Investment strategies play a crucial role in growing your financial portfolio and securing long-term wealth. Understanding market trends, risk tolerance, and asset diversification can significantly enhance your returns while minimizing potential losses. Explore the rest of the article to master effective investment techniques tailored to your financial goals.

Table of Comparison

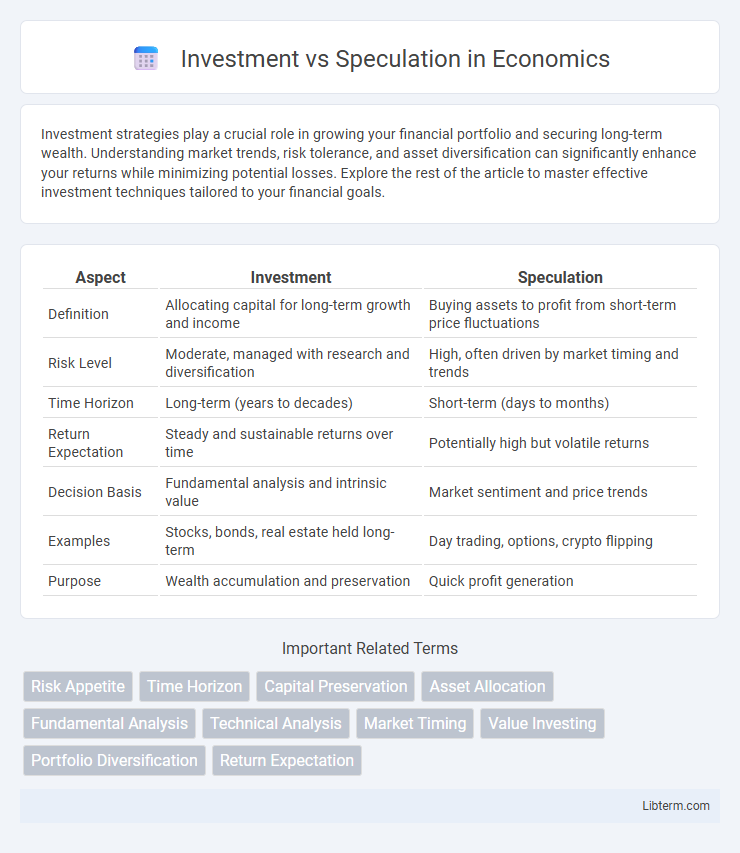

| Aspect | Investment | Speculation |

|---|---|---|

| Definition | Allocating capital for long-term growth and income | Buying assets to profit from short-term price fluctuations |

| Risk Level | Moderate, managed with research and diversification | High, often driven by market timing and trends |

| Time Horizon | Long-term (years to decades) | Short-term (days to months) |

| Return Expectation | Steady and sustainable returns over time | Potentially high but volatile returns |

| Decision Basis | Fundamental analysis and intrinsic value | Market sentiment and price trends |

| Examples | Stocks, bonds, real estate held long-term | Day trading, options, crypto flipping |

| Purpose | Wealth accumulation and preservation | Quick profit generation |

Introduction to Investment and Speculation

Investment involves allocating capital to assets such as stocks, bonds, or real estate with the expectation of generating steady, long-term returns based on intrinsic value and fundamental analysis. Speculation, by contrast, entails engaging in higher-risk transactions aiming for rapid profits, often relying on market trends, price volatility, and short-term price movements rather than underlying asset value. Understanding the key differences in risk tolerance, time horizon, and strategy is essential for distinguishing investment from speculation in financial decision-making.

Defining Investment: Core Principles

Investment involves allocating capital to assets like stocks, bonds, or real estate with the expectation of generating long-term returns through income, interest, or capital appreciation. Core principles emphasize thorough analysis, risk management, and a focus on fundamental value rather than short-term market fluctuations. This disciplined approach prioritizes steady growth and preservation of capital over high-risk, short-term gains characteristic of speculation.

Understanding Speculation: Key Characteristics

Speculation involves high-risk financial activities aimed at achieving substantial short-term profits by capitalizing on market price fluctuations. Speculators often rely on market trends, volatility, and timing rather than fundamental analysis or long-term value assessments. Unlike traditional investment, speculation emphasizes rapid decision-making and the acceptance of significant uncertainties to maximize potential returns.

Risk Profiles: Investment vs. Speculation

Investment involves allocating capital to assets with thorough analysis and a long-term horizon, aiming for steady returns and capital preservation. Speculation entails higher risk by seeking quick profits through short-term market fluctuations, often with limited fundamental support. The risk profile for investment is moderate and managed, while speculation carries significant uncertainty and potential for substantial losses.

Time Horizons: Long-Term vs. Short-Term Approaches

Investment typically involves long-term time horizons, focusing on sustained growth and value appreciation over years or decades. Speculation emphasizes short-term approaches, aiming for rapid gains by capitalizing on market volatility and price fluctuations. Understanding these distinct time frames helps investors align strategies with risk tolerance and financial goals.

Decision-Making Strategies Compared

Investment decisions prioritize thorough analysis of fundamental data, emphasizing long-term value creation, risk management, and asset diversification to achieve steady returns. Speculation relies on market timing, price trends, and short-term momentum, often accepting higher volatility and uncertainty for potential rapid gains. Effective decision-making in investment incorporates comprehensive research and financial metrics, whereas speculation depends heavily on market sentiment and behavioral cues.

Expected Returns and Outcomes

Investment involves allocating capital to assets with a focus on long-term expected returns based on fundamental analysis and risk assessment, aiming for steady growth and income generation. Speculation prioritizes short-term price fluctuations, seeking higher returns but with increased volatility and higher risk of loss. Expected outcomes of investment tend to be more predictable and aligned with the asset's intrinsic value, while speculation outcomes are uncertain and often driven by market sentiment or timing.

Role of Research and Analysis

Effective investment relies heavily on thorough research and detailed analysis, including evaluating financial statements, market trends, and economic indicators to make informed decisions. Speculation typically involves higher risk, relying more on market price movements and sentiment without comprehensive fundamental analysis. Deep analytical processes reduce uncertainty and enhance the probability of long-term returns by grounding decisions in data-driven insights.

Impact on Personal and Economic Growth

Investment fosters long-term personal wealth accumulation and sustainable economic growth by allocating capital to productive assets that generate stable returns and create jobs. Speculation involves higher risk with short-term profit motives, often causing market volatility and potential personal financial losses without contributing significantly to economic stability. Prioritizing investment over speculation enhances capital formation, innovation, and overall economic resilience.

Choosing the Right Approach for Your Goals

Investment involves allocating capital to assets with the expectation of long-term growth and income, focusing on fundamental analysis and risk management. Speculation entails higher-risk decisions aiming for short-term profits, often relying on market trends and timing rather than intrinsic value. Choosing the right approach depends on your financial goals, risk tolerance, and investment horizon, with diversification helping to balance potential rewards and losses.

Investment Infographic

libterm.com

libterm.com