Cash flow accounting tracks the inflows and outflows of cash within a business, providing a clear picture of liquidity and financial health over time. It helps in managing your operational, investing, and financing activities to ensure that the company maintains sufficient cash to meet obligations. Explore the rest of the article to understand how effective cash flow accounting can improve your financial management.

Table of Comparison

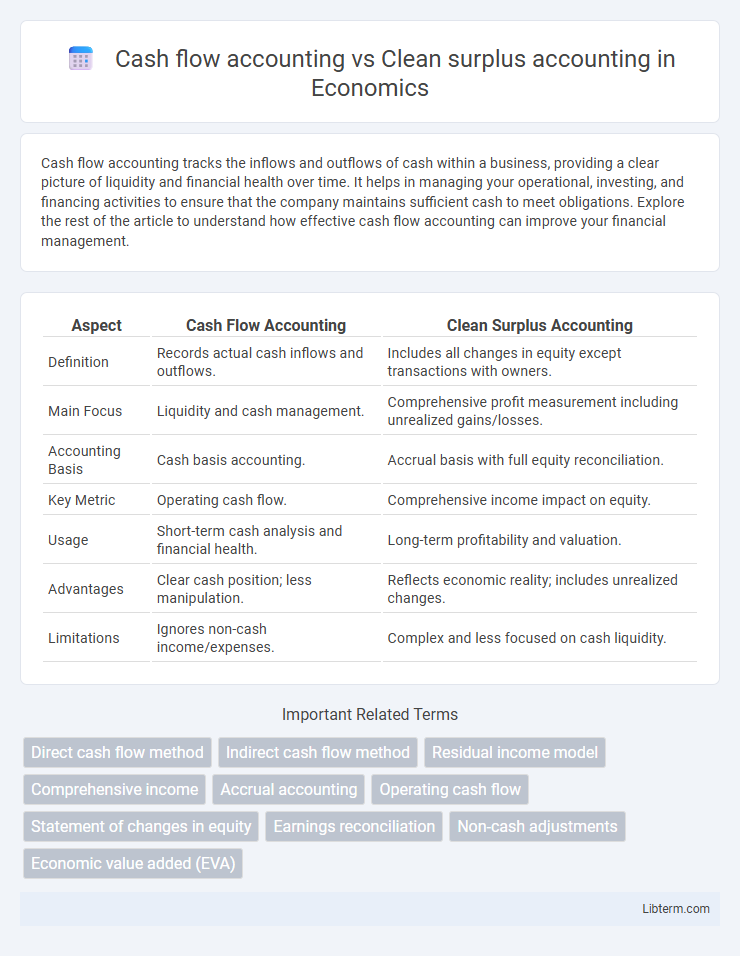

| Aspect | Cash Flow Accounting | Clean Surplus Accounting |

|---|---|---|

| Definition | Records actual cash inflows and outflows. | Includes all changes in equity except transactions with owners. |

| Main Focus | Liquidity and cash management. | Comprehensive profit measurement including unrealized gains/losses. |

| Accounting Basis | Cash basis accounting. | Accrual basis with full equity reconciliation. |

| Key Metric | Operating cash flow. | Comprehensive income impact on equity. |

| Usage | Short-term cash analysis and financial health. | Long-term profitability and valuation. |

| Advantages | Clear cash position; less manipulation. | Reflects economic reality; includes unrealized changes. |

| Limitations | Ignores non-cash income/expenses. | Complex and less focused on cash liquidity. |

Introduction to Cash Flow Accounting and Clean Surplus Accounting

Cash flow accounting records the inflows and outflows of cash, providing clear insights into a company's liquidity and financial health by tracking actual cash movements. Clean surplus accounting, on the other hand, adjusts net income by excluding certain gains and losses that bypass the income statement, ensuring that changes in equity correspond strictly to recognized revenues and expenses. Both methods offer distinct approaches to measuring financial performance, with cash flow accounting emphasizing cash generation and clean surplus focusing on comprehensive income alignment with equity changes.

