Non-diversifiable risk, also known as systematic risk, refers to the inherent uncertainties that affect the entire market or a broad segment, such as economic recessions, political instability, or interest rate changes. This type of risk cannot be eliminated through diversification because it impacts all investments simultaneously. Explore the rest of the article to understand how non-diversifiable risk influences your investment decisions and portfolio management.

Table of Comparison

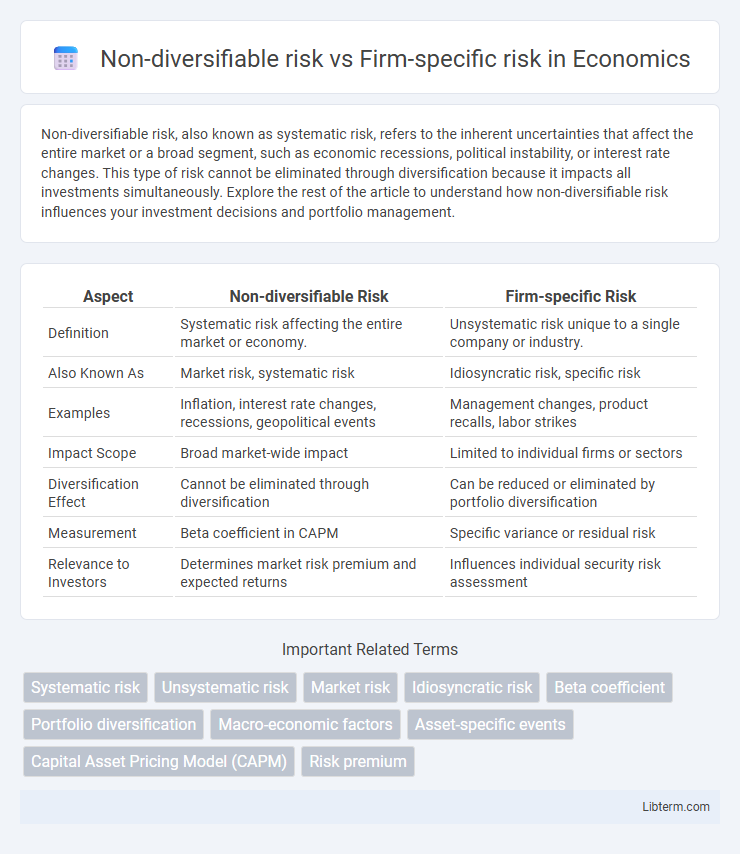

| Aspect | Non-diversifiable Risk | Firm-specific Risk |

|---|---|---|

| Definition | Systematic risk affecting the entire market or economy. | Unsystematic risk unique to a single company or industry. |

| Also Known As | Market risk, systematic risk | Idiosyncratic risk, specific risk |

| Examples | Inflation, interest rate changes, recessions, geopolitical events | Management changes, product recalls, labor strikes |

| Impact Scope | Broad market-wide impact | Limited to individual firms or sectors |

| Diversification Effect | Cannot be eliminated through diversification | Can be reduced or eliminated by portfolio diversification |

| Measurement | Beta coefficient in CAPM | Specific variance or residual risk |

| Relevance to Investors | Determines market risk premium and expected returns | Influences individual security risk assessment |

Understanding Non-Diversifiable Risk

Non-diversifiable risk, also known as systematic risk, represents market-wide uncertainties such as economic recessions, inflation, and geopolitical events that affect all investments and cannot be eliminated through diversification. In contrast, firm-specific risk, or unsystematic risk, arises from factors unique to a particular company, like management changes or product recalls, and can be mitigated by holding a diversified portfolio. Understanding non-diversifiable risk is crucial for investors to evaluate the inherent volatility of the market and to make informed decisions about risk premiums and asset allocation strategies.

Defining Firm-Specific Risk

Firm-specific risk, also known as idiosyncratic risk, refers to the risk inherent in a particular company or industry that can be mitigated through diversification. This type of risk arises from factors such as management decisions, product recalls, labor strikes, or regulatory changes affecting a single firm. Unlike non-diversifiable risk, firm-specific risk does not impact the entire market and can be reduced by holding a well-diversified investment portfolio.

