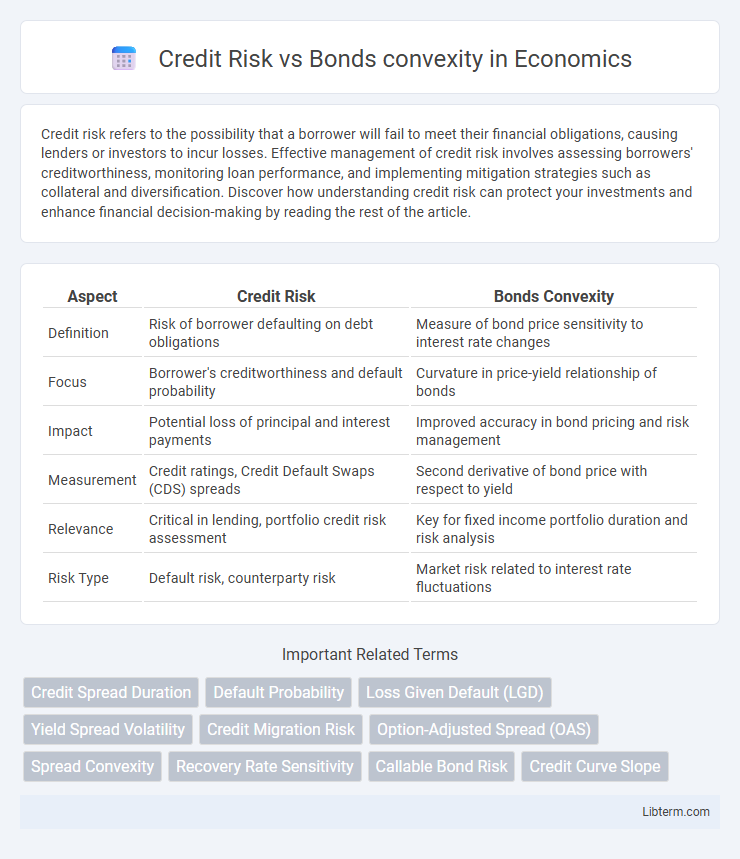

Credit risk refers to the possibility that a borrower will fail to meet their financial obligations, causing lenders or investors to incur losses. Effective management of credit risk involves assessing borrowers' creditworthiness, monitoring loan performance, and implementing mitigation strategies such as collateral and diversification. Discover how understanding credit risk can protect your investments and enhance financial decision-making by reading the rest of the article.

Table of Comparison

| Aspect | Credit Risk | Bonds Convexity |

|---|---|---|

| Definition | Risk of borrower defaulting on debt obligations | Measure of bond price sensitivity to interest rate changes |

| Focus | Borrower's creditworthiness and default probability | Curvature in price-yield relationship of bonds |

| Impact | Potential loss of principal and interest payments | Improved accuracy in bond pricing and risk management |

| Measurement | Credit ratings, Credit Default Swaps (CDS) spreads | Second derivative of bond price with respect to yield |

| Relevance | Critical in lending, portfolio credit risk assessment | Key for fixed income portfolio duration and risk analysis |

| Risk Type | Default risk, counterparty risk | Market risk related to interest rate fluctuations |

Understanding Credit Risk in Bonds

Credit risk in bonds refers to the possibility that the bond issuer will default on interest or principal payments, directly impacting bond valuation and yield spreads. Convexity measures the sensitivity of a bond's duration to interest rate changes, but credit risk introduces additional price volatility beyond interest rate effects, especially for lower-rated bonds. Investors must assess credit risk closely, as it affects expected returns and the risk premium embedded in bond prices, distinguishing credit risk from pure interest rate risk captured by convexity.

What Is Bond Convexity?

Bond convexity measures the sensitivity of a bond's duration to changes in interest rates, reflecting how the bond's price responds non-linearly to yield fluctuations. Higher convexity indicates greater price sensitivity, providing investors with a clearer understanding of interest rate risk and helping to manage credit risk exposure effectively. This metric is crucial for assessing the risk-return profile of bonds, especially when comparing credit risk influenced by issuer default probabilities.