Fundamental Principles of Cash Flow Accounting

Cash flow accounting emphasizes the recording of cash inflows and outflows, reflecting the actual liquidity position of a business by tracking operational, investing, and financing activities. The fundamental principles include recognizing cash transactions when they occur, ensuring transparency in cash movement, and providing stakeholders with clear insights into the company's ability to generate and manage cash. Unlike clean surplus accounting, which focuses on comprehensive income and changes in equity, cash flow accounting prioritizes cash-based measures for financial analysis and decision-making.

Core Concepts of Clean Surplus Accounting

Clean Surplus Accounting emphasizes the reconciliation of changes in equity through recognized income and expenses, excluding transactions with shareholders such as dividends and share issuances. It maintains that all gains and losses affecting equity must pass through the income statement, providing a comprehensive measurement of profitability and enhancing the quality of financial reporting. This approach contrasts with Cash Flow Accounting, which focuses solely on the timing and amount of cash inflows and outflows, often overlooking non-cash items that affect equity and overall firm value.

Key Differences Between the Two Accounting Methods

Cash flow accounting records the actual inflows and outflows of cash within a company, providing a clear view of liquidity and operational efficiency. Clean surplus accounting, on the other hand, reconciles net income with changes in equity, excluding transactions with shareholders to ensure that all changes in equity pass through the income statement or comprehensive income. The key difference lies in focusing on cash transactions for cash flow accounting versus the comprehensive measurement of earnings and equity changes under clean surplus accounting.

Impact on Financial Reporting and Analysis

Cash flow accounting provides a clear view of liquidity by tracking actual cash inflows and outflows, enhancing the assessment of a company's ability to meet short-term obligations and invest in growth opportunities. Clean surplus accounting incorporates all changes in equity excluding transactions with owners, offering a comprehensive measure of financial performance by linking income statement elements directly to changes in book value. Analysts benefit from cash flow accounting for evaluating operational efficiency, while clean surplus accounting improves the prediction of future earnings by maintaining consistency between reported profits and equity changes.

Advantages of Cash Flow Accounting

Cash flow accounting provides a clear representation of a company's liquidity by tracking actual cash inflows and outflows, making it easier for stakeholders to assess financial health and solvency. It enhances decision-making for investors and creditors by focusing on cash generation capabilities rather than accounting profits, which can be influenced by non-cash items or accruals. This approach reduces the risk of earnings manipulation and offers a more transparent view of operational efficiency and sustainability.

Benefits of Clean Surplus Accounting

Clean Surplus Accounting offers more accurate equity valuation by incorporating comprehensive income, including items excluded from cash flows like unrealized gains and losses. This approach better aligns book value changes with economic performance, improving predictive power for future earnings and stock returns. Investors and analysts benefit from enhanced transparency and more reliable signals of long-term firm value growth.

Limitations and Challenges of Each Approach

Cash flow accounting faces limitations in capturing non-cash items like depreciation and amortization, which can obscure a firm's true economic performance and long-term value creation. Clean surplus accounting struggles with the reliable measurement of comprehensive income, as it excludes certain gains and losses from equity changes, leading to potential valuation inconsistencies. Both approaches encounter challenges in accurately reflecting firm profitability and financial health due to differences in recognition timing and treatment of accounting adjustments.

Practical Applications in Business and Investment

Cash flow accounting provides precise insights into a company's liquidity by tracking actual cash transactions, essential for effective working capital management and short-term financial planning. Clean surplus accounting, which integrates comprehensive income changes into equity without excluding unrealized gains and losses, offers a clearer picture of long-term profitability and residual income valuation models critical for investment analysis. Businesses use cash flow statements to assess operational efficiency and solvency, while investors rely on clean surplus metrics to evaluate sustainable earnings and forecast intrinsic stock value.

Choosing the Right Accounting Method for Your Needs

Choosing between cash flow accounting and clean surplus accounting depends on your business goals and financial analysis needs. Cash flow accounting provides a clear picture of actual liquidity by tracking inflows and outflows, essential for managing daily operations and ensuring solvency. Clean surplus accounting emphasizes comprehensive income, integrating changes in equity excluding transactions with owners, which benefits long-term valuation and performance measurement.

Cash flow accounting Infographic

libterm.com

libterm.com