Supply-side policies focus on enhancing the productive capacity of the economy by improving factors such as labor market flexibility, technology adoption, and infrastructure development. These policies aim to increase efficiency, boost economic growth, and reduce inflationary pressures over the long term. Explore the full article to understand how supply-side policies can impact Your economic environment and growth prospects.

Table of Comparison

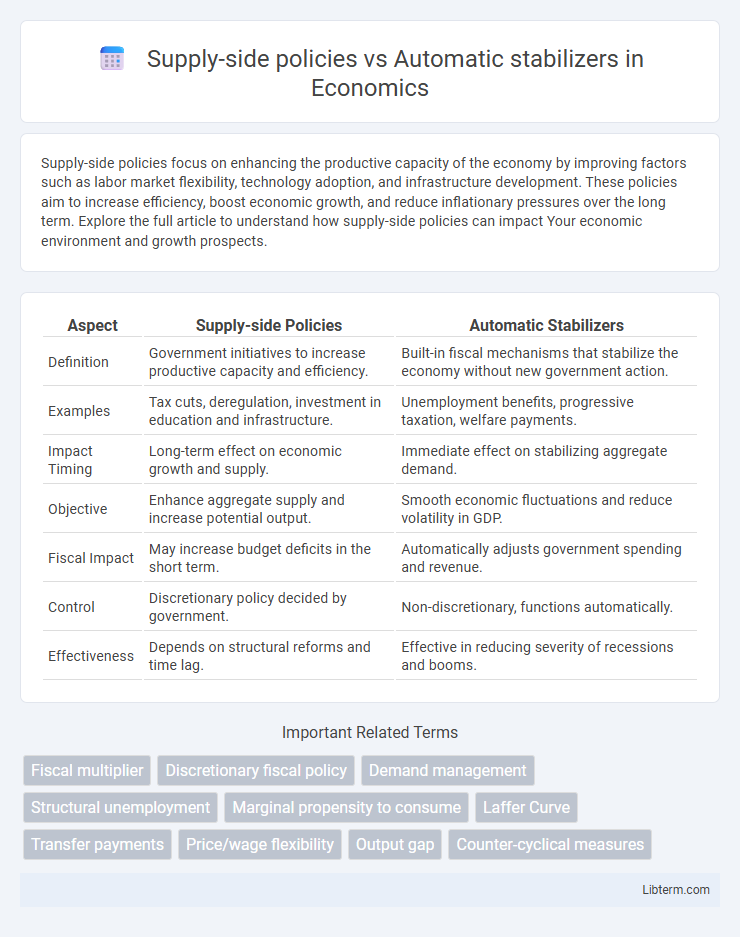

| Aspect | Supply-side Policies | Automatic Stabilizers |

|---|---|---|

| Definition | Government initiatives to increase productive capacity and efficiency. | Built-in fiscal mechanisms that stabilize the economy without new government action. |

| Examples | Tax cuts, deregulation, investment in education and infrastructure. | Unemployment benefits, progressive taxation, welfare payments. |

| Impact Timing | Long-term effect on economic growth and supply. | Immediate effect on stabilizing aggregate demand. |

| Objective | Enhance aggregate supply and increase potential output. | Smooth economic fluctuations and reduce volatility in GDP. |

| Fiscal Impact | May increase budget deficits in the short term. | Automatically adjusts government spending and revenue. |

| Control | Discretionary policy decided by government. | Non-discretionary, functions automatically. |

| Effectiveness | Depends on structural reforms and time lag. | Effective in reducing severity of recessions and booms. |

Introduction to Supply-Side Policies and Automatic Stabilizers

Supply-side policies target long-term economic growth by enhancing productivity through tax cuts, deregulation, and investment in human capital. Automatic stabilizers, such as unemployment benefits and progressive taxes, work instantaneously to moderate economic fluctuations by adjusting fiscal flows without new government intervention. While supply-side policies aim to improve the economy's productive capacity, automatic stabilizers provide immediate cushioning against cyclical downturns.

