The three-sector model divides the economy into primary, secondary, and tertiary sectors, highlighting the evolution from agriculture and raw material extraction to manufacturing and services. Understanding this framework helps you analyze economic growth patterns and labor distribution across industries. Explore the full article to see how this model impacts modern economies worldwide.

Table of Comparison

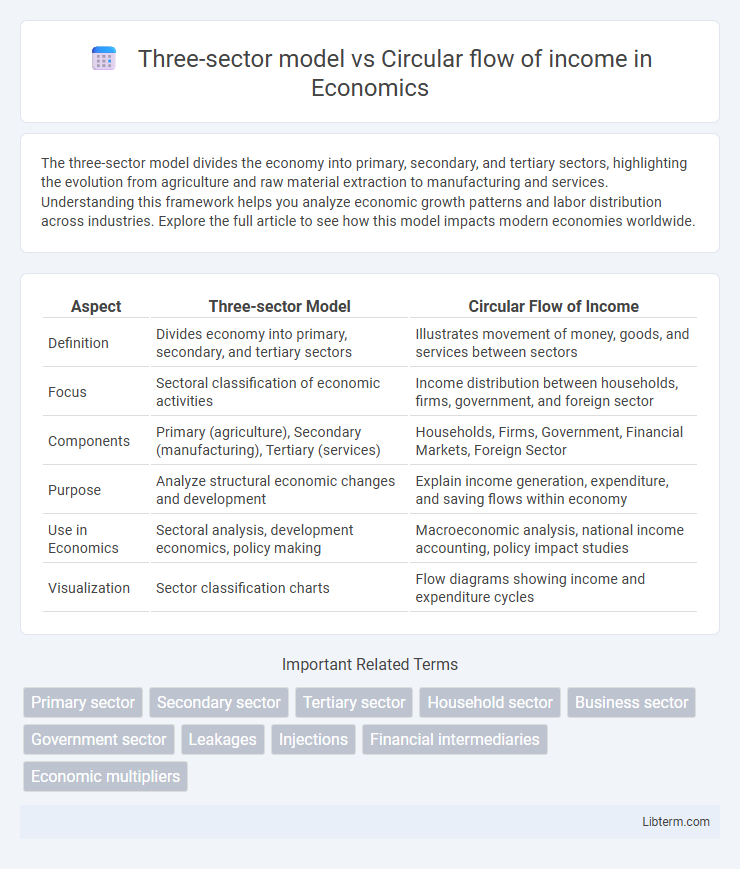

| Aspect | Three-sector Model | Circular Flow of Income |

|---|---|---|

| Definition | Divides economy into primary, secondary, and tertiary sectors | Illustrates movement of money, goods, and services between sectors |

| Focus | Sectoral classification of economic activities | Income distribution between households, firms, government, and foreign sector |

| Components | Primary (agriculture), Secondary (manufacturing), Tertiary (services) | Households, Firms, Government, Financial Markets, Foreign Sector |

| Purpose | Analyze structural economic changes and development | Explain income generation, expenditure, and saving flows within economy |

| Use in Economics | Sectoral analysis, development economics, policy making | Macroeconomic analysis, national income accounting, policy impact studies |

| Visualization | Sector classification charts | Flow diagrams showing income and expenditure cycles |

Introduction to Economic Models

The Three-sector model expands the Circular Flow of Income by incorporating the government sector alongside households and firms, illustrating more complex economic interactions like taxation and public spending. This model enhances understanding of national income distribution and fiscal policy effects, offering a detailed framework compared to the simpler two-sector circular flow. Using these models helps economists analyze how resources and money cycle through the economy, capturing both market exchanges and government interventions.

Overview of the Three-Sector Model

The Three-Sector Model divides the economy into the primary, secondary, and tertiary sectors, representing agriculture, manufacturing, and services respectively, highlighting the structural composition of economic activities. This model emphasizes the relative contribution of each sector to GDP and employment, reflecting stages of economic development from agrarian to industrial to service-oriented economies. Unlike the Circular Flow of Income, which illustrates the movement of money and resources between households and firms, the Three-Sector Model provides a framework for analyzing changes in output and labor distribution across distinct economic sectors.

