Quick look analysis offers an immediate, high-level overview of complex data or situations, enabling swift decision-making without getting bogged down in details. It focuses on extracting key insights and identifying patterns that are crucial for understanding the core message efficiently. Explore the rest of the article to deepen your understanding of how quick look analysis can sharpen your analytical skills and optimize your workflow.

Table of Comparison

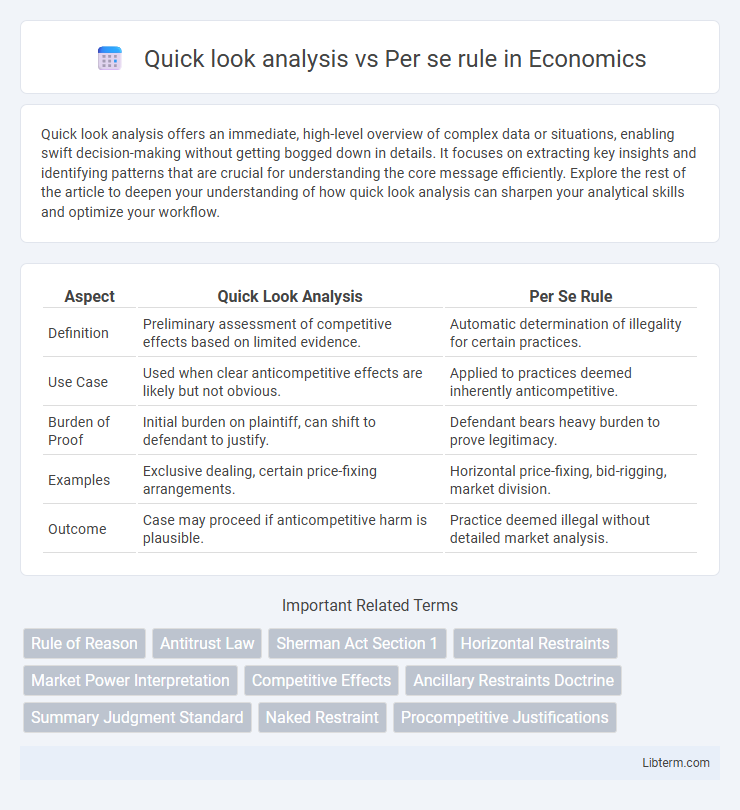

| Aspect | Quick Look Analysis | Per Se Rule |

|---|---|---|

| Definition | Preliminary assessment of competitive effects based on limited evidence. | Automatic determination of illegality for certain practices. |

| Use Case | Used when clear anticompetitive effects are likely but not obvious. | Applied to practices deemed inherently anticompetitive. |

| Burden of Proof | Initial burden on plaintiff, can shift to defendant to justify. | Defendant bears heavy burden to prove legitimacy. |

| Examples | Exclusive dealing, certain price-fixing arrangements. | Horizontal price-fixing, bid-rigging, market division. |

| Outcome | Case may proceed if anticompetitive harm is plausible. | Practice deemed illegal without detailed market analysis. |

Understanding Quick Look Analysis

Quick Look Analysis evaluates anticompetitive effects by allowing courts to infer market power from evidence of apparent coordination without a full market inquiry, streamlining the assessment of potential violations. This approach balances the strictness of the Per Se Rule, which deems certain practices inherently illegal without detailed context, by providing a flexible framework that considers the likelihood of coordinated behavior. Understanding Quick Look Analysis is crucial for identifying when expedited judicial review is appropriate in antitrust cases involving potentially collusive conduct.

Exploring the Per Se Rule

The Per Se Rule criminalizes business practices that are intrinsically anticompetitive, such as price-fixing and market allocation, without requiring detailed market analysis. This legal standard streamlines antitrust litigation by presuming certain agreements are unlawful, thereby eliminating the need for plaintiffs to prove actual harm or market power. Its strict nature contrasts with the Quick Look Analysis, which allows some inquiry into the practice's context before declaring it illegal.

