Supply-side reforms focus on improving economic efficiency by enhancing productivity, reducing regulation, and incentivizing investment and innovation. These measures aim to increase the overall supply capacity of the economy, leading to sustainable growth and job creation. Explore the rest of the article to understand how supply-side reforms can impact Your economic future.

Table of Comparison

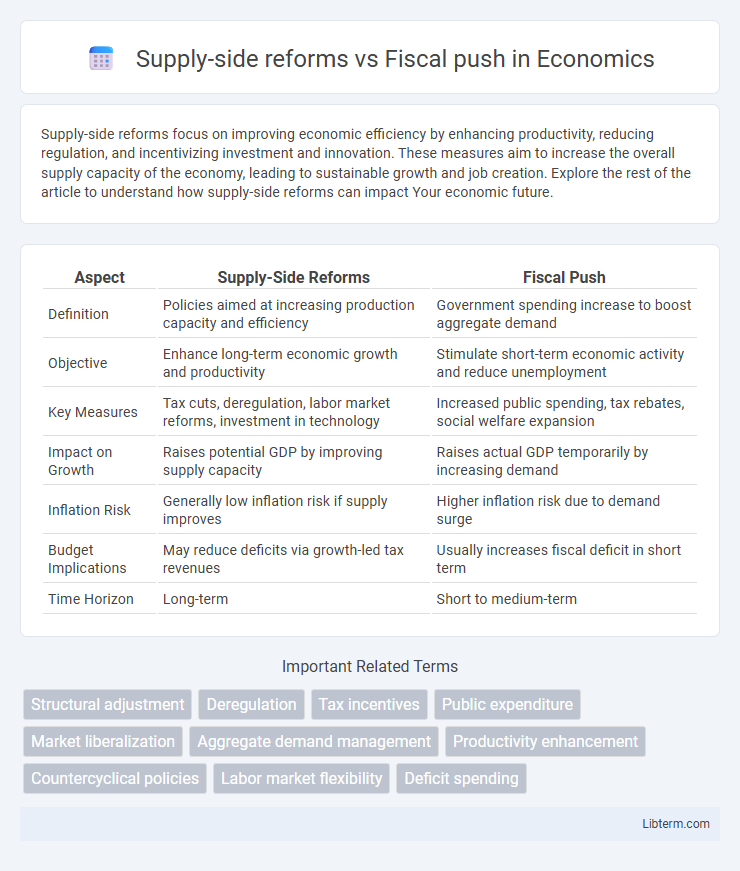

| Aspect | Supply-Side Reforms | Fiscal Push |

|---|---|---|

| Definition | Policies aimed at increasing production capacity and efficiency | Government spending increase to boost aggregate demand |

| Objective | Enhance long-term economic growth and productivity | Stimulate short-term economic activity and reduce unemployment |

| Key Measures | Tax cuts, deregulation, labor market reforms, investment in technology | Increased public spending, tax rebates, social welfare expansion |

| Impact on Growth | Raises potential GDP by improving supply capacity | Raises actual GDP temporarily by increasing demand |

| Inflation Risk | Generally low inflation risk if supply improves | Higher inflation risk due to demand surge |

| Budget Implications | May reduce deficits via growth-led tax revenues | Usually increases fiscal deficit in short term |

| Time Horizon | Long-term | Short to medium-term |

Introduction to Supply-Side Reforms and Fiscal Push

Supply-side reforms target the structural aspects of the economy by enhancing productivity, encouraging investments, and increasing labor market flexibility to stimulate long-term growth. Fiscal push involves government spending and tax policies aimed at boosting aggregate demand in the short term to counteract economic slowdowns. While supply-side reforms focus on improving economic potential, fiscal push emphasizes immediate demand stimulation to accelerate economic activity.