Credit Risk vs Bond Convexity: Key Differences

Credit risk refers to the likelihood that a bond issuer will default on interest or principal payments, directly affecting the bond's credit spread and overall market value. Bond convexity measures the sensitivity of a bond's duration to interest rate changes, impacting price volatility and risk management strategies in fixed-income portfolios. Understanding these differences helps investors balance credit exposure and interest rate risk when selecting bonds for diversification.

How Credit Risk Affects Bond Prices

Credit risk significantly impacts bond prices by increasing the likelihood of default, which leads to higher yields and lower bond values. Bonds with higher credit risk generally trade at a discount compared to safer bonds, reflecting the compensation investors demand for bearing default risk. The presence of credit risk also affects the convexity of bonds, often reducing it since risky bonds exhibit more price sensitivity to interest rate changes combined with potential credit events.

The Role of Convexity in Bond Valuation

Convexity plays a critical role in bond valuation by measuring the sensitivity of a bond's duration to changes in interest rates, which helps investors better estimate price volatility and interest rate risk. While credit risk primarily impacts the likelihood of default and changes the bond's spread, convexity focuses on the curvature of price-yield relationship, providing a more precise adjustment in bond pricing beyond duration. Accurately assessing convexity allows investors to differentiate between yield changes caused by interest rate fluctuations and those influenced by credit risk, optimizing portfolio risk management.

Measuring Credit Risk in Fixed Income Securities

Measuring credit risk in fixed income securities involves analyzing the probability of default and the potential loss given default, which directly impacts the bond's yield spread over risk-free rates. Credit risk affects bond convexity by altering the price sensitivity to interest rate changes, as bonds with higher credit risk often exhibit lower convexity due to increased likelihood of issuer default. Incorporating credit risk models, such as structural or reduced-form approaches, alongside convexity analysis provides a more comprehensive assessment of a bond's risk and price behavior under varying market conditions.

Impact of Convexity on Bond Duration

Convexity measures the curvature of the price-yield relationship of bonds, significantly impacting bond duration by adjusting for changes in interest rates and improving duration's accuracy as a risk metric. Credit risk influences bond yield spreads, which interact with convexity to affect the bond's sensitivity to interest rate changes, particularly in lower-rated bonds. Higher convexity typically reduces the interest rate risk for bonds with credit risk, altering the effective duration and providing better risk adjustments in portfolio management.

Managing Portfolio Risk: Credit Risk and Convexity

Effectively managing portfolio risk requires a deep understanding of credit risk and bonds convexity, as both influence bond valuation and yield sensitivity to interest rate changes. Credit risk impacts the likelihood of issuer default, affecting credit spreads and the bond's fair value, while convexity measures the curvature of a bond's price-yield relationship, providing insight into price volatility under interest rate fluctuations. Integrating credit risk analysis with convexity adjustments enables portfolio managers to optimize risk-return profiles and hedge interest rate and credit spread risks more precisely.

Investor Strategies for Credit Risk and Convexity

Investors managing credit risk focus on diversifying bond portfolios across varying credit qualities to mitigate default risk and enhance yield stability. Strategies involve selecting bonds with appropriate credit spreads, monitoring issuer credit ratings, and employing credit derivatives for hedging purposes. Convexity management includes targeting bonds with favorable convexity profiles to optimize price sensitivity to interest rate changes, balancing duration risk with potential price appreciation in volatile markets.

Future Trends: Credit Risk and Bond Market Convexity

Future trends in credit risk indicate heightened volatility due to increasing economic uncertainties and tightening monetary policies, impacting bond market convexity by amplifying price sensitivity to interest rate changes. Advances in risk modeling and machine learning algorithms enhance the prediction of credit defaults, thereby refining the assessment of bond convexity under varying credit conditions. As investor demand shifts towards higher-yield, lower-grade bonds, market convexity will likely experience greater fluctuations, necessitating improved risk management strategies.

Credit Risk Infographic

libterm.com

libterm.com