Structural adjustment refers to economic policies implemented by governments to stabilize and reform their economies, often guided by international financial institutions. These policies typically include measures like reducing public spending, deregulation, and liberalizing trade to promote growth and efficiency. Discover how structural adjustment can impact your country's economy and the challenges it may pose by reading the rest of this article.

Table of Comparison

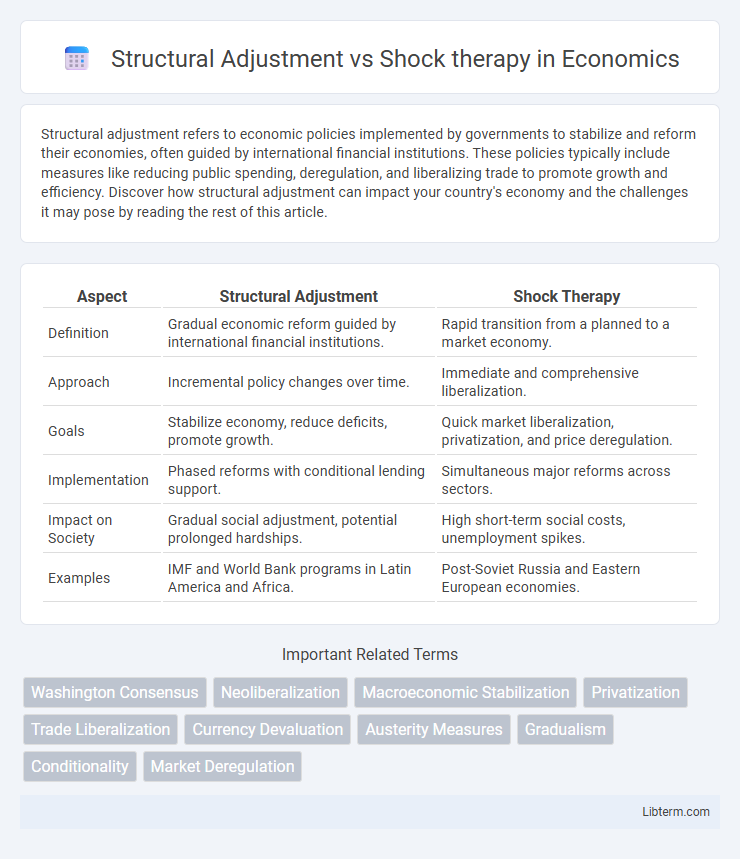

| Aspect | Structural Adjustment | Shock Therapy |

|---|---|---|

| Definition | Gradual economic reform guided by international financial institutions. | Rapid transition from a planned to a market economy. |

| Approach | Incremental policy changes over time. | Immediate and comprehensive liberalization. |

| Goals | Stabilize economy, reduce deficits, promote growth. | Quick market liberalization, privatization, and price deregulation. |

| Implementation | Phased reforms with conditional lending support. | Simultaneous major reforms across sectors. |

| Impact on Society | Gradual social adjustment, potential prolonged hardships. | High short-term social costs, unemployment spikes. |

| Examples | IMF and World Bank programs in Latin America and Africa. | Post-Soviet Russia and Eastern European economies. |

Introduction to Structural Adjustment and Shock Therapy

Structural adjustment refers to economic policies imposed by international financial institutions to stabilize and restructure economies through measures such as fiscal austerity, privatization, and trade liberalization. Shock therapy entails rapid and comprehensive reforms aimed at transitioning from a centrally planned economy to a market-oriented one, often involving immediate price liberalization, deregulation, and removal of subsidies. Both approaches target economic stabilization and growth but differ significantly in speed and scope of implementation.

Historical Context and Origins

Structural Adjustment Programs (SAPs) emerged in the 1980s under the guidance of the International Monetary Fund and World Bank to address debt crises in developing countries through policy reforms promoting fiscal austerity, privatization, and market liberalization. Shock therapy originated in the early 1990s, particularly in Eastern Europe and the former Soviet Union, aiming for rapid economic liberalization and transition from centrally planned to market economies by implementing abrupt price liberalization, removal of subsidies, and opening markets to foreign competition. Both approaches reflect responses to economic crises but differ in timing, geographic focus, and the speed and scale of reforms applied.

