The Quantity Theory of Money explains the relationship between the money supply, price level, and economic output, suggesting that changes in money supply directly affect inflation rates when velocity and output are constant. This theory is crucial for understanding monetary policy and its impact on your purchasing power and overall economy. Dive into the rest of this article to explore how this theory shapes financial decisions and economic stability.

Table of Comparison

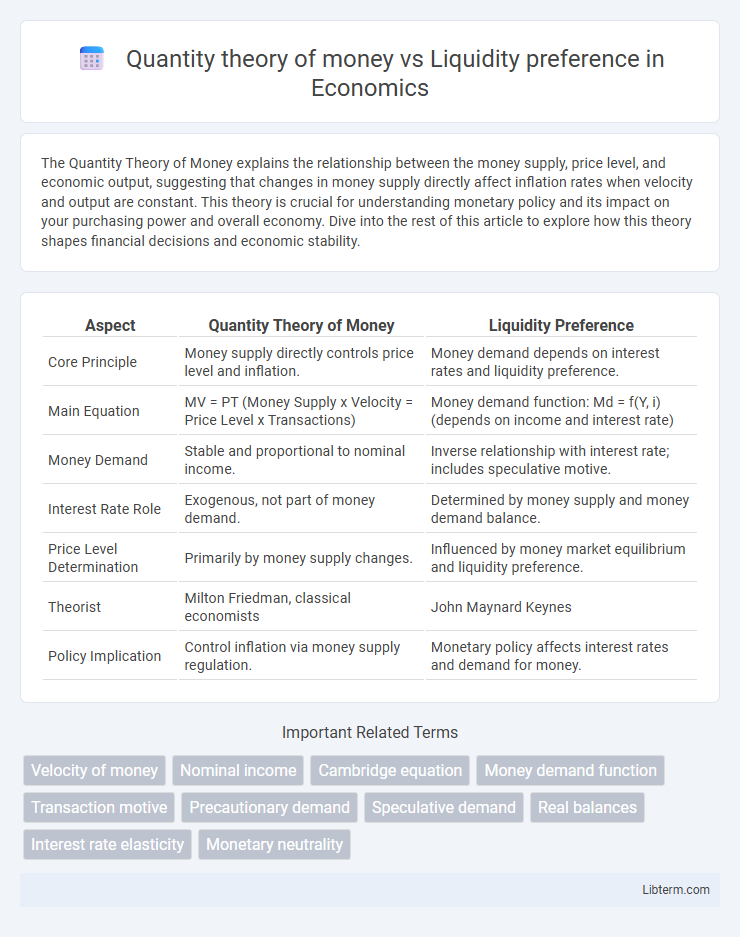

| Aspect | Quantity Theory of Money | Liquidity Preference |

|---|---|---|

| Core Principle | Money supply directly controls price level and inflation. | Money demand depends on interest rates and liquidity preference. |

| Main Equation | MV = PT (Money Supply x Velocity = Price Level x Transactions) | Money demand function: Md = f(Y, i) (depends on income and interest rate) |

| Money Demand | Stable and proportional to nominal income. | Inverse relationship with interest rate; includes speculative motive. |

| Interest Rate Role | Exogenous, not part of money demand. | Determined by money supply and money demand balance. |

| Price Level Determination | Primarily by money supply changes. | Influenced by money market equilibrium and liquidity preference. |

| Theorist | Milton Friedman, classical economists | John Maynard Keynes |

| Policy Implication | Control inflation via money supply regulation. | Monetary policy affects interest rates and demand for money. |

Introduction to Monetary Theories

The Quantity Theory of Money emphasizes the direct relationship between money supply and price levels, asserting that an increase in money supply leads to proportional inflation when velocity and output are constant. In contrast, the Liquidity Preference Theory, introduced by Keynes, highlights the demand for money based on interest rates and individuals' preference for liquidity, affecting investment and interest rate determination. Both theories provide foundational insights into monetary policy, shaping central bank strategies on controlling inflation and influencing economic activity.

Overview of Quantity Theory of Money

The Quantity Theory of Money asserts that the general price level is directly proportional to the money supply, emphasizing the equation of exchange (MV = PT), where M is money supply, V is velocity of money, P is price level, and T is transaction volume. This theory highlights that controlling the money supply is crucial for managing inflation and economic stability. It contrasts with the Liquidity Preference Theory, which centers on interest rates and money demand driven by transaction, precautionary, and speculative motives.

