Interest rate effect influences consumer spending and investment decisions by altering borrowing costs and returns on savings. When interest rates rise, borrowing becomes more expensive, leading to reduced consumption and slower economic growth. Explore the rest of the article to understand how these changes impact your financial choices and the overall economy.

Table of Comparison

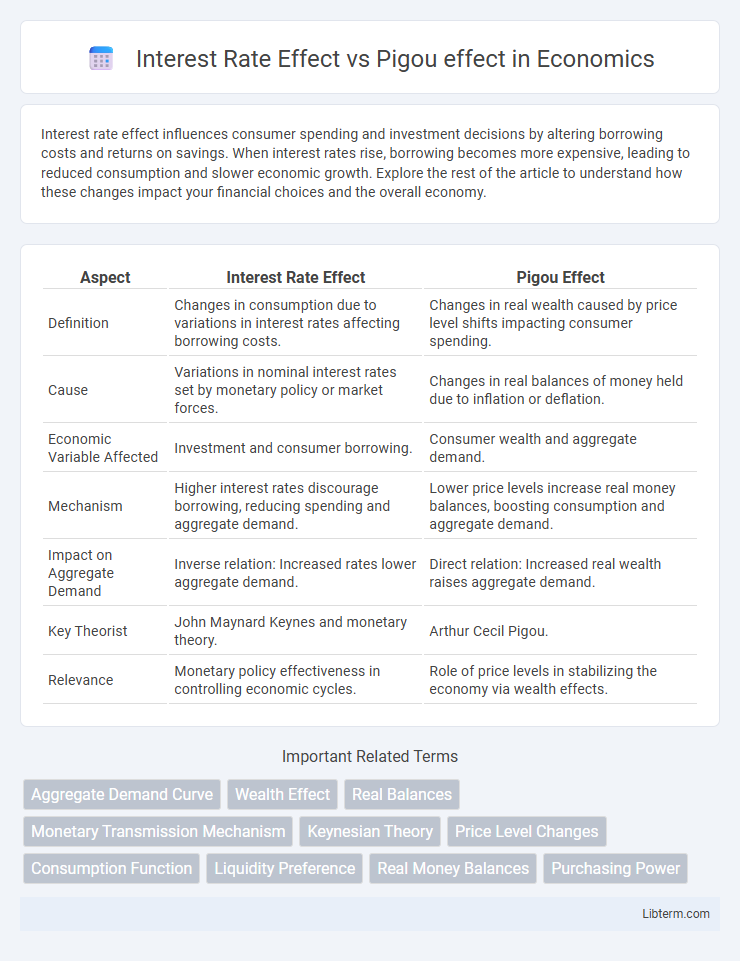

| Aspect | Interest Rate Effect | Pigou Effect |

|---|---|---|

| Definition | Changes in consumption due to variations in interest rates affecting borrowing costs. | Changes in real wealth caused by price level shifts impacting consumer spending. |

| Cause | Variations in nominal interest rates set by monetary policy or market forces. | Changes in real balances of money held due to inflation or deflation. |

| Economic Variable Affected | Investment and consumer borrowing. | Consumer wealth and aggregate demand. |

| Mechanism | Higher interest rates discourage borrowing, reducing spending and aggregate demand. | Lower price levels increase real money balances, boosting consumption and aggregate demand. |

| Impact on Aggregate Demand | Inverse relation: Increased rates lower aggregate demand. | Direct relation: Increased real wealth raises aggregate demand. |

| Key Theorist | John Maynard Keynes and monetary theory. | Arthur Cecil Pigou. |

| Relevance | Monetary policy effectiveness in controlling economic cycles. | Role of price levels in stabilizing the economy via wealth effects. |

Introduction to Interest Rate Effect and Pigou Effect

The Interest Rate Effect describes how changes in price levels impact real interest rates, influencing consumer spending and investment by altering borrowing costs. The Pigou Effect highlights the real balance effect, where lower price levels increase the real value of money holdings, boosting consumer wealth and spending. Both effects explain adjustments in aggregate demand through different mechanisms linked to price level changes in macroeconomic theory.

Defining the Interest Rate Effect

The Interest Rate Effect refers to the inverse relationship between interest rates and consumer spending, where a decrease in price levels leads to lower interest rates, encouraging higher investment and consumption. This effect plays a critical role in aggregate demand by influencing borrowing costs for businesses and households. In contrast, the Pigou Effect centers on the real balance effect, emphasizing changes in consumers' real wealth due to price level fluctuations.

