Partial equilibrium analysis examines the effects of a change in one market while holding other markets constant, providing a focused understanding of supply, demand, and price adjustments. It simplifies complex economic scenarios by isolating a single sector or market, making it easier to predict outcomes without considering broader interactions. Explore the rest of the article to understand how partial equilibrium analysis applies to real-world economic decisions and policy evaluations.

Table of Comparison

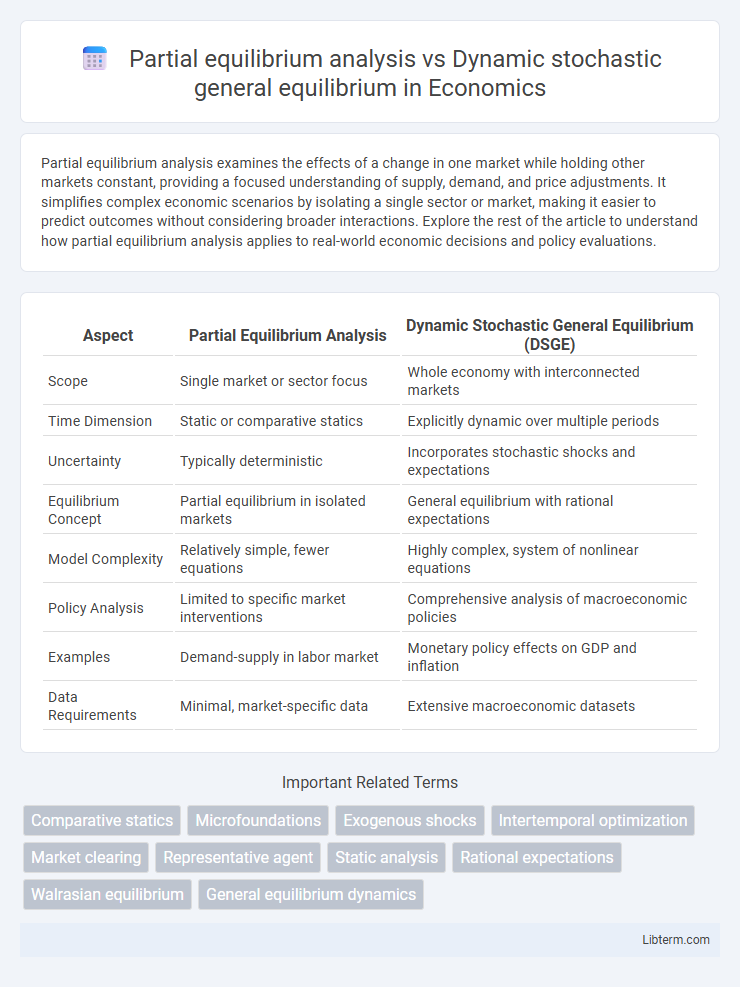

| Aspect | Partial Equilibrium Analysis | Dynamic Stochastic General Equilibrium (DSGE) |

|---|---|---|

| Scope | Single market or sector focus | Whole economy with interconnected markets |

| Time Dimension | Static or comparative statics | Explicitly dynamic over multiple periods |

| Uncertainty | Typically deterministic | Incorporates stochastic shocks and expectations |

| Equilibrium Concept | Partial equilibrium in isolated markets | General equilibrium with rational expectations |

| Model Complexity | Relatively simple, fewer equations | Highly complex, system of nonlinear equations |

| Policy Analysis | Limited to specific market interventions | Comprehensive analysis of macroeconomic policies |

| Examples | Demand-supply in labor market | Monetary policy effects on GDP and inflation |

| Data Requirements | Minimal, market-specific data | Extensive macroeconomic datasets |

Introduction to Economic Equilibrium Models

Partial equilibrium analysis examines individual markets in isolation, assuming ceteris paribus conditions to assess how supply and demand balance within a single sector. Dynamic stochastic general equilibrium (DSGE) models incorporate multiple interrelated markets, capturing time-dependent economic fluctuations and random shocks to analyze the overall economy's behavior. DSGE models provide a comprehensive framework for policy evaluation by integrating expectations, microfoundations, and stochastic processes compared to the static, partial scope of partial equilibrium analysis.

Defining Partial Equilibrium Analysis

Partial equilibrium analysis focuses on a single sector or market, examining the effects of changes within that specific area while holding other factors constant. It simplifies economic modeling by isolating one variable or market to understand supply, demand, and price interactions without considering broader systemic feedback. This approach contrasts with dynamic stochastic general equilibrium (DSGE) models, which analyze entire economies over time under uncertainty, integrating multiple markets and agents simultaneously.

