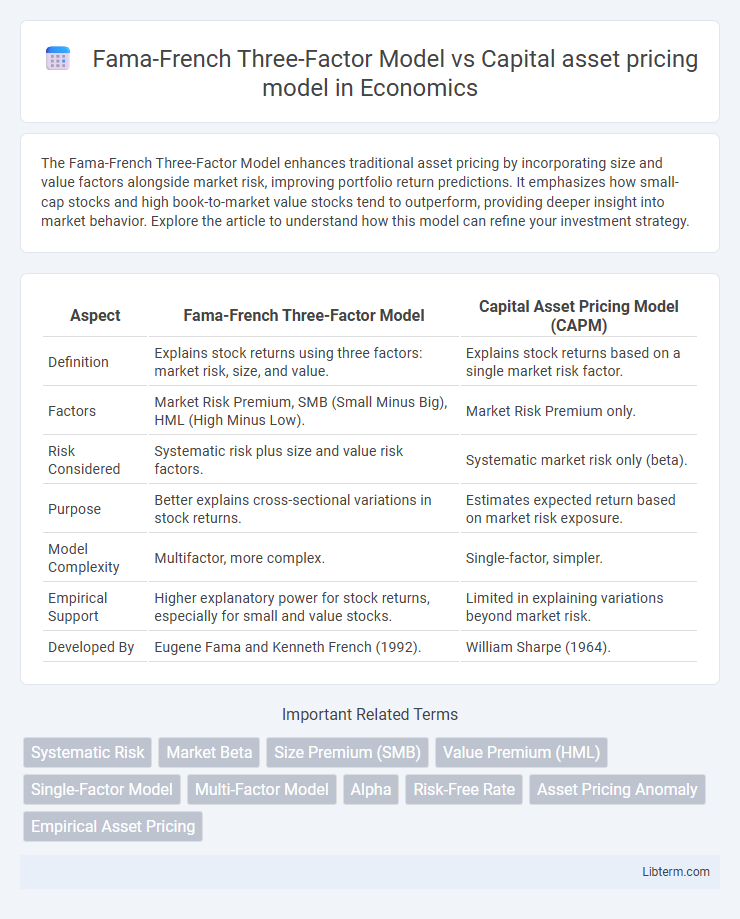

The Fama-French Three-Factor Model enhances traditional asset pricing by incorporating size and value factors alongside market risk, improving portfolio return predictions. It emphasizes how small-cap stocks and high book-to-market value stocks tend to outperform, providing deeper insight into market behavior. Explore the article to understand how this model can refine your investment strategy.

Table of Comparison

| Aspect | Fama-French Three-Factor Model | Capital Asset Pricing Model (CAPM) |

|---|---|---|

| Definition | Explains stock returns using three factors: market risk, size, and value. | Explains stock returns based on a single market risk factor. |

| Factors | Market Risk Premium, SMB (Small Minus Big), HML (High Minus Low). | Market Risk Premium only. |

| Risk Considered | Systematic risk plus size and value risk factors. | Systematic market risk only (beta). |

| Purpose | Better explains cross-sectional variations in stock returns. | Estimates expected return based on market risk exposure. |

| Model Complexity | Multifactor, more complex. | Single-factor, simpler. |

| Empirical Support | Higher explanatory power for stock returns, especially for small and value stocks. | Limited in explaining variations beyond market risk. |

| Developed By | Eugene Fama and Kenneth French (1992). | William Sharpe (1964). |

Introduction to Risk and Return in Finance

The Fama-French Three-Factor Model expands on the Capital Asset Pricing Model (CAPM) by incorporating size and value factors alongside market risk to better explain asset returns. CAPM focuses solely on systematic risk through beta, linking expected return to market volatility, whereas the Fama-French model addresses anomalies unexplained by CAPM by adding the size premium (small vs. large firms) and value premium (high vs. low book-to-market stocks). This enhanced framework improves risk and return predictions, enabling more accurate portfolio management and asset pricing in financial markets.

Overview of the Capital Asset Pricing Model (CAPM)

The Capital Asset Pricing Model (CAPM) quantifies the relationship between expected return and systematic risk, represented by beta, in a single-factor framework. It posits that the expected return on an asset equals the risk-free rate plus the asset's beta multiplied by the market risk premium. CAPM serves as a foundational model in asset pricing, providing a benchmark for evaluating investment performance and portfolio optimization.