Historical Evolution of Antitrust Standards

Quick look analysis emerged in the late 20th century as a pragmatic approach allowing courts to infer anticompetitive effects from evidence without exhaustive market analysis, streamlining enforcement against obviously harmful practices. The per se rule, rooted in early 20th-century antitrust jurisprudence, categorically condemned certain business practices like price-fixing and market division as inherently illegal, reflecting a rigid stance on competition violations. Over time, the antitrust standards evolved from strict per se prohibitions toward more flexible frameworks like quick look analysis to balance efficient enforcement with economic realities.

Key Differences: Quick Look vs Per Se

Quick Look analysis applies to cases where anticompetitive effects are obvious but fall short of automatic condemnation, allowing limited context examination, while the Per Se rule categorically prohibits certain practices without detailed market analysis. Quick Look strikes a balance by permitting a rebuttal or minimal inquiry, contrasting with the Per Se rule's rigid stance that deems specific actions like price-fixing or market allocation inherently unlawful. The key difference lies in the degree of judicial scrutiny and the opportunity for defendants to justify the conduct under Quick Look, unlike the Per Se rule's absolute prohibition.

Criteria for Applying Quick Look Analysis

Quick look analysis applies when the anticompetitive effects of a conduct are obvious and without detailed market inquiry, typically in cases involving horizontal agreements among competitors. The criteria for applying quick look analysis include the presence of a blatant restraint on competition, sufficient market power by the parties, and an absence of plausible procompetitive justifications. Courts rely on readily apparent evidence demonstrating that the conduct restricts competition, bypassing the need for extensive economic analysis required under the rule of reason.

When Courts Use the Per Se Rule

Courts employ the per se rule in antitrust cases when certain business practices, such as price-fixing, bid-rigging, or market allocation, are inherently anticompetitive and illegal without further detailed analysis. This rule streamlines judicial proceedings by eliminating the need for extensive market impact evaluations that are typically required under quick look analysis. Quick look analysis applies when the anticompetitive nature is not obvious but still probable, necessitating limited market examination, whereas the per se rule applies to clearly unlawful conduct established by precedent.

Notable Cases Illustrating Quick Look

In trademark law, Quick Look analysis offers a streamlined approach to assessing likelihood of confusion without extensive evidence, as demonstrated in *Pebble Beach Co. v. Tour 18 I Ltd.*, where the court rapidly found confusion based on obvious trademark similarities. This contrasts with the Per se rule, which applies automatic judgment in cases with facially identical marks, but Quick Look requires some context-driven evaluation. The *Century 21 Real Estate Corp. v. Century Life of America* case further illustrates Quick Look's flexible application, balancing trademark strength and consumer perception.

Landmark Decisions on Per Se Rule

Landmark decisions like *Leegin Creative Leather Products, Inc. v. PSKS, Inc.* significantly reshaped the application of the Per Se Rule by emphasizing a rule of reason approach over automatic illegality. The Per Se Rule categorizes certain business practices, such as price-fixing and market division, as inherently anticompetitive and illegal without detailed market analysis. Quick look analysis offers a middle ground by permitting courts to infer anticompetitive harm in cases where the practice's nature unmistakably reduces competition, streamlining judicial evaluation without the full complexity of a rule of reason inquiry.

Practical Implications in Antitrust Law

Quick look analysis allows courts to address obvious anticompetitive practices with less detailed market analysis, streamlining case resolutions and reducing litigation costs. The per se rule categorically deems certain business practices, such as price-fixing and market division, illegal without requiring extensive examination of competitive effects. Practical implications include faster enforcement under per se rule but greater flexibility under quick look analysis, which can adapt to novel antitrust issues lacking clear precedent.

Choosing the Right Analytical Approach

Choosing between Quick Look Analysis and the Per Se Rule hinges on the complexity and context of the antitrust case. Quick Look Analysis suits situations with moderately clear competitive harm, allowing a streamlined review without detailed market analysis, while the Per Se Rule applies to agreements presumed illegal based on established precedent, requiring no further inquiry into their competitive effects. Selecting the appropriate approach ensures efficient enforcement and accurate assessment of potential antitrust violations.

Quick look analysis Infographic

libterm.com

libterm.com