Stamp duty is a tax imposed on legal documents, commonly associated with property transactions and agreements. Understanding how this duty impacts your purchase or sale can save you significant money and prevent legal complications. Explore the rest of the article to learn how stamp duty affects you and ways to manage it effectively.

Table of Comparison

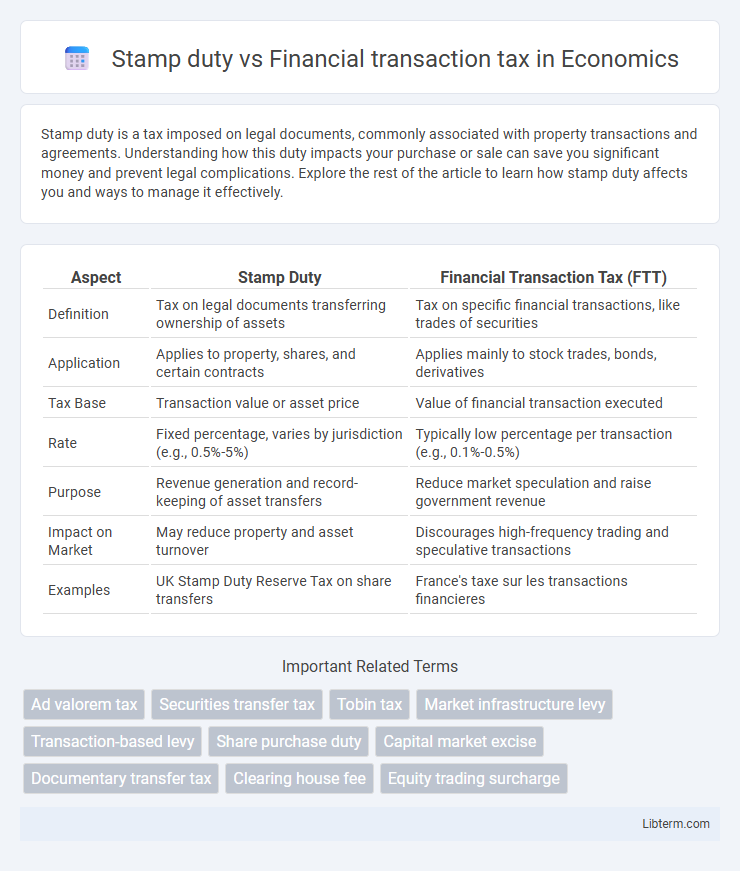

| Aspect | Stamp Duty | Financial Transaction Tax (FTT) |

|---|---|---|

| Definition | Tax on legal documents transferring ownership of assets | Tax on specific financial transactions, like trades of securities |

| Application | Applies to property, shares, and certain contracts | Applies mainly to stock trades, bonds, derivatives |

| Tax Base | Transaction value or asset price | Value of financial transaction executed |

| Rate | Fixed percentage, varies by jurisdiction (e.g., 0.5%-5%) | Typically low percentage per transaction (e.g., 0.1%-0.5%) |

| Purpose | Revenue generation and record-keeping of asset transfers | Reduce market speculation and raise government revenue |

| Impact on Market | May reduce property and asset turnover | Discourages high-frequency trading and speculative transactions |

| Examples | UK Stamp Duty Reserve Tax on share transfers | France's taxe sur les transactions financieres |

Overview of Stamp Duty and Financial Transaction Tax

Stamp duty is a tax levied on legal documents, most commonly on the transfer of property or shares, typically calculated as a percentage of the transaction value. Financial transaction tax (FTT) targets trades of financial instruments such as stocks, bonds, and derivatives, imposing a small fee to reduce market volatility and generate public revenue. Both taxes serve fiscal and regulatory purposes but differ in scope, with stamp duty emphasizing asset transfer documentation and FTT focusing on the frequency and volume of financial trades.

Key Differences Between Stamp Duty and Financial Transaction Tax

Stamp duty is a one-time tax levied on legal documents, primarily during the transfer of ownership of assets like property or shares, whereas a financial transaction tax (FTT) is imposed on trades or transactions involving financial instruments such as stocks, bonds, or derivatives. Stamp duty rates are typically fixed or based on the asset's value at the point of transfer, while FTTs are usually a small percentage charged on the transaction amount and can apply repeatedly on multiple trades. Key differences include the scope of application, with stamp duty targeting ownership transfers and FTT aiming at trading activities, as well as the impact on market liquidity, since FTTs can influence trading volume more directly than stamp duties.