Understanding the Pigou (Real Balance) Effect

The Pigou effect, also known as the real balance effect, explains how changes in the price level influence consumer spending by altering the real value of money holdings, which increases consumption as real balances rise. Unlike the interest rate effect, which links lower prices to reduced interest rates and higher investment, the Pigou effect directly boosts aggregate demand through increased real wealth. Understanding the Pigou effect highlights its role in stabilizing the economy by encouraging consumption when deflation raises the purchasing power of cash balances.

Historical Background and Theoretical Origins

The Interest Rate Effect, rooted in Keynesian economics, emerged from John Maynard Keynes' *General Theory* (1936), illustrating how a change in aggregate price level influences interest rates and consequently investment and consumption. The Pigou Effect, named after economist Arthur Cecil Pigou, originates from his 1943 work that emphasized the real balance effect where changes in price levels affect real wealth and thereby increase consumption. These two effects represent distinct theoretical responses to price level fluctuations, with the Interest Rate Effect highlighting monetary mechanisms and the Pigou Effect emphasizing real wealth adjustments.

Key Differences Between Interest Rate Effect and Pigou Effect

The Interest Rate Effect refers to changes in consumer spending triggered by fluctuations in real interest rates, which influence borrowing costs and saving incentives. In contrast, the Pigou Effect centers on changes in real wealth due to variations in the price level, affecting consumer purchasing power and consumption directly. While the Interest Rate Effect primarily impacts investment and saving decisions, the Pigou Effect emphasizes wealth-induced shifts in aggregate demand.

Role in Aggregate Demand and Macroeconomic Analysis

The Interest Rate Effect influences aggregate demand by affecting borrowing costs, where higher interest rates reduce consumer and business spending, leading to a decrease in overall demand. The Pigou Effect, also known as the real balance effect, suggests that lower price levels increase the real value of money holdings, boosting consumer wealth and spending, thereby raising aggregate demand. In macroeconomic analysis, the Interest Rate Effect highlights monetary policy's impact on demand, while the Pigou Effect emphasizes wealth changes due to price level fluctuations.

Impact on Consumer Spending and Investment

The Interest Rate Effect influences consumer spending and investment by altering borrowing costs; lower interest rates reduce loan expenses, encouraging higher consumer purchases and increased business investment. In contrast, the Pigou Effect centers on real wealth changes due to price level variations, where falling prices boost consumers' real balances, enhancing their purchasing power and stimulating spending. While the Interest Rate Effect primarily affects financing decisions through monetary channels, the Pigou Effect operates through wealth perception and its impact on aggregate demand.

Policy Implications in Monetary and Fiscal Frameworks

The Interest Rate Effect influences monetary policy by dictating how changes in interest rates affect aggregate demand, guiding central banks to adjust rates for economic stabilization. The Pigou Effect emphasizes fiscal policy's role in wealth-induced consumption changes, suggesting that government spending or tax cuts can boost real balances and stimulate demand during recessions. Understanding these effects enables policymakers to coordinate monetary easing with fiscal stimuli for more effective macroeconomic management.

Criticisms and Limitations of Each Effect

The Interest Rate Effect faces criticism for oversimplifying consumer behavior by assuming that changes in interest rates uniformly influence spending and saving patterns, often ignoring liquidity constraints and varying marginal propensities to consume. The Pigou Effect is limited by its reliance on real balances and assumes that wealth effects can sufficiently counteract decreases in aggregate demand, an assumption challenged during deflationary periods when people may hoard money despite rising real balances. Both effects struggle to account for complex macroeconomic dynamics such as expectations, credit availability, and the role of fiscal policy in influencing economic activity beyond interest rates and real wealth changes.

Conclusion: Relevance in Modern Economic Theory

The Interest Rate Effect and Pigou Effect both illustrate crucial mechanisms by which changes in price levels impact aggregate demand through wealth and real interest rates. The Interest Rate Effect remains central in modern Keynesian models for explaining monetary policy transmission via investment spending and consumption decisions. Pigou Effect provides an important theoretical insight into self-correcting tendencies of the economy by emphasizing real balances' influence on consumption, though it is less dominant in empirical applications today.

Interest Rate Effect Infographic

libterm.com

libterm.com