transparency. | Direct effect by creating price stickiness, affecting monetary policy transmission. |

Understanding Information Costs

Information costs refer to the expenses incurred while gathering, processing, and analyzing data necessary for making informed economic decisions. These costs influence market efficiency by affecting how quickly and accurately agents can respond to price changes or new information. Understanding information costs is crucial for businesses and consumers to optimize decision-making and resource allocation in dynamic markets.

Defining Menu Costs

Menu costs refer to the expenses that firms incur when changing prices, including printing new menus, updating marketing materials, and reprogramming computer systems; these costs can discourage frequent price adjustments. Information costs involve the resources spent by firms and consumers to gather and process data about market conditions and prices. Understanding menu costs is crucial for analyzing price stickiness and its impact on market efficiency and inflation dynamics.

Key Differences Between Information and Menu Costs

Information costs refer to the expenses incurred in gathering and processing data necessary for making informed economic decisions, while menu costs are the tangible costs businesses face when changing prices, such as printing new menus or labels. Information costs primarily involve sourcing, analyzing, and interpreting market signals, influencing price adjustments indirectly through better decision-making. In contrast, menu costs directly impact price stickiness by imposing immediate financial burdens on firms whenever price revisions are implemented.

The Role of Information Costs in Decision-Making

Information costs significantly impact decision-making by influencing the amount and quality of data individuals or firms gather before making economic choices. Higher information costs can lead to suboptimal decisions as decision-makers may rely on incomplete or outdated information to avoid the expense of thorough data collection. This contrasts with menu costs, which are the expenses associated with changing prices, highlighting that information costs primarily affect the initial gathering and processing of data rather than the adjustment process itself.

How Menu Costs Affect Business Pricing

Menu costs represent the expenses businesses incur when changing prices, including printing new menus, updating labels, and reprogramming systems, which can deter frequent price adjustments despite changing market conditions. High menu costs lead businesses to maintain stable prices, potentially resulting in temporary misalignment with demand or cost fluctuations. Understanding these costs helps firms balance the trade-off between pricing accuracy and the operational burden of adjustments.

Economic Theories Involving Information and Menu Costs

Information costs represent the expenses incurred in gathering and processing market data to make informed economic decisions, influencing price adjustments and consumer behavior. Menu costs refer to the costs businesses face when changing prices, such as printing new menus or updating software, which can cause price rigidity despite changes in market conditions. Economic theories integrating information and menu costs explain price stickiness and imperfect competition by highlighting how firms balance the trade-offs between the costs of acquiring information and the costs of adjusting prices.

Real-World Examples of Information Costs

Information costs refer to the expenses incurred in gathering and processing data necessary for making informed economic decisions, such as market research fees or monitoring competitor prices. In real-world examples, online retailers invest heavily in data analytics tools and consumer behavior tracking to optimize pricing strategies and reduce uncertainty. These costs contrast with menu costs, which are the tangible expenses firms face when physically changing prices, like printing new menus or updating labels.

Real-World Examples of Menu Costs

Menu costs refer to the tangible expenses businesses incur when changing prices, such as printing new menus in restaurants or updating price tags on retail products. In the real world, large retail chains like Walmart face significant menu costs when adjusting prices across thousands of items, leading to infrequent price changes despite fluctuating demand or supply conditions. Information costs differ as they involve the resources spent by consumers and firms to gather and analyze data before making economic decisions, such as monitoring competitor prices or market trends.

Impact on Market Efficiency

Information costs, the expenses incurred to gather and process relevant market data, directly influence market efficiency by affecting the speed and accuracy of price adjustments. Menu costs, the costs firms face when changing prices, contribute to price stickiness, which can lead to short-term market inefficiencies and distort resource allocation. Together, high information costs and significant menu costs slow down the equilibrium adjustment process, reducing overall market responsiveness and efficiency.

Strategies to Minimize Information and Menu Costs

Firms implement advanced digital platforms and real-time data analytics to minimize information costs, enabling quicker access to market trends and competitor pricing. To reduce menu costs, companies adopt flexible pricing strategies such as dynamic pricing software and automated price adjustments, thereby lowering the expense of physically updating price lists or catalogs. Integrating both approaches improves overall pricing efficiency and responsiveness in competitive markets.

Information costs Infographic

libterm.com

libterm.com