Cost-benefit analysis evaluates the financial and intangible impacts of a decision to determine its overall value. By comparing the expected costs against the potential benefits, you can identify the most efficient and profitable course of action. Explore the full article to learn how cost-benefit analysis can enhance your decision-making process.

Table of Comparison

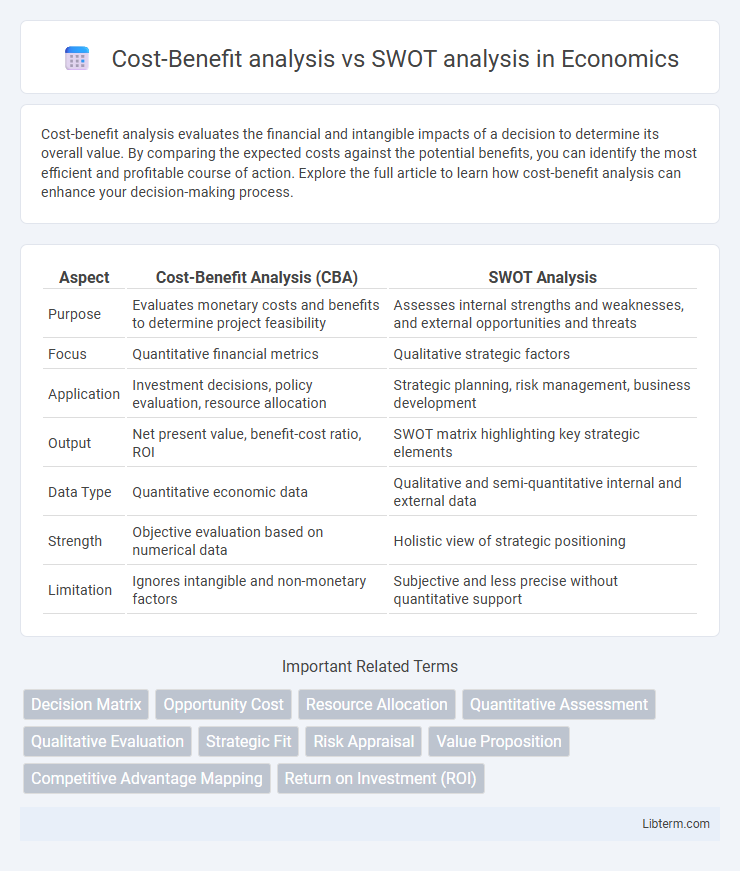

| Aspect | Cost-Benefit Analysis (CBA) | SWOT Analysis |

|---|---|---|

| Purpose | Evaluates monetary costs and benefits to determine project feasibility | Assesses internal strengths and weaknesses, and external opportunities and threats |

| Focus | Quantitative financial metrics | Qualitative strategic factors |

| Application | Investment decisions, policy evaluation, resource allocation | Strategic planning, risk management, business development |

| Output | Net present value, benefit-cost ratio, ROI | SWOT matrix highlighting key strategic elements |

| Data Type | Quantitative economic data | Qualitative and semi-quantitative internal and external data |

| Strength | Objective evaluation based on numerical data | Holistic view of strategic positioning |

| Limitation | Ignores intangible and non-monetary factors | Subjective and less precise without quantitative support |

Introduction to Analytical Tools in Decision-Making

Cost-benefit analysis quantifies the financial advantages and disadvantages of a decision, providing a clear monetary comparison to guide resource allocation. SWOT analysis evaluates internal strengths and weaknesses alongside external opportunities and threats, offering a strategic overview for informed decision-making. Employing both tools enhances analytical rigor by combining quantitative data with qualitative insights in the decision-making process.

What is Cost-Benefit Analysis?

Cost-Benefit Analysis (CBA) is a quantitative evaluation method used to compare the total expected costs against the anticipated benefits of a project or decision, helping organizations determine its feasibility and profitability. This analytical tool assigns monetary values to both tangible and intangible factors, ensuring that decision-makers can assess potential economic impact accurately. By quantifying costs and benefits, CBA supports data-driven decisions that maximize resource allocation efficiency.

