Adam Smith's theory of the invisible hand explains how individuals pursuing their own self-interest can unintentionally benefit society by promoting economic efficiency and growth. His ideas laid the foundation for modern capitalism, emphasizing free markets and minimal government intervention to foster innovation and wealth creation. Explore the rest of the article to understand how Adam Smith's principles continue to influence today's economic policies and your financial decisions.

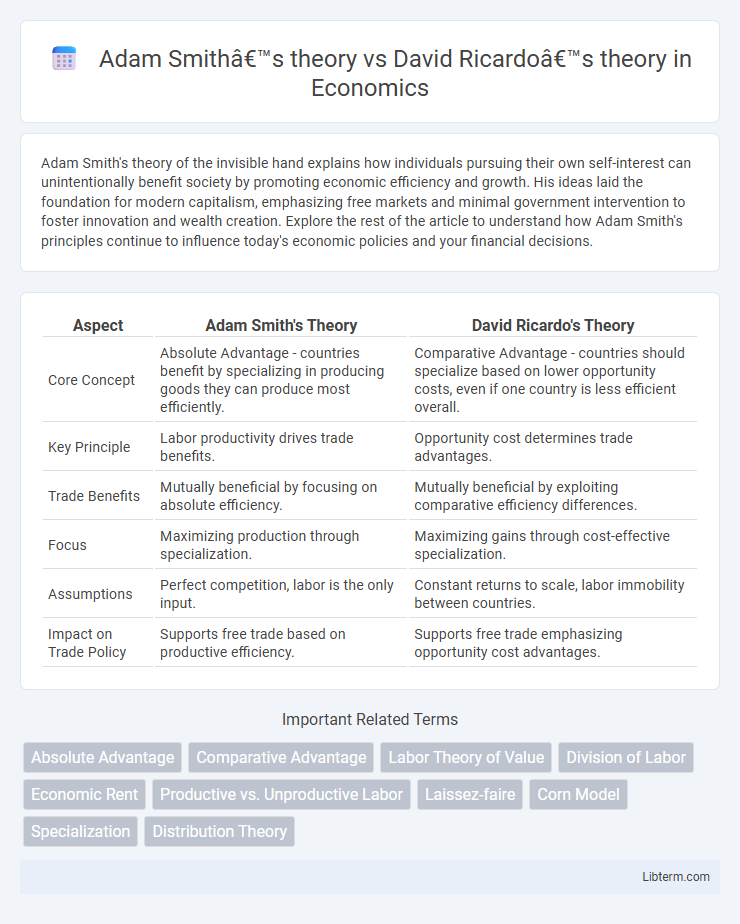

Table of Comparison

| Aspect | Adam Smith's Theory | David Ricardo's Theory |

|---|---|---|

| Core Concept | Absolute Advantage - countries benefit by specializing in producing goods they can produce most efficiently. | Comparative Advantage - countries should specialize based on lower opportunity costs, even if one country is less efficient overall. |

| Key Principle | Labor productivity drives trade benefits. | Opportunity cost determines trade advantages. |

| Trade Benefits | Mutually beneficial by focusing on absolute efficiency. | Mutually beneficial by exploiting comparative efficiency differences. |

| Focus | Maximizing production through specialization. | Maximizing gains through cost-effective specialization. |

| Assumptions | Perfect competition, labor is the only input. | Constant returns to scale, labor immobility between countries. |

| Impact on Trade Policy | Supports free trade based on productive efficiency. | Supports free trade emphasizing opportunity cost advantages. |

Introduction: Comparing Adam Smith and David Ricardo

Adam Smith's theory centers on the concept of absolute advantage, emphasizing the benefits of specialization and free trade to increase overall wealth. David Ricardo introduced the theory of comparative advantage, highlighting that even if one country has an absolute advantage, trade can be beneficial if countries specialize based on relative efficiency. These foundational economic principles shape modern international trade policies and global market strategies.

Historical Context of Smith and Ricardo

Adam Smith's theory emerged during the late 18th century amid the Industrial Revolution in Britain, emphasizing free markets and the division of labor as drivers of economic growth. David Ricardo developed his theory in the early 19th century when industrial capitalism was expanding across Europe, focusing on comparative advantage and the distribution of income between landlords, workers, and capitalists. The historical context of Smith and Ricardo reflects the transformation from mercantilist economies to capitalist markets, influencing classical economics and shaping modern trade theory.

