Price-level targeting aims to stabilize the overall price level by adjusting monetary policy to counteract inflation or deflation trends. This approach helps maintain purchasing power and economic stability by targeting a specific price index over time rather than focusing solely on inflation rates. Discover how price-level targeting can influence your financial decisions and the broader economy in the rest of this article.

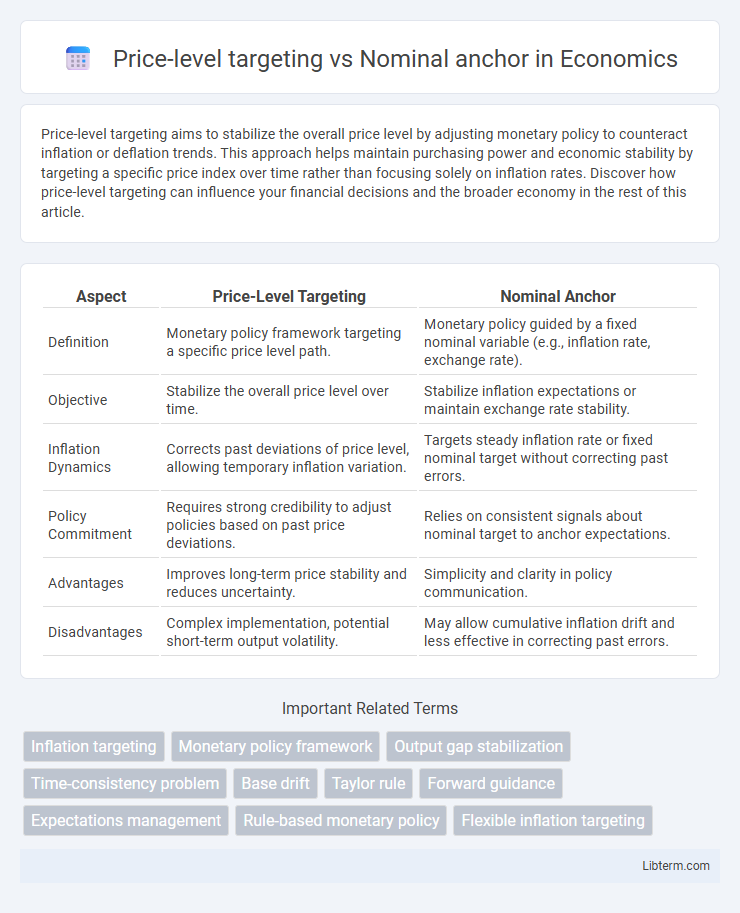

Table of Comparison

| Aspect | Price-Level Targeting | Nominal Anchor |

|---|---|---|

| Definition | Monetary policy framework targeting a specific price level path. | Monetary policy guided by a fixed nominal variable (e.g., inflation rate, exchange rate). |

| Objective | Stabilize the overall price level over time. | Stabilize inflation expectations or maintain exchange rate stability. |

| Inflation Dynamics | Corrects past deviations of price level, allowing temporary inflation variation. | Targets steady inflation rate or fixed nominal target without correcting past errors. |

| Policy Commitment | Requires strong credibility to adjust policies based on past price deviations. | Relies on consistent signals about nominal target to anchor expectations. |

| Advantages | Improves long-term price stability and reduces uncertainty. | Simplicity and clarity in policy communication. |

| Disadvantages | Complex implementation, potential short-term output volatility. | May allow cumulative inflation drift and less effective in correcting past errors. |

Introduction to Monetary Policy Frameworks

Price-level targeting involves central banks aiming to stabilize the overall price level over time, allowing inflation to fluctuate but offsetting past deviations to maintain long-term price stability. Nominal anchor strategies focus on fixing a specific nominal variable, such as an inflation rate or exchange rate, to guide expectations and monetary policy decisions. These frameworks shape monetary policy by influencing credibility, expectations, and the ability to respond to economic shocks effectively.

Defining Price-Level Targeting

Price-level targeting is a monetary policy strategy where the central bank aims to stabilize the overall price level by correcting past deviations from a predetermined price path, ensuring long-term price stability. Unlike a nominal anchor, which fixes the inflation rate or exchange rate without reference to past price levels, price-level targeting adjusts policy to return prices to a specific targeted trajectory over time. This method enhances credibility by treating deviations symmetrically, anchoring inflation expectations more effectively than rules focused solely on inflation targeting.

