Wagner's law explains the relationship between economic growth and government spending, stating that as an economy expands, public expenditure tends to increase both in absolute terms and as a proportion of GDP. This principle highlights how rising incomes lead to greater demand for public services such as education, healthcare, and infrastructure. Explore the rest of the article to understand how Wagner's law impacts fiscal policy and economic planning.

Table of Comparison

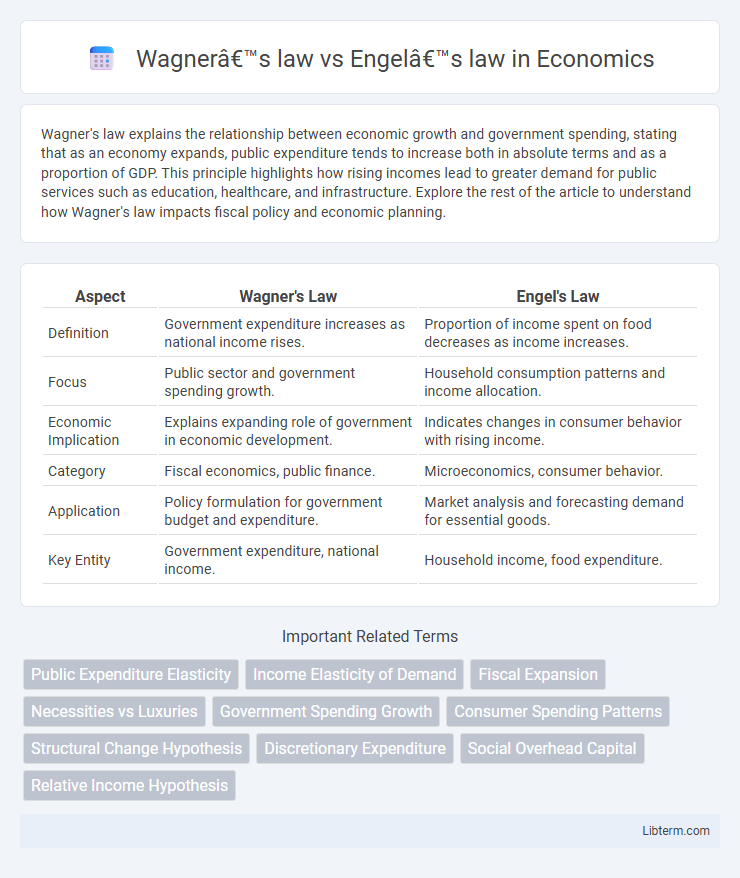

| Aspect | Wagner's Law | Engel's Law |

|---|---|---|

| Definition | Government expenditure increases as national income rises. | Proportion of income spent on food decreases as income increases. |

| Focus | Public sector and government spending growth. | Household consumption patterns and income allocation. |

| Economic Implication | Explains expanding role of government in economic development. | Indicates changes in consumer behavior with rising income. |

| Category | Fiscal economics, public finance. | Microeconomics, consumer behavior. |

| Application | Policy formulation for government budget and expenditure. | Market analysis and forecasting demand for essential goods. |

| Key Entity | Government expenditure, national income. | Household income, food expenditure. |

Introduction to Wagner’s Law and Engel’s Law

Wagner's Law posits that public expenditure tends to increase as a country's economy grows, reflecting expanding government functions in sectors like education, health, and infrastructure. Engel's Law states that as household income rises, the proportion of income spent on food declines, although total food expenditure may still increase. Both laws highlight fundamental patterns in economic behavior: Wagner's Law emphasizes government spending dynamics tied to income growth, while Engel's Law focuses on consumer spending patterns related to income changes.