Adam Smith’s Theory of Absolute Advantage

Adam Smith's Theory of Absolute Advantage argues that a country should specialize in producing goods where it can produce more efficiently than others, maximizing overall productivity and wealth. In contrast, David Ricardo's Theory of Comparative Advantage emphasizes producing goods at a lower opportunity cost, even if one country is less efficient in all products. Smith's focus on absolute productivity differences laid the foundation for free trade principles, highlighting how specialization benefits global economic growth.

David Ricardo’s Theory of Comparative Advantage

David Ricardo's theory of comparative advantage emphasizes that countries should specialize in producing goods for which they have the lowest opportunity cost, leading to increased global efficiency and trade benefits. Unlike Adam Smith's theory of absolute advantage, which suggests countries should produce goods they can make more efficiently than others, Ricardo's model demonstrates that mutual gains arise even when one country is less efficient in producing all goods. This principle underpins modern international trade policies by promoting specialization based on relative efficiency rather than absolute productivity.

Key Differences in Economic Assumptions

Adam Smith's theory centers on the idea of absolute advantage, where countries benefit by specializing in producing goods they can create more efficiently than others, assuming labor is the primary factor of production. David Ricardo's theory emphasizes comparative advantage, highlighting that even if one country is less efficient in producing all goods, trade can still be beneficial by focusing on goods with the lowest relative opportunity cost. While Smith assumes labor productivity drives trade, Ricardo introduces opportunity cost and assumes labor mobility within countries but immobility between countries, leading to different predictions about specialization and gains from trade.

Impacts on International Trade Policy

Adam Smith's theory of absolute advantage emphasizes the efficiency gains when countries specialize in producing goods they can generate most efficiently, encouraging free trade policies that reduce tariffs and barriers. David Ricardo's theory of comparative advantage extends this idea by illustrating how countries benefit from trade even when one is less efficient at producing all goods, promoting policies that support specialization based on opportunity costs. These theories underpin modern international trade policies advocating for reduced protectionism, increased trade liberalization, and strategic economic partnerships to enhance global economic growth.

Labor Value Theory: Smith vs Ricardo

Adam Smith's Labor Value Theory emphasizes the amount of labor embodied in a commodity as the primary determinant of its value, focusing on labor as the source of wealth in a pre-capitalist economy. David Ricardo refined this concept by introducing the distinction between "embodied labor" and "labor command," highlighting how relative labor costs determine comparative advantage and international trade patterns. Ricardo's theory integrates capital and labor inputs, providing a more dynamic analysis of value in capitalist production compared to Smith's labor-centric approach.

Criticisms of Smith’s and Ricardo’s Theories

Adam Smith's theory of absolute advantage faces criticism for oversimplifying international trade by ignoring comparative advantage and the role of relative opportunity costs highlighted by David Ricardo. Ricardo's theory, while emphasizing comparative advantage and mutual benefits from trade, is criticized for relying on unrealistic assumptions such as constant returns to scale and labor as the only production factor. Both theories are challenged for neglecting dynamic factors like technological change, capital mobility, and the complexities of modern global markets.

Modern Relevance of Their Economic Ideas

Adam Smith's theory of the invisible hand and specialization emphasizes free markets and division of labor as drivers of economic efficiency, principles widely applied in today's global trade and digital economies. David Ricardo's comparative advantage theory remains foundational in understanding international trade by encouraging countries to specialize based on relative opportunity costs, fostering global economic integration. Modern economic policies on trade liberalization, outsourcing, and market deregulation reflect the enduring influence of both thinkers' ideas in shaping efficient and interconnected markets.

Conclusion: Legacy and Influence on Economics

Adam Smith's theory of the invisible hand laid the foundation for classical economics by emphasizing free markets and the self-regulating nature of supply and demand, profoundly influencing economic thought and policy. David Ricardo's theory of comparative advantage advanced international trade theory by demonstrating how nations benefit from specialization and exchange, shaping modern trade policies and economic integration. Together, their contributions continue to underpin contemporary economic analysis, policy-making, and global market frameworks.

Adam Smith’s theory Infographic

libterm.com

libterm.com