Understanding the Nominal Anchor

A nominal anchor is a monetary policy tool used by central banks to stabilize inflation expectations by tying the nominal variables, such as the money supply or exchange rate, to a fixed target. Unlike price-level targeting, which adjusts policy based on past price levels to ensure long-term price stability, nominal anchors provide a clear and straightforward guideline to maintain economic stability. Understanding the nominal anchor is crucial for grasping how central banks use fixed reference points to influence inflation and stabilize economic growth.

Key Differences Between Price-Level Targeting and Nominal Anchors

Price-level targeting focuses on maintaining a stable price index over time, directly controlling inflation by adjusting monetary policy based on deviations from a predetermined price level path. Nominal anchors, such as fixed exchange rates or inflation targets, provide a reference point for expectations but do not require correcting past deviations, allowing for more flexible monetary policy responses. The key difference lies in the price-level targeting's commitment to price path stability versus nominal anchors' emphasis on targeting inflation rates or other nominal variables without restoring past price-level errors.

Advantages of Price-Level Targeting

Price-level targeting stabilizes the overall price index, reducing long-term inflation volatility and enhancing economic predictability for businesses and consumers. It provides a more effective anchor for inflation expectations compared to nominal anchors by correcting past deviations and maintaining consistent purchasing power. This approach improves policy credibility and supports sustainable economic growth by minimizing the risk of cumulative inflation errors.

Benefits and Drawbacks of Nominal Anchors

Nominal anchors, such as fixed exchange rates or inflation targets, provide clear and straightforward benchmarks that help stabilize expectations and reduce uncertainty in the economy. Their main benefit lies in simplicity and transparency, which can enhance policy credibility and anchor inflation effectively. However, nominal anchors may lack flexibility, potentially leading to rigid policy responses during economic shocks and limiting the central bank's ability to address real economic fluctuations dynamically.

Economic Stability: Comparing Policy Effectiveness

Price-level targeting promotes long-term economic stability by ensuring the overall price level remains on a predetermined path, reducing inflation volatility and anchoring inflation expectations. Nominal anchors, such as fixed exchange rates or inflation targets, provide clear benchmarks but can be vulnerable to shocks, sometimes resulting in rigid policy responses that destabilize output. Empirical studies suggest price-level targeting offers more effective stabilization by smoothing price fluctuations and enhancing credibility over nominal anchors in dynamic economic environments.

Implementation Challenges and Risks

Price-level targeting faces implementation challenges such as accurately measuring the price level in real-time and responding effectively to inflationary or deflationary shocks, which can complicate monetary policy decisions. Nominal anchors, while providing clear guidance by fixing variables like the money supply or exchange rate, risk becoming ineffective during structural economic changes or supply shocks that decouple these anchors from inflation dynamics. Both strategies carry risks of misalignment with market expectations, potentially leading to volatility in inflation, interest rates, and economic output.

Case Studies: International Policy Experiences

Price-level targeting has shown effectiveness in countries like Sweden and Canada, where central banks aimed to stabilize inflation by adjusting interest rates to maintain a stable price level over time. Nominal anchor policies, such as fixed exchange rate regimes in Hong Kong and currency boards in Estonia, provided clear benchmarks that helped anchor inflation expectations and enhance monetary credibility. Comparative case studies reveal that price-level targeting offers more flexibility in response to economic shocks, while nominal anchors provide stronger initial credibility but may limit policy responsiveness.

Future Perspectives on Monetary Policy Frameworks

Price-level targeting aims to stabilize the overall price index by correcting past deviations, offering a systematic approach to inflation management that may enhance long-term price stability and expectations. Nominal anchor frameworks, such as inflation targeting, focus on maintaining a stable inflation rate without adjusting for past inflation fluctuations, often providing clearer communication but potentially less flexibility. Future perspectives on monetary policy frameworks emphasize integrating forward-looking indicators, data-driven models, and central bank credibility to balance price stability with economic growth under evolving financial conditions.

Price-level targeting Infographic

libterm.com

libterm.com