Historical Context and Origins

Wagner's Law, formulated by economist Adolph Wagner in the late 19th century, posits that as a nation's economy develops, public expenditure increases disproportionately, reflecting expanding government roles during industrialization. Engel's Law, introduced by statistician Ernst Engel in the mid-19th century, reveals that the proportion of income spent on food declines as income rises, highlighting shifts in consumer behavior amid rising living standards. Both laws emerged during periods of significant economic transformation in Europe, offering foundational insights into public finance and household consumption patterns.

Defining Wagner’s Law

Wagner's Law defines the relationship between economic development and public expenditure, stating that as a country's income rises, the government tends to increase its spending at a faster rate. This principle highlights the expanding role of the state in providing public goods and social services during industrialization and urbanization phases. In contrast, Engel's Law focuses on household consumption patterns, observing that as income increases, the proportion of income spent on food decreases.

Explaining Engel’s Law

Engel's Law describes how household expenditure patterns shift as income rises, with the proportion spent on food decreasing while spending on non-food items and services increases. This principle highlights that food expenditure is a basic necessity, causing its relative share of total income to decline as purchasing power improves. Understanding Engel's Law is essential for analyzing consumption behavior and economic development across different income levels.

Key Differences Between Wagner’s and Engel’s Laws

Wagner's law predicts that public expenditure increases as national income rises, reflecting the growing complexity and demands of a developing economy. Engel's law states that as household income increases, the proportion of income spent on food decreases, indicating changing consumption patterns with income growth. The key difference lies in Wagner's focus on government spending in relation to economic development, whereas Engel's law addresses consumer behavior and expenditure structure at the household level.

Applications in Economic Analysis

Wagner's law explains the relationship between economic growth and public expenditure, suggesting that government spending increases as an economy develops, which aids fiscal policy planning and budgetary allocation. Engel's law examines changes in household consumption patterns, showing that as income rises, the proportion of income spent on food decreases, guiding consumer demand forecasting and poverty analysis. Both laws are essential for economic analysis, with Wagner's law informing public sector growth strategies and Engel's law optimizing market segmentation and welfare programs.

Implications for Public Policy

Wagner's law implies that as national income grows, public expenditure should increase to support expanding government functions, suggesting policymakers need to plan for higher budget allocations over economic development phases. Engel's law, highlighting that the proportion of income spent on food decreases as income rises, indicates shifting consumer priorities that influence tax policies and welfare programs to better target changing needs. Public policy must therefore balance the expanding role of government with evolving consumption patterns to ensure efficient resource distribution and sustainable economic growth.

Empirical Evidence and Case Studies

Empirical evidence for Wagner's law demonstrates a positive correlation between economic growth and public expenditure, supported by case studies from industrialized nations like Germany and Japan, where rising GDP aligns with increased government spending on infrastructure and social services. Engel's law, verified through household consumption data in developing countries such as India and Brazil, reveals that as incomes rise, the proportion of expenditure on food decreases while spending on non-essential goods and services expands. Comparative analyses indicate Wagner's law holds stronger in mature economies with established welfare systems, whereas Engel's law offers critical insights into consumer behavior dynamics in lower-income populations.

Criticisms and Limitations

Wagner's law faces criticism for its assumption that government expenditure growth is inevitable with economic development, which may not hold true in economies with efficient governance or strict fiscal constraints. Engel's law, while broadly accepted, is limited by its reliance on income as the sole determinant of food expenditure patterns, ignoring other factors like culture, prices, or demographics. Both laws face challenges in contemporary analyses due to structural changes in economies and evolving consumer behaviors that reduce the universality of their original postulates.

Conclusion: Comparing Economic Insights

Wagner's law highlights the positive relationship between economic growth and increased public expenditure, suggesting that government spending expands as an economy develops. Engel's law emphasizes the declining proportion of income spent on food as income rises, reflecting changes in consumer behavior and living standards. Comparing these insights reveals that while Wagner's law addresses public sector dynamics amid economic growth, Engel's law captures household consumption patterns, together offering a comprehensive view of economic development impacts.

Wagner’s law Infographic

libterm.com

libterm.com