Central bank independence ensures monetary policy decisions are made free from political pressure, promoting economic stability and controlling inflation effectively. By insulating central banks from short-term political interests, countries can achieve sustained growth and maintain investor confidence. Explore the rest of the article to understand how central bank independence impacts your economy and financial future.

Table of Comparison

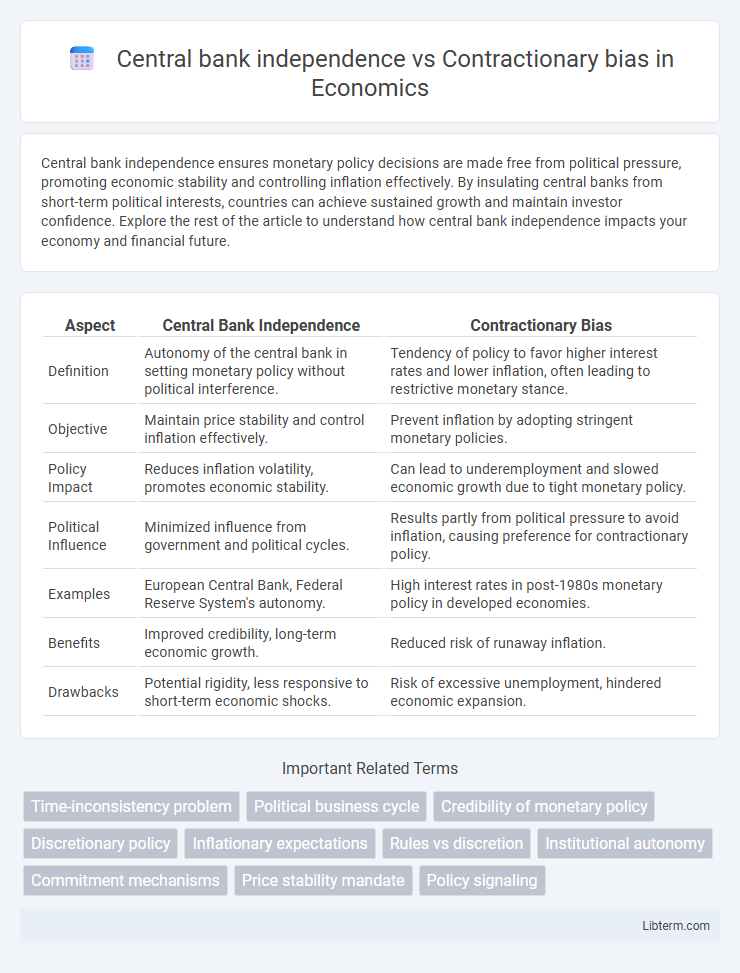

| Aspect | Central Bank Independence | Contractionary Bias |

|---|---|---|

| Definition | Autonomy of the central bank in setting monetary policy without political interference. | Tendency of policy to favor higher interest rates and lower inflation, often leading to restrictive monetary stance. |

| Objective | Maintain price stability and control inflation effectively. | Prevent inflation by adopting stringent monetary policies. |

| Policy Impact | Reduces inflation volatility, promotes economic stability. | Can lead to underemployment and slowed economic growth due to tight monetary policy. |

| Political Influence | Minimized influence from government and political cycles. | Results partly from political pressure to avoid inflation, causing preference for contractionary policy. |

| Examples | European Central Bank, Federal Reserve System's autonomy. | High interest rates in post-1980s monetary policy in developed economies. |

| Benefits | Improved credibility, long-term economic growth. | Reduced risk of runaway inflation. |

| Drawbacks | Potential rigidity, less responsive to short-term economic shocks. | Risk of excessive unemployment, hindered economic expansion. |

Understanding Central Bank Independence

Central bank independence is crucial for insulating monetary policy from short-term political pressures, which helps maintain price stability and anchor inflation expectations. A truly independent central bank can resist contractionary bias--the tendency to overly tighten monetary policy due to fears of inflation--by balancing inflation control with economic growth objectives. Empirical evidence shows that countries with higher central bank independence typically experience lower inflation volatility and more credible monetary policy outcomes.