Defining Supply-Side Policies

Supply-side policies are economic measures aimed at increasing the productive capacity of an economy by enhancing factors such as labor market flexibility, capital investment, and technological innovation. These policies include tax cuts, deregulation, and incentives for research and development, designed to stimulate long-term economic growth by improving supply conditions rather than demand. Unlike automatic stabilizers that respond passively to economic fluctuations, supply-side strategies require deliberate government intervention to boost aggregate supply.

Explaining Automatic Stabilizers

Automatic stabilizers are government programs like unemployment benefits and progressive tax systems that automatically adjust to economic fluctuations without new legislation. These mechanisms help moderate the business cycle by increasing government spending or reducing tax burdens during recessions, boosting aggregate demand and mitigating economic downturns. Unlike supply-side policies that target long-term growth through structural changes, automatic stabilizers provide immediate fiscal support to stabilize income and consumption levels.

Key Objectives of Supply-Side Policies

Supply-side policies aim to enhance economic productivity by improving factors such as labor market flexibility, capital investment, and technological innovation to foster long-term economic growth. These policies focus on increasing potential output through measures like tax cuts, deregulation, and education improvements, which incentivize work, investment, and entrepreneurship. Unlike automatic stabilizers that dampen economic fluctuations, supply-side policies target structural improvements to boost aggregate supply sustainably.

Core Mechanisms of Automatic Stabilizers

Automatic stabilizers operate primarily through built-in fiscal mechanisms such as progressive taxation and unemployment benefits, which automatically adjust government spending and tax revenues in response to economic fluctuations. These policies increase government spending or decrease tax liabilities during economic downturns, cushioning demand without new legislative action. This contrasts with supply-side policies that aim to enhance long-term productive capacity through tax cuts, deregulation, and labor market reforms.

Impact on Economic Growth and Stability

Supply-side policies, such as tax cuts and deregulation, enhance economic growth by improving productivity, incentivizing investment, and increasing labor market efficiency, leading to long-term expansion in potential output. Automatic stabilizers, including progressive taxes and unemployment benefits, promote economic stability by moderating fluctuations in aggregate demand during business cycles without discretionary intervention. While supply-side policies drive sustained growth by shifting aggregate supply, automatic stabilizers help smooth economic volatility and reduce the amplitude of recessions and booms.

Advantages and Limitations of Supply-Side Policies

Supply-side policies enhance economic growth by improving productivity, labor market flexibility, and incentives for investment through tax cuts, deregulation, and education reforms, leading to increased output and employment. However, these policies often require significant time to take effect and may increase income inequality or budget deficits if not carefully managed. In contrast, automatic stabilizers provide immediate fiscal support during economic fluctuations but do not directly influence long-term productive capacity.

Strengths and Weaknesses of Automatic Stabilizers

Automatic stabilizers, such as unemployment benefits and progressive tax systems, provide timely and automatic responses to economic fluctuations by increasing government spending or reducing tax burdens during downturns without new legislation. Their strength lies in effectively smoothing business cycles and cushioning aggregate demand, reducing the depth and duration of recessions. However, weaknesses include potential delays in adjustment due to eligibility rules and the risk of creating fiscal deficits or disincentives to work during prolonged economic expansions.

Real-World Examples and Case Studies

Supply-side policies such as tax cuts in the 1980s Reagan administration aimed to boost economic growth by incentivizing investment, while automatic stabilizers like unemployment benefits during the 2008 financial crisis helped stabilize consumer demand without explicit government intervention. Germany's use of Kurzarbeit (short-time work allowances) during the COVID-19 pandemic exemplifies effective automatic stabilizers that maintained employment levels and income. In contrast, China's supply-side structural reforms since 2015 targeted overcapacity reduction and innovation to enhance long-term productivity while relying on fiscal stimuli as automatic stabilizers to smooth cyclical fluctuations.

Policy Implications and Conclusion

Supply-side policies, such as tax cuts and deregulation, aim to enhance productive capacity and long-term economic growth by improving incentives for investment and labor participation. Automatic stabilizers, including progressive taxation and unemployment benefits, provide immediate counter-cyclical support by smoothing fluctuations in disposable income and demand during economic downturns. Policy implications suggest that combining supply-side reforms with robust automatic stabilizers can optimize both sustainable growth and short-term economic stability.

Supply-side policies Infographic

libterm.com

libterm.com