Understanding Dynamic Stochastic General Equilibrium (DSGE)

Dynamic Stochastic General Equilibrium (DSGE) models capture the complex interactions of multiple economic agents within a macroeconomic framework under uncertainty and over time, incorporating microeconomic foundations and expectations. Unlike Partial Equilibrium Analysis, which examines individual markets in isolation, DSGE models analyze the entire economy's response to shocks and policy changes, emphasizing time dynamics and stochastic processes. These models are essential for central banks and policymakers to simulate economic scenarios and evaluate the effects of monetary and fiscal policies in a coherent, forward-looking manner.

Key Assumptions of Partial Equilibrium Models

Partial equilibrium models assume ceteris paribus, isolating a single market or sector while holding other markets constant, which simplifies analysis and focuses on direct effects. These models typically presume fixed prices in related markets, ignoring feedback loops and interdependencies that dynamic stochastic general equilibrium (DSGE) models capture. Partial equilibrium analysis assumes static conditions without accounting for time dynamics or stochastic shocks, contrasting with DSGE's integration of expectations and macroeconomic fluctuations.

Core Features of DSGE Models

Dynamic Stochastic General Equilibrium (DSGE) models incorporate microeconomic foundations and intertemporal optimization under uncertainty, capturing the interactions of agents within a general equilibrium framework. Unlike partial equilibrium analysis, which examines a single market in isolation, DSGE models address macroeconomic fluctuations by modeling stochastic shocks and their propagation through the entire economy. Core features of DSGE include rational expectations, forward-looking behavior, and the integration of policy rules, making them instrumental for analyzing monetary and fiscal policy impacts.

Comparative Scope: Partial vs. General Equilibrium

Partial equilibrium analysis examines the effects of economic changes within a single market or sector, isolating variables to predict supply and demand adjustments without accounting for feedback loops from other markets. Dynamic stochastic general equilibrium (DSGE) models incorporate interactions across multiple markets and economic agents over time, capturing the dynamic, random shocks affecting the entire economy simultaneously. The broader comparative scope of DSGE offers a comprehensive framework for analyzing economy-wide policies and their interrelated impacts, whereas partial equilibrium provides targeted insights limited to specific segments.

Strengths and Limitations of Partial Equilibrium

Partial equilibrium analysis offers simplicity and clarity by focusing on a single market, allowing detailed examination of supply and demand interactions and policy impacts within that specific sector. Its strengths lie in reducing complexity and computational demands, making it suitable for targeted, short-term analysis. However, this approach ignores cross-market feedbacks and dynamic adjustments, limiting its ability to capture economy-wide effects and long-term changes, unlike Dynamic Stochastic General Equilibrium models that integrate multiple sectors and stochastic shocks.

Strengths and Limitations of DSGE Models

Dynamic Stochastic General Equilibrium (DSGE) models excel at capturing the complex interactions between multiple markets and agents under uncertainty, enabling policymakers to evaluate macroeconomic policies and shocks in a coherent framework. Their strengths include incorporating microeconomic foundations, forward-looking behaviors, and stochastic shocks, providing rich insights into economic dynamics. However, DSGE models face limitations such as relying on strong assumptions about agent rationality and market clearing, potential misspecification of shocks, and challenges in accurately modeling financial frictions and heterogeneity across agents.

Real-World Applications and Case Studies

Partial equilibrium analysis offers precise insights into specific markets, widely used in tax policy evaluations and tariff impact assessments, such as analyzing sugar tariffs in developing economies. Dynamic stochastic general equilibrium (DSGE) models simulate whole-economy responses to shocks, instrumental in central bank monetary policy design and crisis forecasting, exemplified by the Federal Reserve's modeling of interest rate adjustments during the 2008 financial crisis. Real-world applications demonstrate partial equilibrium's strength in sector-specific analysis, while DSGE provides comprehensive macroeconomic scenario planning.

Choosing the Best Approach: Policy Implications

Partial equilibrium analysis simplifies policy evaluation by isolating specific markets, making it useful for targeted interventions with limited data requirements. In contrast, dynamic stochastic general equilibrium (DSGE) models incorporate time dynamics, stochastic shocks, and intertemporal behavior, providing a comprehensive framework for assessing macroeconomic policy implications under uncertainty. Policymakers should choose DSGE models for holistic analysis of economy-wide effects, while partial equilibrium models remain valuable for sector-specific policy design and quick assessments.

Partial equilibrium analysis Infographic

libterm.com

libterm.com