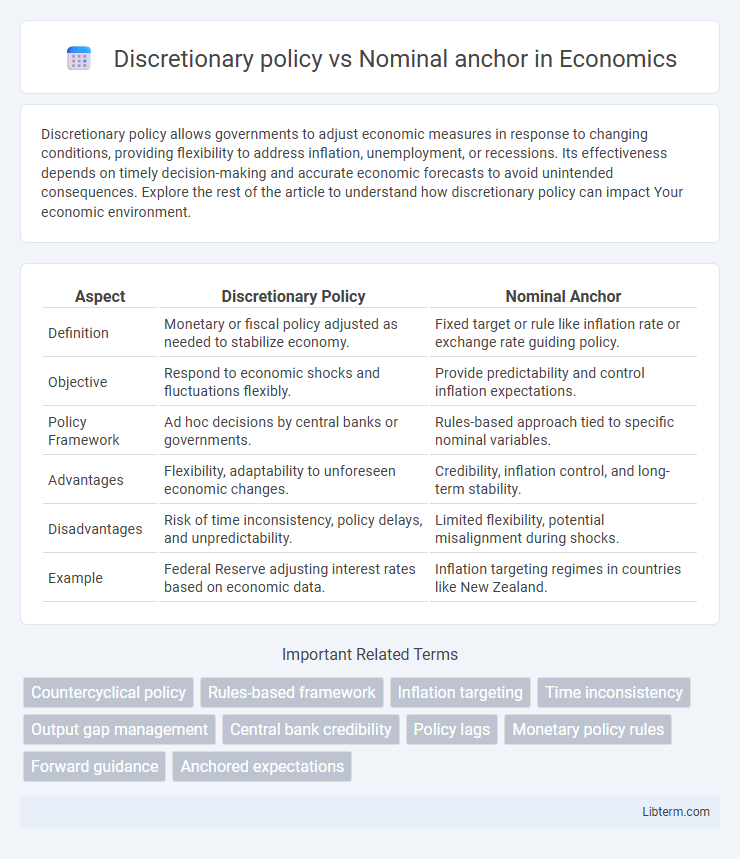

Discretionary policy allows governments to adjust economic measures in response to changing conditions, providing flexibility to address inflation, unemployment, or recessions. Its effectiveness depends on timely decision-making and accurate economic forecasts to avoid unintended consequences. Explore the rest of the article to understand how discretionary policy can impact Your economic environment.

Table of Comparison

| Aspect | Discretionary Policy | Nominal Anchor |

|---|---|---|

| Definition | Monetary or fiscal policy adjusted as needed to stabilize economy. | Fixed target or rule like inflation rate or exchange rate guiding policy. |

| Objective | Respond to economic shocks and fluctuations flexibly. | Provide predictability and control inflation expectations. |

| Policy Framework | Ad hoc decisions by central banks or governments. | Rules-based approach tied to specific nominal variables. |

| Advantages | Flexibility, adaptability to unforeseen economic changes. | Credibility, inflation control, and long-term stability. |

| Disadvantages | Risk of time inconsistency, policy delays, and unpredictability. | Limited flexibility, potential misalignment during shocks. |

| Example | Federal Reserve adjusting interest rates based on economic data. | Inflation targeting regimes in countries like New Zealand. |

Introduction to Discretionary Policy and Nominal Anchor

Discretionary policy allows central banks to adjust monetary measures flexibly in response to real-time economic conditions, emphasizing short-term stabilization. A nominal anchor serves as a commitment device, linking monetary policy to specific targets like inflation rates or exchange rates to maintain price stability. Understanding the interplay between discretionary actions and nominal anchors is essential for effective macroeconomic management and credibility in monetary policy.

Defining Discretionary Policy

Discretionary policy refers to economic policy actions taken by policymakers in response to current economic conditions, allowing flexibility to address unforeseen economic fluctuations. This approach contrasts with rules-based frameworks, such as a nominal anchor, which fix targets like inflation or exchange rates to provide predictability and credibility. Discretionary policy enables central banks and fiscal authorities to adjust interest rates, government spending, or taxation rapidly to stabilize output and employment.