Defining SWOT Analysis

SWOT analysis identifies an organization's internal strengths and weaknesses alongside external opportunities and threats to inform strategic decision-making. This qualitative tool helps businesses assess competitive positioning and potential risks by categorizing factors that impact success. Unlike cost-benefit analysis, which quantifies financial impacts, SWOT focuses on a comprehensive review of both internal capabilities and external environments.

Core Differences Between Cost-Benefit and SWOT Analysis

Cost-Benefit Analysis (CBA) quantifies financial impacts by comparing total expected costs against benefits to determine feasibility, while SWOT Analysis identifies internal Strengths and Weaknesses and external Opportunities and Threats to inform strategic planning. CBA primarily focuses on numerical data and economic value, providing a clear financial metric, whereas SWOT offers a qualitative assessment emphasizing situational awareness and strategic positioning. The core difference lies in CBA's objective, data-driven approach for decision-making contrasted with SWOT's comprehensive evaluation of organizational and environmental factors.

Key Components of Cost-Benefit Analysis

Cost-Benefit Analysis involves quantifying and comparing the total expected costs against the total expected benefits of a project or decision to determine its feasibility and profitability. Key components include the identification and valuation of direct and indirect costs, measurement of anticipated benefits in monetary terms, and discounting future costs and benefits to present value for accurate comparison. SWOT analysis, by contrast, focuses on identifying internal strengths and weaknesses, as well as external opportunities and threats, without assigning monetary values.

Essential Elements of SWOT Analysis

SWOT analysis focuses on identifying the essential elements of Strengths, Weaknesses, Opportunities, and Threats to provide a comprehensive overview of an organization's internal and external factors. Cost-Benefit analysis, by contrast, evaluates the financial implications by comparing the costs and benefits of a decision or project. Emphasizing SWOT's critical components facilitates strategic planning by highlighting areas that require improvement and potential growth avenues without directly quantifying monetary values.

When to Use Cost-Benefit Analysis

Cost-Benefit Analysis is ideal for projects with quantifiable financial impacts, such as budgeting, investment decisions, and policy evaluation. It excels in scenarios where measurable data on costs and benefits enable objective comparison to determine economic viability. Use Cost-Benefit Analysis when precise financial metrics guide decision-making processes, contrasting with SWOT analysis that emphasizes qualitative strengths, weaknesses, opportunities, and threats.

Situations Ideal for SWOT Analysis

SWOT analysis is ideal for situations requiring a comprehensive evaluation of internal strengths and weaknesses alongside external opportunities and threats, such as strategic planning, market entry assessments, and organizational change initiatives. It excels in identifying qualitative factors that influence decision-making, enabling businesses to align strategies with their competitive landscape. Unlike cost-benefit analysis, which focuses primarily on quantitative financial metrics, SWOT provides a broader perspective essential for assessing risks and potential advantages in dynamic environments.

Limitations of Cost-Benefit vs SWOT Analysis

Cost-benefit analysis often struggles with quantifying intangible benefits and long-term impacts, leading to incomplete evaluations compared to SWOT analysis, which comprehensively assesses strengths, weaknesses, opportunities, and threats qualitatively. The rigid numerical focus of cost-benefit analysis can overlook strategic non-financial factors that SWOT analysis captures through its broader perspective on internal and external environment. While cost-benefit analysis emphasizes measurable economic outcomes, SWOT analysis suffers from subjectivity and potential bias but excels in identifying areas not easily quantified in monetary terms.

Choosing the Right Analysis for Strategic Decisions

Cost-Benefit Analysis quantifies the financial implications of strategic decisions by comparing projected costs and anticipated benefits, making it ideal for projects with measurable economic outcomes. SWOT Analysis identifies internal strengths and weaknesses alongside external opportunities and threats, providing a comprehensive overview suitable for assessing organizational positioning and market dynamics. Selecting the right analysis depends on decision-making needs: use Cost-Benefit Analysis for evaluating tangible investments and ROI, while SWOT Analysis helps in strategic planning and competitive landscape assessment.

Cost-Benefit analysis Infographic

libterm.com

libterm.com