The life-cycle model explains how individuals plan their consumption and savings behavior throughout different stages of life, aiming to optimize their overall well-being. It highlights the importance of balancing income and expenses by saving during working years and spending during retirement. Discover how understanding this model can help you make smarter financial decisions by reading the rest of the article.

Table of Comparison

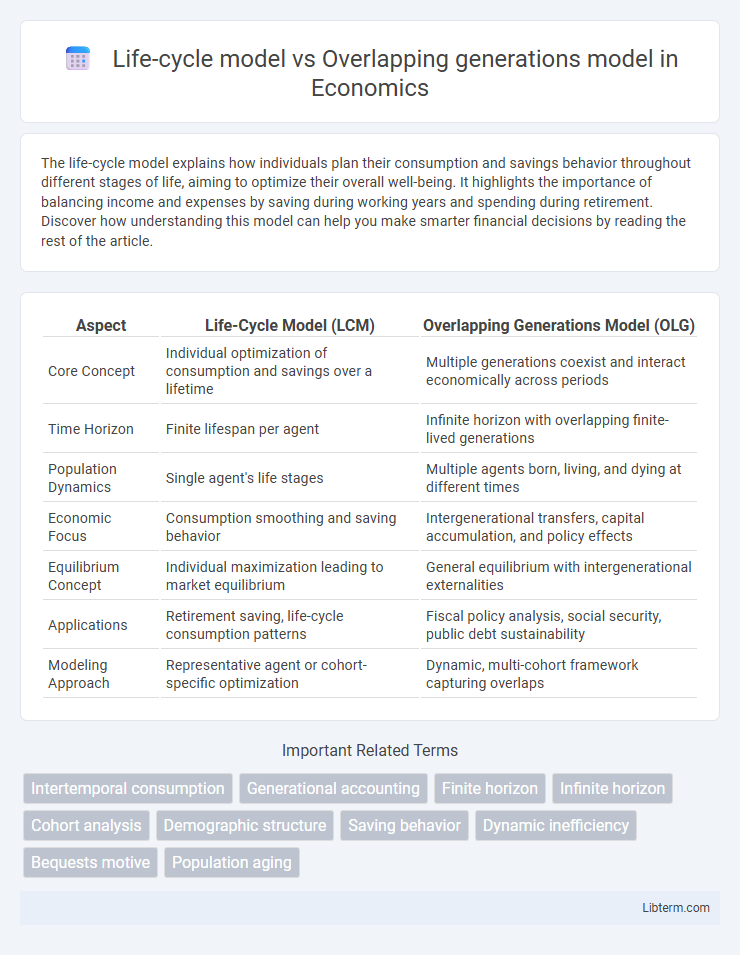

| Aspect | Life-Cycle Model (LCM) | Overlapping Generations Model (OLG) |

|---|---|---|

| Core Concept | Individual optimization of consumption and savings over a lifetime | Multiple generations coexist and interact economically across periods |

| Time Horizon | Finite lifespan per agent | Infinite horizon with overlapping finite-lived generations |

| Population Dynamics | Single agent's life stages | Multiple agents born, living, and dying at different times |

| Economic Focus | Consumption smoothing and saving behavior | Intergenerational transfers, capital accumulation, and policy effects |

| Equilibrium Concept | Individual maximization leading to market equilibrium | General equilibrium with intergenerational externalities |

| Applications | Retirement saving, life-cycle consumption patterns | Fiscal policy analysis, social security, public debt sustainability |

| Modeling Approach | Representative agent or cohort-specific optimization | Dynamic, multi-cohort framework capturing overlaps |

Introduction to Economic Life-Cycle and OLG Models

The Life-cycle model emphasizes individual consumption and saving decisions based on expected lifetime income, highlighting how economic agents allocate resources to smooth consumption across different stages of life. The Overlapping Generations (OLG) model extends this framework by incorporating multiple cohorts alive simultaneously, allowing analysis of intergenerational transfers, capital accumulation, and policy impacts over time. While the Life-cycle model focuses on microeconomic behavior, the OLG model provides a macroeconomic perspective on demographic changes and their effects on economic dynamics.

Defining the Life-Cycle Model: Key Concepts

The Life-Cycle Model centers on individuals optimizing consumption and savings across distinct phases: working years and retirement, emphasizing intertemporal budget constraints. It assumes rational agents who smooth consumption over their lifetime by accumulating wealth during earning periods and decumulating during retirement. The model contrasts with the Overlapping Generations Model by focusing on single-agent lifetime behavior rather than interactions across multiple generation cohorts.