Essentials of Liquidity Preference Theory

Liquidity preference theory centers on the demand for money as a function of interest rates, positing that individuals hold money for transactions, precaution, and speculative motives. Unlike the Quantity Theory of Money, which emphasizes a direct relationship between money supply and price levels, liquidity preference highlights the role of interest rates in determining money demand and thus equilibrium in the money market. Central to this theory is the liquidity trap concept, where interest rates are so low that liquidity preference becomes infinitely elastic, making monetary policy ineffective.

Historical Development of Both Theories

The Quantity Theory of Money, rooted in classical economics and formalized by Irving Fisher in the early 20th century, asserts a direct relationship between money supply and price levels, emphasizing monetary neutrality in the long run. In contrast, Keynes' Liquidity Preference Theory emerged during the 1930s Great Depression, highlighting money demand driven by interest rates and uncertainty, thereby influencing short-term interest rate determination. Both theories have profoundly shaped monetary policy, with Quantity Theory underpinning monetarist schools and Liquidity Preference informing Keynesian economics.

Key Assumptions: Quantity Theory vs. Liquidity Preference

The Quantity Theory of Money assumes a direct, proportional relationship between money supply and price levels, emphasizing that velocity and output remain constant in the short run. In contrast, the Liquidity Preference Theory presumes that money demand depends on interest rates, with individuals holding money for transactions, precautionary, and speculative motives. The Quantity Theory treats money primarily as a medium of exchange, while Liquidity Preference incorporates money as an asset influenced by expectations of future interest rate changes.

Money Demand: Classical vs. Keynesian Perspectives

The Classical Quantity Theory of Money posits that money demand is primarily a stable function of nominal income, emphasizing a direct proportionality between money demand and the price level, with velocity assumed constant. In contrast, Keynesian Liquidity Preference theory views money demand as influenced by interest rates and uncertainty, highlighting speculative and precautionary motives alongside transactional needs, thus rendering money demand more sensitive to changes in interest rates. This fundamental divergence underscores Classical reliance on the assumption of money as a passive medium versus the Keynesian recognition of money's active role in influencing economic activity through liquidity preferences.

Impact on Inflation and Interest Rates

The Quantity Theory of Money emphasizes that an increase in the money supply directly leads to proportional inflation, assuming velocity and output are constant, with little effect on interest rates in the short term. In contrast, the Liquidity Preference Theory highlights how demand for money balances influences interest rates, where higher money demand raises interest rates and can moderate inflation by controlling spending. Central banks use these theories differently: the Quantity Theory guides inflation targeting through money supply control, while Liquidity Preference informs interest rate adjustments to balance inflation and economic activity.

Policy Implications: Monetarist vs. Keynesian Views

Monetarists emphasize controlling the money supply to regulate inflation, advocating for steady, predictable growth in money supply to ensure price stability and economic growth, whereas Keynesians prioritize interest rate adjustments and fiscal interventions to manage demand and address unemployment. Monetarist policy implications call for central banks to focus on monetary rules, reducing discretionary policy to avoid inflationary spirals. Keynesian policy supports active central bank intervention and government spending to influence liquidity preference and stimulate economic activity during downturns.

Critiques and Modern Relevance

The Quantity Theory of Money faces criticism for its oversimplification, assuming a fixed velocity of money and neglecting the role of interest rates and liquidity preferences in influencing money demand. In contrast, Keynes's Liquidity Preference Theory addresses these shortcomings by emphasizing the demand for money based on interest rate fluctuations and uncertainty, offering a more dynamic view of monetary behavior. Modern relevance lies in central banks' reliance on liquidity preference insights to manage interest rates and monetary policy, reflecting the theory's adaptability to contemporary financial markets beyond the Quantity Theory's constraints.

Conclusion: Comparative Insights

The Quantity Theory of Money emphasizes the direct relationship between money supply and price levels, highlighting inflation control through monetary expansion limits. Liquidity Preference theory prioritizes interest rates and the demand for money as a store of value, stressing central banks' role in managing liquidity to stabilize the economy. Comparing both reveals complementary insights: while Quantity Theory focuses on long-term price stability tied to money supply, Liquidity Preference addresses short-term interest rate fluctuations and economic activity.

Quantity theory of money Infographic

libterm.com

libterm.com