Saving money is essential for building a secure financial future and achieving your long-term goals. Prioritizing regular savings, reducing unnecessary expenses, and exploring high-yield accounts can significantly boost your financial stability. Discover practical tips and strategies to optimize your saving habits by reading the rest of this article.

Table of Comparison

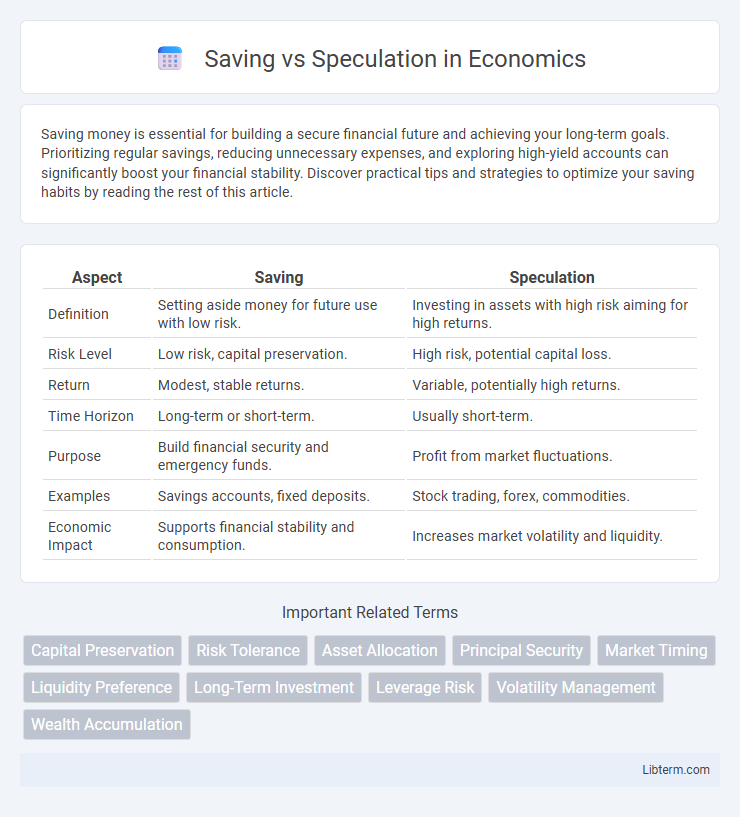

| Aspect | Saving | Speculation |

|---|---|---|

| Definition | Setting aside money for future use with low risk. | Investing in assets with high risk aiming for high returns. |

| Risk Level | Low risk, capital preservation. | High risk, potential capital loss. |

| Return | Modest, stable returns. | Variable, potentially high returns. |

| Time Horizon | Long-term or short-term. | Usually short-term. |

| Purpose | Build financial security and emergency funds. | Profit from market fluctuations. |

| Examples | Savings accounts, fixed deposits. | Stock trading, forex, commodities. |

| Economic Impact | Supports financial stability and consumption. | Increases market volatility and liquidity. |

Understanding the Basics: Saving vs Speculation

Saving involves setting aside a portion of income in secure, low-risk accounts or investments to build financial stability over time. Speculation entails taking higher risks by investing in assets with uncertain returns, aiming for substantial profits but facing possible losses. Understanding these fundamental differences helps individuals align their financial strategies with their risk tolerance and long-term goals.

Key Differences Between Saving and Speculation

Saving involves setting aside money in secure, low-risk accounts such as savings accounts or fixed deposits to preserve capital and earn modest interest, ensuring financial stability and liquidity. Speculation entails taking high-risk positions in assets like stocks, commodities, or cryptocurrencies, aiming for substantial short-term profits but with a significant possibility of loss. The key differences center on risk tolerance, investment horizon, and primary objectives: saving prioritizes capital preservation and steady growth, while speculation focuses on capitalizing on market volatility for higher returns.

The Role of Risk in Saving and Speculating

Saving involves setting aside funds with minimal risk and predictable returns, providing financial security and liquidity. Speculation entails higher risk investments aimed at significant gains but exposes capital to potential losses. Understanding risk tolerance is crucial for deciding between conservative saving strategies and aggressive speculation approaches.

Financial Goals: Which Strategy Suits You?

Saving prioritizes building a secure financial foundation through low-risk, steady income streams like savings accounts or certificates of deposit. Speculation involves higher-risk investments such as stocks, cryptocurrencies, or commodities, aiming for rapid wealth accumulation but with potential for significant losses. Choosing between saving and speculation depends on your financial goals, risk tolerance, and investment timeline, with saving suited for long-term stability and speculation for aggressive growth opportunities.

Time Horizon: Short-Term Speculation vs Long-Term Saving

Short-term speculation involves frequent trading aimed at capitalizing on market volatility within days or weeks, posing higher risks and potential for quick gains or losses. Long-term saving focuses on steady accumulation of wealth over years or decades, utilizing compounding interest and less exposure to market fluctuations. Time horizon significantly influences risk tolerance and investment strategy, with short-term speculation requiring active management while long-term saving prioritizes consistency and financial security.

Common Mistakes in Saving and Speculating

Common mistakes in saving include neglecting to set clear financial goals and failing to automate contributions, which can hinder building a consistent emergency fund. In speculation, frequent high-risk trades without adequate research often lead to significant financial losses and emotional stress. Many individuals overlook the importance of balancing conservative saving strategies with cautious speculative opportunities to optimize long-term wealth growth.

The Impact of Emotions on Financial Decisions

Emotions significantly influence financial decisions, often causing individuals to favor speculation over saving due to the allure of quick gains and excitement. Fear and greed can drive impulsive investments, leading to higher risk exposure and potential financial instability. Conversely, disciplined saving habits supported by emotional regulation foster long-term financial security and wealth accumulation.

Tools and Accounts for Saving and Speculation

Savings tools typically include high-yield savings accounts, certificates of deposit (CDs), and money market accounts that prioritize capital preservation and steady interest earnings. Speculation often involves using brokerage accounts, options trading platforms, and margin accounts designed for buying stocks, commodities, or cryptocurrencies with the goal of generating higher returns but increased risk. Choosing between these relies on risk tolerance and financial goals, with savings vehicles offering security and speculation platforms enabling aggressive growth strategies.

How Economic Factors Influence Choices

Economic factors such as inflation rates, interest rates, and market volatility significantly influence whether individuals prioritize saving or speculation. High inflation often discourages saving due to diminishing purchasing power, prompting more speculative investments in stocks or cryptocurrencies to achieve higher returns. Conversely, stable economic conditions and favorable interest rates encourage saving in traditional accounts, emphasizing security over risk.

Building a Balanced Financial Approach

Saving ensures financial security by accumulating a stable reserve for emergencies and future needs, while speculation involves higher-risk investments aimed at generating rapid returns through market fluctuations. Balancing these approaches requires allocating a portion of capital to low-risk savings vehicles like high-yield savings accounts or certificates of deposit, alongside carefully researched speculative investments in stocks, cryptocurrencies, or real estate. A diversified portfolio that combines steady savings growth with calculated speculative opportunities can maximize long-term wealth and protect against market volatility.

Saving Infographic

libterm.com

libterm.com