Defining Supply-Side Reforms

Supply-side reforms encompass policy measures aimed at enhancing productivity and economic efficiency by improving factors such as labor market flexibility, innovation capacity, and infrastructure quality. These reforms often include deregulation, tax incentives, and investments in education and technology to boost long-term growth potential. Unlike a fiscal push, which relies on increased government spending or tax cuts to stimulate demand, supply-side reforms target the underlying structural aspects of the economy to promote sustainable expansion.

Understanding Fiscal Push Strategies

Fiscal push strategies emphasize increasing government spending to stimulate economic growth by boosting aggregate demand and creating jobs, often through infrastructure projects and social programs. These approaches directly inject funds into the economy, aiming to accelerate consumption and investment in the short term. Effective fiscal pushes require careful balancing of budget deficits and debt sustainability to avoid long-term economic risks.

Key Differences Between Supply-Side and Fiscal Approaches

Supply-side reforms emphasize enhancing productive capacity through tax cuts, deregulation, and investment in innovation to stimulate long-term economic growth. Fiscal push relies on increased government spending and budget deficits to boost aggregate demand and short-term economic activity. Key differences lie in supply-side policies targeting structural efficiency and incentives, whereas fiscal measures focus on immediate demand stimulation and fiscal stimulus packages.

Economic Impact: Growth and Productivity

Supply-side reforms enhance economic growth and productivity by improving labor market efficiency, reducing regulatory burdens, and incentivizing innovation and investment. Fiscal push, through increased government spending and tax cuts, stimulates demand in the short term but may lead to inflationary pressures and higher public debt if not managed prudently. Long-term growth relies more on supply-side improvements that boost productive capacity and sustainable output rather than temporary demand boosts from fiscal measures.

Policy Tools: Taxation, Incentives, and Government Spending

Supply-side reforms emphasize reducing tax rates and simplifying tax codes to stimulate investment and productivity by increasing after-tax returns for businesses and individuals. Fiscal push strategies rely on increased government spending and targeted incentives to boost aggregate demand and create jobs in the short term. Policy tools under supply-side reforms focus on incentivizing private sector growth, while fiscal push depends on direct expenditure and subsidies to influence economic activity.

Case Studies: Global Examples of Each Approach

Supply-side reforms in countries like Singapore and Germany emphasize deregulation, tax cuts, and enhanced labor market flexibility, driving long-term productivity and economic growth. Fiscal push strategies, exemplified by the United States' 2009 American Recovery and Reinvestment Act and Japan's stimulus packages in the 1990s, focus on increasing government spending to boost demand and short-term economic activity. Case studies reveal that supply-side reforms yield sustainable growth benefits, while fiscal pushes provide immediate relief but may increase public debt.

Short-term vs Long-term Benefits

Supply-side reforms enhance economic productivity and competitiveness by improving labor markets, infrastructure, and business regulations, yielding significant long-term growth and increased potential output. Fiscal push, through increased government spending and tax cuts, stimulates immediate demand and consumption, offering short-term economic boosts and reduced unemployment rates. While fiscal measures deliver rapid economic relief, supply-side reforms build sustainable growth foundations, making the two approaches complementary across different time horizons.

Challenges and Criticisms of Both Strategies

Supply-side reforms face challenges such as long implementation timelines and uncertain short-term economic impacts, often criticized for disproportionately benefiting higher-income groups and widening income inequality. Fiscal push strategies encounter limitations related to increasing public debt and potential inflationary pressures, with critics arguing that they can lead to inefficient resource allocation and crowd out private investment. Both approaches contend with the difficulty of balancing growth stimulation against fiscal sustainability and social equity concerns.

Choosing the Right Mix for Sustainable Growth

Supply-side reforms enhance productivity by improving labor market flexibility, infrastructure, and innovation capacity, driving long-term economic expansion. Fiscal push, characterized by increased government spending and tax cuts, boosts demand in the short term but risks inflation and debt accumulation if overused. Optimal growth strategies involve calibrating supply-side measures with prudent fiscal policies to balance immediate stimulus with durable structural improvements.

Supply-side reforms Infographic

libterm.com

libterm.com