Defining Contractionary Bias in Monetary Policy

Contractionary bias in monetary policy occurs when central banks systematically favor tighter monetary measures, leading to higher interest rates and reduced economic output. This tendency often arises from the central bank's desire to maintain low inflation and avoid the political pressure to finance government deficits through monetary expansion. The result can be an overly restrictive policy stance that stifles growth and contributes to economic volatility despite the central bank's independence.

Historical Context: Evolution of Central Bank Roles

The evolution of central bank roles reflects a transition from political influence to increased independence, mitigating contractionary bias--a tendency for policymakers to favor tight monetary policies to control inflation but at the expense of higher unemployment. Historically, central banks operated under government directives, often prioritizing short-term political goals, which led to time-inconsistent policies and economic instability. The shift towards central bank independence, exemplified by the Federal Reserve's reforms in the 1970s and the European Central Bank's establishment in 1998, aimed to anchor inflation expectations while allowing for balanced economic growth.

Theoretical Frameworks on Central Bank Autonomy

Theoretical frameworks on central bank autonomy emphasize the trade-off between insulating monetary policy from political pressures and the risk of contractionary bias, where independent central banks may prioritize low inflation at the cost of higher unemployment. Models like Rogoff's conservative central banker hypothesis suggest that granting independence reduces inflationary bias but can lead to overly tight policies when policymakers are overly focused on inflation control. New-Keynesian frameworks incorporate time-inconsistency problems and highlight how central bank autonomy shapes expectations and the optimal balance between inflation stabilization and output gap management.

Arguments for Central Bank Independence

Central bank independence promotes credible monetary policy by insulating decision-making from political pressures, reducing inflationary biases often caused by short-term political interests. Empirical data indicate that countries with independent central banks generally experience lower and more stable inflation rates, improving long-term economic growth and financial market stability. Furthermore, independence enables central banks to implement contractionary measures when necessary without undue political interference, mitigating the risk of demand-pull inflation and supporting sustainable macroeconomic conditions.

Risks of Contractionary Bias in Independent Central Banks

Contractionary bias in independent central banks risks prolonged periods of restrictive monetary policy that can suppress economic growth and increase unemployment. This bias often stems from conservative mandates prioritizing inflation control over output stabilization, leading to excessively tight interest rates. Persistent contractionary policies may undermine public trust and limit policy flexibility during economic downturns, exacerbating recessions and financial instability.

Political Pressures vs. Monetary Policy Objectives

Central bank independence plays a critical role in mitigating contractionary bias by insulating monetary policy decisions from short-term political pressures that often prioritize fiscal discipline over economic growth. Political pressures can lead policymakers to adopt overly restrictive monetary stances to control inflation or reduce deficit spending, potentially stifling economic expansion and increasing unemployment. Ensuring central banks have autonomy allows for objective pursuit of monetary policy objectives such as price stability and full employment, balancing inflation control without undue political influence.

Empirical Evidence: Independence and Economic Outcomes

Empirical evidence indicates that higher central bank independence correlates with lower inflation rates without sacrificing economic growth, as found in studies by Alesina and Summers (1993) and Cukierman et al. (1992). Countries with independent central banks tend to avoid contractionary bias, characterized by excessive tightening of monetary policy to combat inflation, thereby promoting stable macroeconomic environments. Data from OECD nations confirm that institutional autonomy enhances credibility and reduces inflation expectations, contributing to improved long-term economic outcomes.

Policy Tools to Mitigate Contractionary Bias

Central bank independence reduces contractionary bias by insulating monetary policy decisions from short-term political pressures, allowing for a focus on long-term economic stability. Policy tools such as inflation targeting, transparent communication strategies, and rule-based frameworks like the Taylor Rule enhance accountability and reduce discretionary tightening. These mechanisms improve credibility, anchoring inflation expectations and minimizing unnecessary contractionary interventions that could stifle growth.

Future Directions: Balancing Independence and Accountability

Central bank independence remains crucial for controlling inflation and ensuring policy credibility, but emerging empirical research suggests that strict autonomy can sometimes lead to contractionary bias, where overly tight monetary policies slow economic growth. Future directions emphasize designing institutional frameworks that balance independence with enhanced accountability mechanisms, such as transparent communication strategies, performance-based evaluations, and legislative oversight. Integrating these elements aims to mitigate contractionary bias while preserving the central bank's ability to respond effectively to macroeconomic challenges.

Central bank independence Infographic

libterm.com

libterm.com