Representative money is a type of currency that holds value because it can be exchanged for a specific amount of a commodity, usually precious metals like gold or silver. This form of money emerged to facilitate easier and more convenient trade compared to carrying physical gold or silver. Explore the article to understand how representative money functions and its significance in the evolution of modern financial systems.

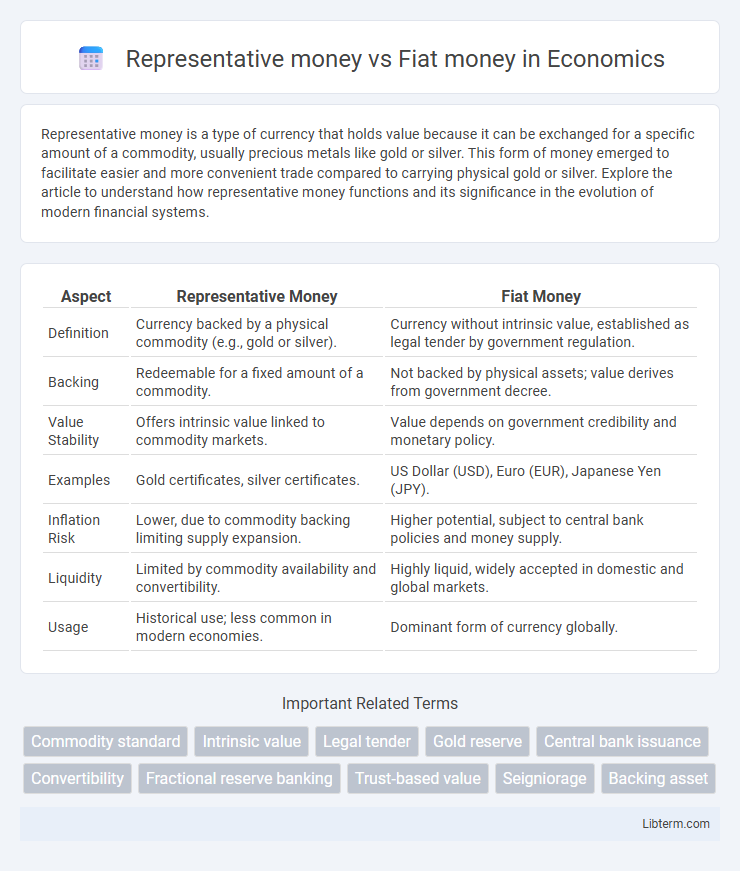

Table of Comparison

| Aspect | Representative Money | Fiat Money |

|---|---|---|

| Definition | Currency backed by a physical commodity (e.g., gold or silver). | Currency without intrinsic value, established as legal tender by government regulation. |

| Backing | Redeemable for a fixed amount of a commodity. | Not backed by physical assets; value derives from government decree. |

| Value Stability | Offers intrinsic value linked to commodity markets. | Value depends on government credibility and monetary policy. |

| Examples | Gold certificates, silver certificates. | US Dollar (USD), Euro (EUR), Japanese Yen (JPY). |

| Inflation Risk | Lower, due to commodity backing limiting supply expansion. | Higher potential, subject to central bank policies and money supply. |

| Liquidity | Limited by commodity availability and convertibility. | Highly liquid, widely accepted in domestic and global markets. |

| Usage | Historical use; less common in modern economies. | Dominant form of currency globally. |

Introduction to Representative and Fiat Money

Representative money is a type of currency backed by a physical commodity, such as gold or silver, allowing holders to exchange it for a fixed amount of that commodity. Fiat money holds value solely through government regulation and trust, without intrinsic backing by physical reserves. The key distinction lies in representative money's connection to tangible assets, whereas fiat money relies on legal tender status and public confidence.

Definition of Representative Money

Representative money consists of tokens or certificates that represent a claim on a commodity, such as gold or silver, which can be exchanged upon demand. Unlike fiat money, which holds value by government decree and lacks intrinsic worth, representative money derives its value from the physical reserves backing it. This type of money was historically used to facilitate trade while ensuring trust through tangible assets.

Definition of Fiat Money

Fiat money is a type of currency that a government declares legal tender without backing by a physical commodity such as gold or silver. Unlike representative money, which is backed by a tangible asset and can be exchanged for it, fiat money's value is derived solely from trust and government regulation. Modern economies primarily use fiat money due to its flexibility in monetary policy and wide acceptance in daily transactions.

Historical Evolution of Money Types

Representative money emerged as a key stage in the historical evolution of money, backed by physical commodities like gold or silver certificates that could be exchanged for a fixed amount of those metals. Fiat money replaced representative money over time, deriving value solely from government decree without intrinsic commodity backing, facilitating easier monetary policy adjustments and broader economic control. This transition marked a critical shift from tangible asset-based currency to modern paper and digital forms that dominate global financial systems today.

Key Differences Between Representative and Fiat Money

Representative money is backed by a physical commodity such as gold or silver, allowing holders to exchange it for a fixed amount of that asset, while fiat money has no intrinsic value and is not convertible into a physical commodity. Fiat money derives its value solely from government decree and public trust in its stability, whereas representative money's value depends on the availability and backing of the physical reserve. Inflation control and monetary policy flexibility are greater with fiat money, contrasting with representative money systems that are constrained by commodity reserves.

Advantages of Representative Money

Representative money offers the advantage of being backed by a physical commodity like gold or silver, providing intrinsic value and reducing inflation risks. It facilitates easier trade and transactions by eliminating the need to carry bulky commodities while maintaining trust through tangible backing. Unlike fiat money, which relies solely on government decree, representative money often ensures greater stability and confidence in the currency's worth.

Advantages of Fiat Money

Fiat money offers greater flexibility and control over the economy as it is not backed by physical commodities, allowing governments to adjust the money supply to manage inflation and economic growth. It facilitates easier transaction processes since it is widely accepted as legal tender without the need for conversion, unlike representative money which depends on a reserve asset. The cost-effectiveness of producing fiat money compared to maintaining reserves of precious metals enhances its efficiency for modern financial systems.

Disadvantages of Each System

Representative money faces significant risks of losing value if the backing commodity, such as gold or silver, becomes scarce or its market value fluctuates, leading to possible loss of public confidence. Fiat money, lacking intrinsic value and commodity backing, is susceptible to inflation and hyperinflation due to overissuance by governments or central banks, eroding purchasing power. Both systems present challenges in maintaining economic stability and trust, complicating monetary policy and long-term financial planning.

Impact on Modern Economies

Representative money, backed by a physical commodity like gold or silver, historically limited inflation and provided tangible value but constrained monetary policy flexibility in modern economies. Fiat money, lacking intrinsic value and not backed by physical assets, enables central banks to implement expansive monetary policies, influencing economic growth, inflation control, and financial stability. The transition to fiat money systems has facilitated complex economic management but also introduced risks related to currency devaluation and inflationary pressures in global markets.

Future Trends in Monetary Systems

Future trends in monetary systems indicate a gradual shift from traditional representative money, which is backed by physical commodities like gold, to purely fiat money issued by central authorities without intrinsic value. Emerging digital currencies and central bank digital currencies (CBDCs) are expected to transform fiat money by enhancing transparency, traceability, and transaction efficiency. The integration of blockchain technology and decentralized finance (DeFi) platforms will further redefine trust mechanisms and regulatory frameworks in the evolving landscape of fiat money.

Representative money Infographic

libterm.com

libterm.com