Key Objectives and Principles

Structural adjustment aims to stabilize and reform economies through gradual fiscal discipline, trade liberalization, and privatization, focusing on long-term sustainable growth. Shock therapy emphasizes rapid implementation of free-market reforms, including abrupt price liberalization and currency stabilization, to quickly transition from a controlled economy to a market-driven system. Both strategies seek to control inflation, reduce deficits, and promote economic efficiency, but differ in speed and social impact considerations.

Implementation Strategies: Gradualism vs Rapid Reform

Structural adjustment emphasizes gradualism, implementing economic reforms step-by-step to minimize social disruption and allow institutions time to adapt. Shock therapy pursues rapid reform, enacting comprehensive changes immediately to quickly stabilize the economy and attract investment. The success of gradualism depends on long-term political commitment and sustained support, whereas shock therapy demands strong initial policy enforcement and often faces short-term socioeconomic challenges.

Economic Impacts and Outcomes

Structural adjustment programs often lead to gradual economic stabilization by implementing fiscal austerity, trade liberalization, and deregulation, but can trigger short-term increases in unemployment and social inequality. Shock therapy involves rapid market liberalization and privatization, frequently resulting in initial economic contraction, hyperinflation, and widespread social disruption before potential recovery. Empirical studies show that countries adopting gradual reforms tend to experience more sustainable growth and less social upheaval compared to those undergoing abrupt economic transitions.

Social Consequences and Public Response

Structural Adjustment Programs (SAPs) imposed by international financial institutions often lead to reduced public spending on social services, causing increased poverty and social inequality, which trigger widespread public protests and labor strikes. Shock therapy, characterized by rapid economic liberalization and market reforms, typically results in sharp rises in unemployment and inflation, eroding social safety nets and provoking significant social unrest and political instability. Both approaches generate profound social consequences, with public response frequently manifesting as resistance movements demanding policy reversals or more equitable economic frameworks.

Case Studies: Notable Global Examples

Structural adjustment programs (SAPs) in countries like Nigeria and Ghana emphasized gradual economic reforms tied to International Monetary Fund (IMF) and World Bank loans, focusing on privatization, deregulation, and fiscal austerity. In contrast, shock therapy in post-Soviet states such as Russia and Poland implemented rapid market liberalization, price liberalization, and immediate withdrawal of state intervention to quickly transform centrally planned economies into market-oriented systems. Russia's experience highlighted severe initial economic contraction and social hardship, whereas Poland achieved relatively faster stabilization and growth due to pre-existing institutional frameworks and cautious sequencing of reforms.

Criticisms of Structural Adjustment Programs

Structural Adjustment Programs (SAPs) often face criticism for prioritizing austerity measures that lead to reduced public spending on essential services like healthcare and education, disproportionately impacting vulnerable populations. These programs frequently impose market liberalization and privatization without adequate social safety nets, resulting in increased unemployment and income inequality. Critics argue that SAPs undermine economic sovereignty by forcing developing countries to adhere to strict conditions set by international financial institutions, limiting their policy flexibility and long-term growth prospects.

Controversies Surrounding Shock Therapy

Shock therapy, characterized by rapid market liberalization and privatization, ignited fierce debates over its socio-economic consequences, notably in post-Soviet states. Critics argue it led to severe economic contraction, social inequality, and a collapse of public services due to abrupt dismantling of state controls. Proponents contend it was a necessary transition to stabilize inflation and attract foreign investment, but the controversy persists over its human cost and long-term efficacy.

Lessons Learned and Policy Recommendations

Structural adjustment programs often emphasize gradual fiscal discipline and market liberalization, while shock therapy advocates for rapid transition to free-market principles, each yielding mixed socio-economic outcomes. Lessons learned highlight the importance of tailoring reforms to country-specific contexts, prioritizing social safety nets, and maintaining institutional capacity to manage reforms effectively. Policy recommendations suggest adopting a phased approach with robust monitoring, ensuring transparency, and fostering inclusive growth to mitigate adverse social impacts during economic transitions.

Structural Adjustment Infographic

libterm.com

libterm.com