Components of the Circular Flow of Income

The Circular Flow of Income model illustrates the continuous movement of money, goods, and services between households, businesses, and the government, emphasizing key components such as consumption, production, and taxation. The Three-sector model expands this by integrating the government sector, highlighting government expenditures and tax revenues alongside household consumption and firm investments. Understanding these components is crucial to analyzing national income distribution and economic activity within an open economy framework.

Differences Between Three-Sector Model and Circular Flow of Income

The Three-sector model includes households, businesses, and government, emphasizing the role of government in economic activities, unlike the Circular Flow of Income which primarily focuses on interactions between households and businesses. The Circular Flow of Income illustrates the continuous movement of money, goods, and services in a simplified economy, while the Three-sector model introduces additional complexity by accounting for government spending, taxation, and fiscal policies. This inclusion in the Three-sector model enables more detailed analysis of public sector influence on national income, economic output, and resource allocation.

Role of Households, Firms, and Government

Households in the Three-sector model supply labor and consume goods while paying taxes, influencing government revenue and social services, whereas in the Circular flow of income, they primarily act as consumers and resource providers. Firms produce goods and services, generate income by selling to households and government, and pay taxes in both models, fueling economic activity and public expenditure. Government collects taxes from households and firms, redistributes income through spending on public goods and services in the Three-sector model, enhancing economic stability compared to the simplified flows in the circular income framework.

Inclusion of Financial and Foreign Sectors

The three-sector model includes households, firms, and the government, emphasizing real economic activities without explicitly accounting for financial or foreign sectors. In contrast, the circular flow of income expands to incorporate the financial sector, capturing savings and investments, and the foreign sector, reflecting exports and imports, providing a more comprehensive representation of economic interactions. This inclusion allows the circular flow model to analyze leakages and injections affecting national income and economic equilibrium more effectively.

Flow of Goods, Services, and Money in Each Model

The Three-sector model emphasizes the interaction between households, firms, and the government, where goods and services flow from firms to households and government, while money flows from households and government as consumption and taxes to firms. The Circular flow of income model illustrates the continuous movement of money, goods, and services between households and firms, highlighting how households provide factors of production to firms and receive wages, which they spend on goods and services produced by firms. In both models, the key distinction lies in the inclusion of the government sector in the Three-sector model, adding layers of taxation and government spending that influence the flow of money and resources.

Limitations of the Three-Sector Model

The Three-Sector Model simplifies the economy into primary, secondary, and tertiary sectors but fails to capture the complexity of modern economies with quaternary and quinary sectors. It overlooks the intricate interactions between households, firms, government, and foreign sectors, which the Circular Flow of Income model integrates more effectively. This limitation reduces its practical applicability in analyzing income distribution, economic growth, and policy impacts across diverse economic activities.

Advantages of the Circular Flow Framework

The Circular Flow of Income model effectively illustrates the continuous movement of money, goods, and services between households, businesses, and the government, providing a comprehensive understanding of economic interactions. It incorporates income generation, expenditure, and resource allocation, allowing for accurate analysis of macroeconomic stability and policy impacts. This framework supports more precise measurement of national income and highlights the role of savings, investments, and government interventions in maintaining economic equilibrium.

Implications for Economic Policy and Analysis

The Three-sector model, incorporating households, firms, and government, highlights the role of fiscal policy in regulating economic activity through government spending and taxation, enabling targeted interventions to stabilize growth and control inflation. The Circular flow of income model emphasizes the continuous movement of money between sectors, providing a foundational framework for analyzing income distribution, aggregate demand, and national output without explicitly accounting for government actions. Policymakers utilize the Three-sector model for crafting budgetary policies, while the Circular flow model aids in understanding overall economic equilibrium and multiplier effects, both essential for effective macroeconomic management.

Three-sector model Infographic

libterm.com

libterm.com