Understanding the Overlapping Generations (OLG) Model

The Overlapping Generations (OLG) model captures economic dynamics by representing multiple cohorts coexisting and interacting over time, unlike the Life-cycle model which focuses on individual decision-making across a single lifetime. OLG models analyze intergenerational transfers, savings behavior, and capital accumulation, reflecting real-world demographic structures. This framework enables policy evaluation on social security, public debt, and pension systems by considering the economic impact across overlapping age groups.

Fundamental Assumptions of Each Model

The Life-cycle model assumes individuals maximize lifetime utility by smoothing consumption over a finite lifespan, with distinct working and retirement phases influencing savings and labor supply decisions. The Overlapping Generations model posits an economy with multiple cohorts of agents coexisting at different life stages, each making consumption and saving choices based on intergenerational transfers and capital accumulation dynamics. Fundamental assumptions differ as the Life-cycle model centers on individual optimization over a predetermined lifespan, while the Overlapping Generations model emphasizes dynamic interactions between overlapping cohorts affecting aggregate economic variables.

Modeling Savings and Consumption Decisions

The Life-cycle model explains savings and consumption patterns by considering individuals' optimization over a finite lifespan, balancing income, consumption, and wealth accumulation to smooth consumption. The Overlapping Generations (OLG) model extends this by analyzing multiple interacting cohorts simultaneously, capturing intergenerational transfers, public debt effects, and savings behavior across different age groups. Both models provide frameworks for understanding how agents make consumption and saving choices, but the OLG model uniquely incorporates the impact of demographic structure on aggregate savings and capital formation.

Treatment of Generational Dynamics

The Life-cycle model treats generational dynamics by modeling individuals who optimize consumption and savings over a finite lifespan, emphasizing how personal income and wealth accumulate and decumulate across distinct life stages. In contrast, the Overlapping Generations (OLG) model incorporates multiple cohorts simultaneously interacting within the economy, allowing for analysis of intergenerational transfers, asset bequests, and the impact of demographic changes on macroeconomic variables. The OLG framework captures dynamic feedback between younger and older agents, providing a richer understanding of fiscal policy effects and social security systems on different generations.

Implications for Fiscal and Pension Policy

The Life-cycle model emphasizes individual saving behavior over a lifetime, suggesting pension policies must ensure sufficient retirement income while avoiding distortions in labor supply and savings incentives. The Overlapping Generations (OLG) model highlights intergenerational transfers and fiscal sustainability challenges, particularly regarding public debt and pay-as-you-go pension systems under demographic changes. Policymakers must balance retirement adequacy with long-term fiscal stability, considering demographic shifts, intertemporal budget constraints, and potential crowding-out effects on private savings.

Advantages and Limitations: Life-Cycle vs OLG

The Life-Cycle model offers a clear framework for analyzing individual saving and consumption patterns across a single lifetime, emphasizing intertemporal smoothing but often neglects the influence of intergenerational interactions. The Overlapping Generations (OLG) model captures the dynamic interplay between different age cohorts, allowing for a richer analysis of macroeconomic issues like debt dynamics and social security, though it can become complex and less tractable due to multiple overlapping agents. While the Life-Cycle model excels in simplicity and microeconomic foundations, the OLG model provides more realistic insights into long-term economic growth and policy effects involving multiple generations.

Empirical Applications and Comparisons

The Life-cycle model effectively explains individual savings behavior and retirement planning through age-specific income and consumption patterns, supported by empirical studies on pension reforms and wealth accumulation. The Overlapping Generations (OLG) model captures intergenerational transfers and macroeconomic dynamics, frequently applied to analyze fiscal policy impacts, public debt sustainability, and social security systems. Comparative analyses reveal the Life-cycle model's strength in micro-level predictive accuracy, while the OLG model excels in addressing macroeconomic phenomena involving multiple cohorts over time.

Conclusion: Choosing the Appropriate Model

Selecting between the Life-cycle model and the Overlapping Generations (OLG) model depends on the research focus, with the Life-cycle model emphasizing individual consumption and saving behavior over a lifetime, while the OLG model captures intergenerational interactions and macroeconomic dynamics. The Life-cycle model is optimal for analyzing personal financial planning and retirement savings, whereas the OLG model better addresses public policy issues like social security and fiscal sustainability. Researchers should align their model choice with the specific economic questions, data availability, and the scale of analysis required.

Life-cycle model Infographic

libterm.com

libterm.com