Crowding out occurs when increased government spending leads to a reduction in private sector investment or consumption, often due to higher interest rates or resource competition. This economic phenomenon can impact your financial decisions by altering market dynamics and investment opportunities. Explore the rest of the article to understand how crowding out influences economic growth and your personal finances.

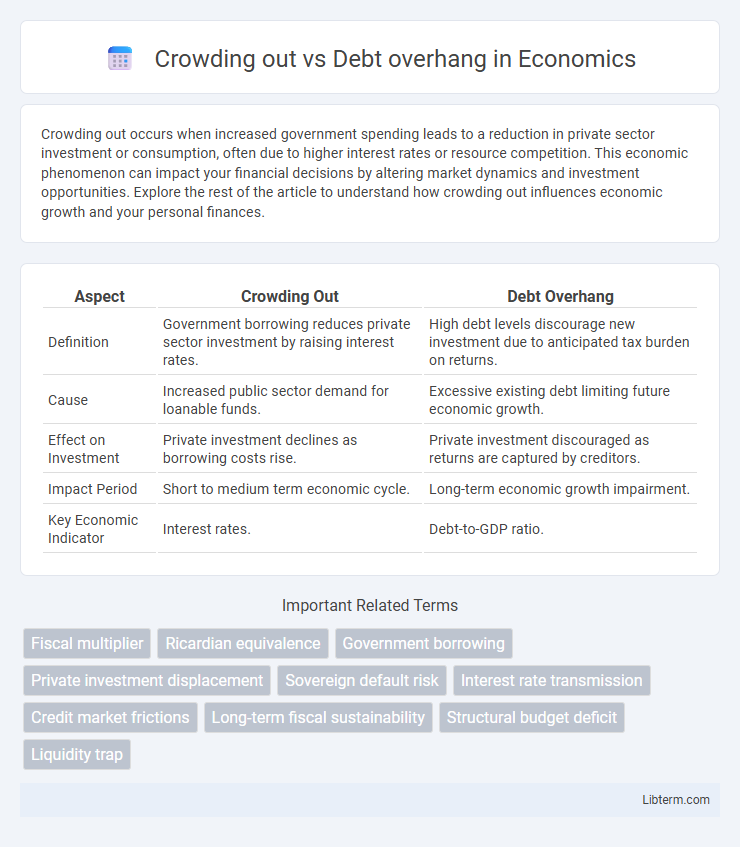

Table of Comparison

| Aspect | Crowding Out | Debt Overhang |

|---|---|---|

| Definition | Government borrowing reduces private sector investment by raising interest rates. | High debt levels discourage new investment due to anticipated tax burden on returns. |

| Cause | Increased public sector demand for loanable funds. | Excessive existing debt limiting future economic growth. |

| Effect on Investment | Private investment declines as borrowing costs rise. | Private investment discouraged as returns are captured by creditors. |

| Impact Period | Short to medium term economic cycle. | Long-term economic growth impairment. |

| Key Economic Indicator | Interest rates. | Debt-to-GDP ratio. |

Introduction to Crowding Out and Debt Overhang

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment by making capital more expensive for businesses. Debt overhang refers to a situation where existing high levels of public debt discourage new investment because future returns are expected to be used primarily for debt repayment. Both phenomena negatively impact economic growth by limiting private sector investment opportunities.

Defining Crowding Out: Causes and Mechanisms

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment by making borrowing more expensive for businesses. This mechanism stems from a limited supply of loanable funds, where government demand for credit competes with the private sector, thereby diverting resources away from productive private ventures. High government debt also signals future tax increases, further discouraging private investment and slowing economic growth.

Understanding Debt Overhang: Key Features

Debt overhang occurs when a company's existing debt is so large that it deters new investment, as creditors expect most returns to go towards repaying old loans rather than funding growth. Key features include impaired ability to raise new capital, reduced incentives for management to pursue profitable projects, and a heightened risk of financial distress. This contrasts with crowding out, where government borrowing raises interest rates and limits private investment, rather than corporate internal financial constraints.

Economic Impacts of Crowding Out

Crowding out occurs when increased government borrowing raises interest rates, limiting private investment and slowing economic growth, whereas debt overhang refers to excessive debt discouraging new investment due to repayment concerns. The economic impacts of crowding out include reduced capital formation and diminished productivity, leading to lower long-term GDP growth. High government debt levels amplify this effect by competing for financial resources, thereby constraining private sector expansion.

Growth Limitations Due to Debt Overhang

Debt overhang restricts economic growth by discouraging firms from investing, as high existing debt limits returns to new investments. Crowding out occurs when government borrowing raises interest rates, reducing private sector investment. Unlike crowding out, debt overhang directly impairs firm-level incentives, causing persistent underinvestment and slower growth.

Distinguishing Factors: Crowding Out vs Debt Overhang

Crowding out occurs when increased government borrowing raises interest rates, reducing private investment by making credit more expensive, whereas debt overhang describes a situation where excessive existing debt discourages firms from undertaking new investments because future returns will primarily benefit creditors. Crowding out primarily impacts capital markets through interest rate mechanisms, while debt overhang affects investment incentives due to the firm's balance sheet burden. Understanding these distinctions is critical for policymakers addressing fiscal sustainability and promoting economic growth.

Real-World Examples and Case Studies

Crowding out occurs when increased government borrowing drives up interest rates, reducing private investment, as seen in post-World War II United States when heavy public debt constrained private sector growth. Debt overhang refers to a situation where existing debt levels discourage new investment because returns primarily serve creditors, exemplified by Greece's sovereign debt crisis starting in 2009, which stifled economic recovery. These phenomena demonstrate how high public debt can limit economic expansion by either raising borrowing costs or disincentivizing new financing.

Policy Responses and Mitigation Strategies

Policy responses to crowding out prioritize increasing government spending efficiency and incentivizing private investment through tax breaks or public-private partnerships to counter reduced private sector borrowing. Debt overhang mitigation strategies emphasize restructuring sovereign debt, implementing fiscal consolidation to restore debt sustainability, and enhancing transparency to rebuild investor confidence. Both approaches require coordinated monetary policies to maintain low interest rates and support economic growth while preventing excessive fiscal deficits.

Implications for Fiscal and Monetary Policy

Crowding out occurs when increased government borrowing leads to higher interest rates, reducing private investment, which can constrain economic growth and complicate monetary policy by limiting central banks' ability to lower rates effectively. Debt overhang arises when high public debt levels deter private investment due to future tax burdens, impairing long-term growth prospects and forcing fiscal policy toward debt reduction rather than expansion. Policymakers must balance fiscal stimulus with debt sustainability to avoid crowding out and mitigate debt overhang risks, coordinating with monetary policy to maintain stable interest rates and support economic recovery.

Conclusion: Lessons for Sustainable Economic Management

Crowding out occurs when government borrowing raises interest rates, reducing private investment, while debt overhang arises when excessive debt discourages new investment due to anticipated high future tax burdens. Sustainable economic management requires balancing public debt to avoid deterring private sector growth and ensuring borrowing supports productive investments that generate returns exceeding debt costs. Effective fiscal policies should focus on maintaining debt at manageable levels and prioritizing spending that boosts long-term economic potential.

Crowding out Infographic

libterm.com

libterm.com