Historical Evolution of Both Taxes

Stamp duty originated in the 17th century as a tax on legal documents and transactions, primarily introduced to raise revenue for governments during wartime. Financial transaction tax (FTT), however, emerged more recently in the 20th century as a tool aimed at reducing market volatility and generating revenue from high-frequency trading. Both taxes evolved in response to economic conditions and policy objectives, with stamp duty maintaining a broad historical presence while FTT reflects modern regulatory concerns in financial markets.

Global Prevalence and Implementation

Stamp duty is globally prevalent in countries such as the United Kingdom, India, and Hong Kong, primarily applied to property transactions and legal documents with rates varying widely between jurisdictions. Financial transaction tax (FTT) sees implementation in regions like the European Union, Japan, and parts of Latin America, targeting securities trades with objectives to curb speculative trading and generate public revenue. While stamp duty is typically a fixed percentage of transaction value, FTT often impacts a broader range of financial instruments, reflecting differing regulatory priorities and market structures worldwide.

Taxpayer Impact: Who Bears the Cost?

Stamp duty primarily affects buyers and sellers of property or shares, who directly pay a percentage of the transaction value, often leading to higher upfront costs and potentially reduced market liquidity. Financial transaction tax (FTT) imposes a levy on the value of trades in financial markets, which can be indirectly borne by investors through increased trading costs, wider bid-ask spreads, and reduced market efficiency. Both taxes may influence investor behavior, but stamp duty's impact is more concentrated on specific asset transfers, whereas FTT broadly affects market participants across various financial instruments.

Revenue Generation and Economic Effects

Stamp duty generates significant government revenue through taxes on legal documents, particularly property transactions, often resulting in reduced housing market liquidity and potential distortions in buyer behavior. Financial transaction tax (FTT) targets trades on financial markets, raising revenue by imposing small levies on securities transactions, which can decrease high-frequency trading and reduce market volatility but may also lower trading volumes and increase costs for investors. Both taxes contribute to revenue generation but differ in economic effects, with stamp duty primarily impacting real estate markets and FTT influencing financial market dynamics.

Administration and Compliance Challenges

Stamp duty involves complex paperwork and time-consuming verification processes, leading to higher administrative costs and delays for both taxpayers and authorities. Financial transaction tax systems require real-time tracking of high volumes of trades, demanding advanced technology infrastructure and robust data management to prevent evasion and ensure accurate reporting. Compliance challenges in stamp duty include identifying taxable events and assets, whereas financial transaction taxes face issues in monitoring cross-border transactions and multiple intermediaries.

Pros and Cons for Investors and Markets

Stamp duty imposes a direct tax on the transfer of ownership of assets, providing clear government revenue but potentially increasing transaction costs and reducing market liquidity for investors. Financial transaction tax applies broadly to various trades, discouraging excessive speculation and stabilizing markets, yet it may also lead to higher costs for frequent traders and lower trading volumes. Both taxes aim to generate fiscal revenue and curb market volatility but differ in scope, impact on investment strategies, and market efficiency.

Recent Trends and Policy Shifts

Recent trends in stamp duty reveal a shift towards digital transactions, with many governments reducing rates or introducing exemptions to promote electronic property and securities transfers. Financial transaction tax (FTT) policies are increasingly targeted at high-frequency trading and large financial institutions to curb market volatility and generate public revenue, reflecting a growing focus on financial market stability. Several countries are recalibrating these taxes to balance economic growth with revenue needs, incorporating technology-driven compliance measures and cross-border coordination.

Future Outlook: Taxation on Financial Transactions

Stamp duty and financial transaction tax (FTT) represent evolving tools in fiscal policy aimed at regulating market activities and generating government revenue. The future outlook for taxation on financial transactions suggests increased adoption of FTTs due to growing digital finance and cross-border trading complexities, promoting fairness and reducing speculative trading. Regulatory bodies worldwide are exploring harmonized FTT frameworks to balance market stability with economic growth, reinforcing transparent and efficient financial markets.

Stamp duty Infographic

libterm.com

libterm.com