Understanding Nominal Anchors

Nominal anchors are key policy tools used to stabilize inflation expectations by linking monetary policy to a specific variable like inflation rate, exchange rate, or money supply. Unlike discretionary policy, which allows central banks to adjust decisions based on current economic conditions, nominal anchors provide a fixed target that anchors public expectations and enhances credibility. Understanding nominal anchors is essential for interpreting how central banks commit to maintaining price stability and reducing uncertainty in macroeconomic planning.

Historical Context and Evolution

Discretionary policy gained prominence during the mid-20th century as policymakers sought flexibility to respond to economic fluctuations, often at the expense of long-term inflation control, exemplified by the behaviorist approaches of the 1950s and 1960s. The concept of a nominal anchor emerged in the 1970s and 1980s amidst stagflation crises, with central banks adopting targets like fixed exchange rates, money supply growth, or inflation targeting to provide commitment and credibility, as highlighted by Kydland and Prescott's time inconsistency problem. Over time, the evolution shifted the focus from purely discretionary actions to rules-based frameworks, embedding nominal anchors to stabilize expectations and enhance policy effectiveness in modern monetary regimes.

Key Differences Between Discretionary Policy and Nominal Anchors

Discretionary policy allows central banks to adjust monetary actions based on current economic conditions, offering flexibility but potentially leading to time inconsistency problems and higher inflation risks. Nominal anchors, such as inflation targeting or fixed exchange rates, provide a clear benchmark to guide expectations and stabilize inflation by limiting policymakers' discretion. The key difference lies in discretionary policy's adaptive approach versus nominal anchors' commitment to predetermined monetary targets, which enhances credibility and predictability in economic management.

Advantages and Disadvantages of Discretionary Policy

Discretionary policy allows policymakers to respond flexibly to economic fluctuations, enabling quick adjustments to interest rates and fiscal measures tailored to current conditions. However, it risks time inconsistency and political manipulation, potentially leading to inflationary bias and loss of credibility in monetary policy. This contrasts with a nominal anchor, which provides long-term price stability and expectations management but limits policymakers' ability to address short-term economic shocks.

Pros and Cons of Nominal Anchors

Nominal anchors, such as inflation targets or fixed exchange rates, provide clear guidelines that help stabilize expectations and reduce inflation volatility, fostering economic predictability and credibility. However, their rigidity can limit policymakers' flexibility to respond to unexpected shocks or changing economic conditions, potentially exacerbating recessions or financial crises. While nominal anchors enhance transparency and long-term stability, they risk losing effectiveness when economic structures evolve rapidly or external shocks demand discretionary interventions.

Real-World Examples and Case Studies

Discretionary policy allows central banks to adjust monetary measures in response to changing economic conditions, exemplified by the Federal Reserve's flexible interest rate cuts during the 2008 financial crisis. In contrast, a nominal anchor, such as the European Central Bank's commitment to maintaining inflation close to 2%, provides a fixed target that guides expectations and enhances credibility. Case studies of Zimbabwe's hyperinflation highlight the dangers of lacking a credible nominal anchor, whereas Singapore's use of exchange rate targeting showcases effective nominal anchoring stabilizing inflation and currency value.

Policy Implications and Economic Outcomes

Discretionary policy allows flexible, short-term responses to economic shocks, risking inflation volatility and diminished policy credibility, while a nominal anchor, such as inflation targeting or exchange rate pegs, provides a stable benchmark that anchors inflation expectations and reduces uncertainty. Rigid adherence to a nominal anchor can enhance long-term economic stability and low inflation but may limit the central bank's ability to respond to unforeseen downturns or supply shocks. The trade-off between discretion and commitment shapes macroeconomic outcomes, influencing inflation volatility, output stability, and central bank credibility.

Conclusion: Choosing Between Discretionary Policy and Nominal Anchors

Choosing between discretionary policy and nominal anchors depends on the trade-off between flexibility and credibility in monetary policy. Discretionary policy allows for responsive adjustments to economic shocks but risks increasing inflation volatility and undermining inflation expectations. Nominal anchors, such as inflation targets or exchange rate pegs, enhance policy credibility and stabilize inflation but may limit policymakers' ability to respond to unexpected economic changes.

Discretionary policy Infographic

libterm.com

libterm.com