The Unholy Trinity refers to a powerful alliance or combination of three entities often depicted as destructive or malevolent in various contexts. This concept appears in literature, theology, and pop culture, symbolizing a trio whose combined influence carries significant negative impact. Discover how the Unholy Trinity shapes narratives and influences your understanding in the rest of this article.

Table of Comparison

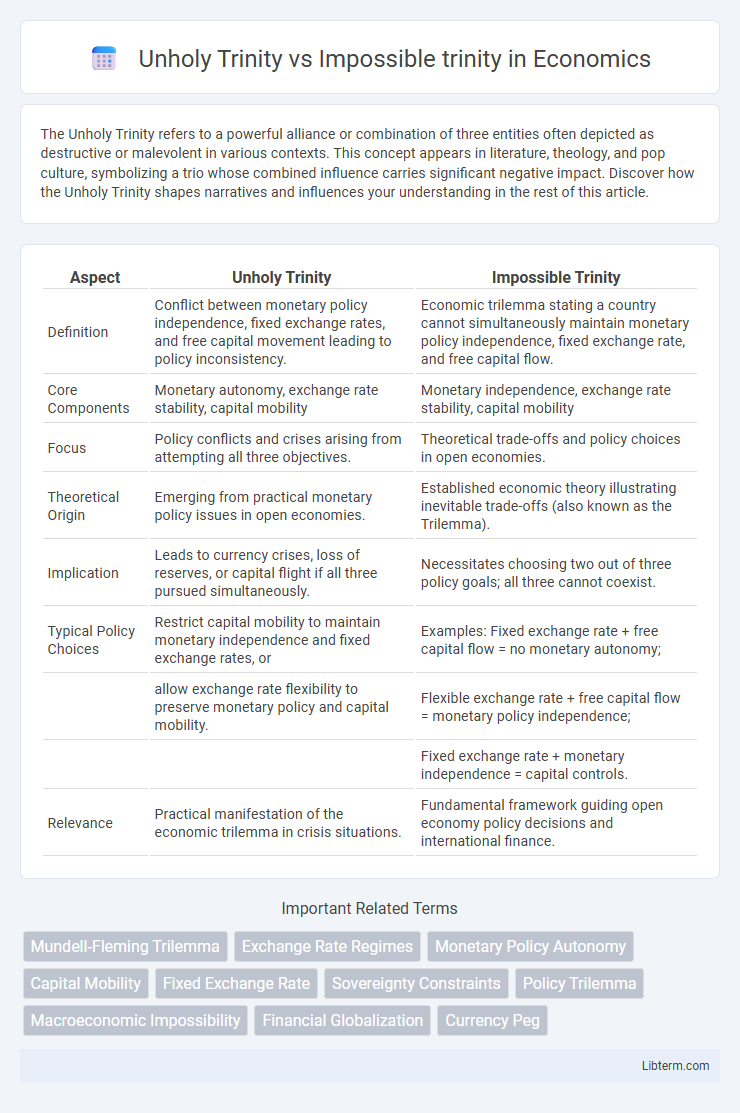

| Aspect | Unholy Trinity | Impossible Trinity |

|---|---|---|

| Definition | Conflict between monetary policy independence, fixed exchange rates, and free capital movement leading to policy inconsistency. | Economic trilemma stating a country cannot simultaneously maintain monetary policy independence, fixed exchange rate, and free capital flow. |

| Core Components | Monetary autonomy, exchange rate stability, capital mobility | Monetary independence, exchange rate stability, capital mobility |

| Focus | Policy conflicts and crises arising from attempting all three objectives. | Theoretical trade-offs and policy choices in open economies. |

| Theoretical Origin | Emerging from practical monetary policy issues in open economies. | Established economic theory illustrating inevitable trade-offs (also known as the Trilemma). |

| Implication | Leads to currency crises, loss of reserves, or capital flight if all three pursued simultaneously. | Necessitates choosing two out of three policy goals; all three cannot coexist. |

| Typical Policy Choices | Restrict capital mobility to maintain monetary independence and fixed exchange rates, or | Examples: Fixed exchange rate + free capital flow = no monetary autonomy; |

| allow exchange rate flexibility to preserve monetary policy and capital mobility. | Flexible exchange rate + free capital flow = monetary policy independence; | |

| Fixed exchange rate + monetary independence = capital controls. | ||

| Relevance | Practical manifestation of the economic trilemma in crisis situations. | Fundamental framework guiding open economy policy decisions and international finance. |

Understanding the Unholy Trinity

The Unholy Trinity in economics refers to the conflict between achieving fixed exchange rates, free capital mobility, and sovereign monetary policy simultaneously, illustrating the limitations policymakers face. Unlike the Impossible Trinity, which states that only two of these three objectives can be attained at once, the Unholy Trinity highlights the destabilizing effects when all three are pursued aggressively. Understanding the Unholy Trinity requires recognizing how rigid exchange rates combined with open capital markets can severely constrain national monetary autonomy, often leading to financial crises.