Key Differences Between Risks

Non-diversifiable risk, also known as systematic risk, affects the entire market and cannot be eliminated through diversification, including factors like interest rates, inflation, and geopolitical events. Firm-specific risk, or unsystematic risk, impacts individual companies due to internal factors such as management decisions, product recalls, or competitive dynamics and can be mitigated through portfolio diversification. The primary difference lies in their scope and mitigability, with non-diversifiable risk being inherent to the entire market and firm-specific risk being unique to a particular company.

Causes of Non-Diversifiable Risk

Non-diversifiable risk, also known as systematic risk, stems from macroeconomic factors such as interest rate fluctuations, inflation, geopolitical events, and changes in national fiscal policies that impact the entire market. This type of risk cannot be mitigated through diversification because it affects all securities simultaneously. In contrast, firm-specific risk arises from internal company issues like management decisions, product recalls, or operational failures, which are unique to individual firms and avoidable through portfolio diversification.

Factors Leading to Firm-Specific Risk

Firm-specific risk arises from factors unique to a company, such as management decisions, product recalls, or regulatory changes affecting its operations. These risks are influenced by internal events like leadership changes, labor strikes, or technological failures that directly impact a firm's performance. Unlike non-diversifiable risk, which affects the entire market due to economic or geopolitical factors, firm-specific risk can be mitigated through portfolio diversification.

Impact on Investment Portfolios

Non-diversifiable risk, also known as systematic risk, affects the entire market and cannot be eliminated through diversification, impacting investment portfolios by exposing them to macroeconomic factors such as interest rates, inflation, and geopolitical events. Firm-specific risk, or unsystematic risk, is unique to individual companies and can be mitigated through proper portfolio diversification by holding a variety of assets across different sectors. Effective portfolio management prioritizes minimizing firm-specific risk while accepting non-diversifiable risk inherent to market-wide fluctuations.

Methods to Manage Firm-Specific Risk

Firm-specific risk can be effectively managed through diversification by holding a wide array of assets across different industries and sectors, which reduces the impact of any single company's adverse events. Active portfolio management, including thorough fundamental analysis and regular monitoring of individual securities, helps identify and mitigate potential firm-specific issues. Employing hedging techniques such as options or short selling targeted at particular stocks also provides protection against firm-specific downside risks.

Role in Capital Asset Pricing Model

Non-diversifiable risk, also known as systematic risk, is the only type of risk accounted for in the Capital Asset Pricing Model (CAPM) because it impacts the entire market and cannot be eliminated through diversification. Firm-specific risk, or unsystematic risk, pertains to individual company factors and is assumed to be mitigated by portfolio diversification, thus not affecting the expected return calculated by CAPM. The model uses the beta coefficient to measure an asset's sensitivity to non-diversifiable risk, helping investors determine the appropriate expected return based on market volatility.

Real-World Examples of Both Risks

Non-diversifiable risk, also known as systematic risk, affects the entire market and includes events like global recessions or interest rate changes seen during the 2008 financial crisis, impacting all sectors. Firm-specific risk, or unsystematic risk, pertains to individual companies, such as the 2016 Volkswagen emissions scandal that significantly hurt its stock but had limited impact on the broader automotive industry. Investors mitigate firm-specific risk through diversification, while non-diversifiable risk requires strategies like asset allocation or hedging with derivatives.

Importance for Investors and Risk Management

Non-diversifiable risk, also known as systematic risk, affects the entire market and cannot be eliminated through diversification, making it crucial for investors to assess macroeconomic factors like interest rates and geopolitical events in their risk management strategies. Firm-specific risk, or unsystematic risk, pertains to individual companies and can be mitigated by holding a diversified portfolio, allowing investors to minimize exposure to events such as management changes or product recalls. Effective risk management combines understanding both risk types to optimize portfolio performance and safeguard against unpredictable market-wide shocks and isolated company failures.

Non-diversifiable risk Infographic

libterm.com

libterm.com