Assumptions and Limitations of CAPM

The Capital Asset Pricing Model (CAPM) assumes a single-factor market risk approach, relying on the market portfolio's expected return as the sole determinant of asset returns, which oversimplifies risk representation. It presumes investors have homogeneous expectations, markets are frictionless with no taxes or transaction costs, and that all investors can borrow and lend at a risk-free rate, assumptions often unrealistic in practice. These limitations led to the development of the Fama-French Three-Factor Model, which incorporates size and value factors to better explain asset returns beyond the market risk captured by CAPM.

Introduction to the Fama-French Three-Factor Model

The Fama-French Three-Factor Model enhances the Capital Asset Pricing Model (CAPM) by incorporating size and value factors alongside market risk, addressing CAPM's limitation of explaining asset returns solely through market beta. By introducing the SMB (Small Minus Big) and HML (High Minus Low) factors, it captures returns due to small-cap versus large-cap stocks and value versus growth stocks. This multi-factor approach provides a more comprehensive framework for understanding portfolio returns and risk.

Key Components: Market, Size, and Value Factors

The Fama-French Three-Factor Model expands on the Capital Asset Pricing Model by incorporating three key components: market risk, size, and value factors. Market risk represents the sensitivity of a portfolio to overall market movements, size factor captures the outperformance of small-cap stocks over large-cap stocks, and value factor reflects the higher returns of high book-to-market (value) stocks compared to growth stocks. These additional size and value factors enhance the explanatory power for asset returns beyond the single market factor used in the CAPM.

Comparative Analysis: CAPM vs Fama-French Model

The Fama-French Three-Factor Model improves on the Capital Asset Pricing Model (CAPM) by incorporating size and value factors alongside market risk, addressing CAPM's limitation of relying solely on market beta. Empirical evidence demonstrates that the Fama-French model better explains variations in stock returns, particularly for small-cap and high book-to-market stocks, which CAPM often misprices. By capturing additional dimensions of risk, the Fama-French model provides investors with a more comprehensive framework for asset pricing and portfolio management.

Empirical Evidence and Model Performance

Empirical evidence consistently shows the Fama-French Three-Factor Model outperforms the Capital Asset Pricing Model (CAPM) in explaining cross-sectional variations in stock returns by incorporating size and value factors alongside market risk. Studies reveal that the Three-Factor Model accounts for anomalies that CAPM overlooks, such as the size effect and value premium, leading to more accurate asset pricing and risk assessment. Comparative analyses demonstrate higher explanatory power and improved model performance metrics like R-squared and pricing errors in the Fama-French framework.

Practical Applications in Portfolio Management

The Fama-French Three-Factor Model enhances portfolio management by incorporating size and value factors alongside market risk, improving the explanation of asset returns over the traditional Capital Asset Pricing Model (CAPM). Portfolio managers utilize the model to identify and exploit small-cap and high book-to-market stocks, enabling more nuanced risk adjustment and performance attribution. This multi-factor approach leads to more diversified portfolios and better risk management compared to the single-factor CAPM framework.

Criticisms and Limitations of Both Models

The Capital Asset Pricing Model (CAPM) faces criticism for its reliance on a single market factor and assumptions of market efficiency and investor rationality, which often do not hold in real-world markets, leading to poor explanatory power for asset returns. The Fama-French Three-Factor Model improves on CAPM by adding size and value factors but is criticized for its empirical nature without underlying theoretical justification and limited scope in explaining anomalies like momentum. Both models struggle with stability over time and across markets, raising concerns about their predictive accuracy and universality in portfolio management and asset pricing.

Future Directions in Asset Pricing Models

Future directions in asset pricing models emphasize integrating behavioral finance insights with traditional frameworks like the Capital Asset Pricing Model (CAPM) and the Fama-French Three-Factor Model to better capture market anomalies and investor sentiment. Researchers are developing multi-factor models that incorporate macroeconomic variables, liquidity factors, and time-varying risk premia to enhance predictive accuracy and asset return explanations. Advances in machine learning and big data analytics are also expected to drive dynamic, data-driven models tailored for evolving financial markets.

Fama-French Three-Factor Model Infographic

libterm.com

libterm.com