Defining the Impossible Trinity

The Impossible Trinity, also known as the Trilemma in international economics, defines the concept that a country cannot simultaneously achieve free capital flow, a fixed foreign exchange rate, and an independent monetary policy. This principle highlights the trade-offs governments face in managing exchange rates, monetary control, and capital mobility, restricting them to choose only two of the three objectives at any given time. Unholy Trinity refers to the real-world complexities and market imperfections that complicate this theoretical framework, emphasizing how external pressures and economic dynamics challenge policymakers beyond the classical trilemma.

Origins and Theoretical Backgrounds

The Unholy Trinity originates from critiques of global financial imbalances and consists of global imbalances, excessive private debt, and volatile capital flows, highlighting systemic vulnerabilities in international economics. The Impossible Trinity, or trilemma, originates from monetary economics and posits that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital mobility, and an independent monetary policy, reflecting inherent policy trade-offs. Both concepts emerge from the study of international finance but address different dimensions: the Unholy Trinity focuses on macroeconomic disequilibria, whereas the Impossible Trinity emphasizes policy constraints faced by sovereign states.

Key Differences Between the Two Trinities

The Unholy Trinity in economics refers to the conflict between inflation, unemployment, and stagnant demand, whereas the Impossible Trinity, or trilemma, concerns a nation's inability to simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy. Key differences lie in their focus: the Unholy Trinity centers on domestic macroeconomic trade-offs and policy challenges, while the Impossible Trinity addresses constraints in international financial policy frameworks. The Unholy Trinity highlights economic stagnation risks, while the Impossible Trinity emphasizes the trade-offs in monetary sovereignty and exchange rate regimes.

Mechanisms and Policy Implications

The Unholy Trinity highlights the trade-off between capital mobility, monetary policy autonomy, and financial stability, with mechanisms showing that pursuing two often destabilizes the third. The Impossible Trinity, or Mundell-Fleming Trilemma, articulates that a country cannot simultaneously maintain a fixed exchange rate, free capital movement, and an independent monetary policy, forcing policymakers to prioritize two at the expense of the third. Both frameworks imply critical policy decisions on exchange rate regimes, capital controls, and monetary sovereignty to manage economic volatility and maintain macroeconomic equilibrium.

Historical Context and Case Studies

The Unholy Trinity, emerging from historical critiques of international monetary systems, highlights the inherent conflict among fixed exchange rates, free capital mobility, and independent monetary policy, first identified during the Bretton Woods era's collapse. The Impossible Trinity, formalized in economic theory, asserts no country can simultaneously achieve all three policy goals without sacrificing at least one, with notable cases like the 1997 Asian Financial Crisis illustrating countries forced to abandon fixed exchange rates or capital controls. Historical case studies, including the European Exchange Rate Mechanism crisis and Argentina's 2001 financial collapse, concretely demonstrate the practical challenges governments face in balancing these conflicting macroeconomic objectives.

Impact on Global Financial Stability

The Unholy Trinity theory explains the challenges of simultaneously achieving fixed exchange rates, free capital movement, and independent monetary policy, often leading to financial instability and currency crises. The Impossible Trinity, or Trilemma, emphasizes that countries can only achieve two of these three policy objectives at the same time, forcing trade-offs that impact global financial stability by constraining policymakers' ability to respond to external shocks. Both theories highlight structural vulnerabilities in the international financial system, underscoring the importance of coordinated policy frameworks to mitigate systemic risks and maintain global economic equilibrium.

Real-World Applications and Outcomes

The Unholy Trinity theory explains persistent conflicts among countries trying to simultaneously maintain fixed exchange rates, free capital movement, and independent monetary policies, often leading to economic imbalances and crises in real-world scenarios like the Asian Financial Crisis. The Impossible Trinity, or Trilemma, highlights the trade-offs policymakers face, where choosing any two of these three policy goals necessitates sacrificing the third, impacting monetary stability and investment flows in global economies. Understanding these frameworks aids governments and financial institutions in designing economic strategies that balance exchange rate regimes, capital mobility, and policy autonomy to mitigate risks of currency crises and capital flight.

Criticisms and Controversies

The Unholy Trinity, comprising corruption, inequality, and economic instability, faces criticism for oversimplifying complex socio-economic dynamics and ignoring structural factors driving systemic issues. In contrast, the Impossible Trinity in international economics, which states that a country cannot simultaneously maintain a fixed foreign exchange rate, free capital movement, and an independent monetary policy, is often debated for its rigid assumptions and limited applicability in today's interconnected global markets. Both concepts spark controversy by either underestimating policy tools available or by not fully accounting for diverse economic contexts and evolving financial instruments.

Future Perspectives and Policy Recommendations

The Unholy Trinity, involving capital mobility, fixed exchange rates, and independent monetary policy, challenges future economic stability by limiting policy flexibility compared to the Impossible Trinity, which asserts that only two of these three goals can be achieved simultaneously. Future perspectives emphasize innovative policy frameworks that leverage digital currencies and enhanced financial regulations to navigate these constraints effectively. Policy recommendations advocate for adaptive monetary policies and international coordination to balance exchange rate stability with capital flow management while preserving monetary autonomy.

Unholy Trinity Infographic

libterm.com

libterm.com