Purchasing Power Parity (PPP) is an economic theory that compares different countries' currencies through a "basket of goods" approach to determine the relative value of currencies. It helps you understand how exchange rates should adjust to equalize the purchasing power between nations, influencing international trade and investment decisions. Explore the rest of the article to learn how PPP impacts global markets and your economic outlook.

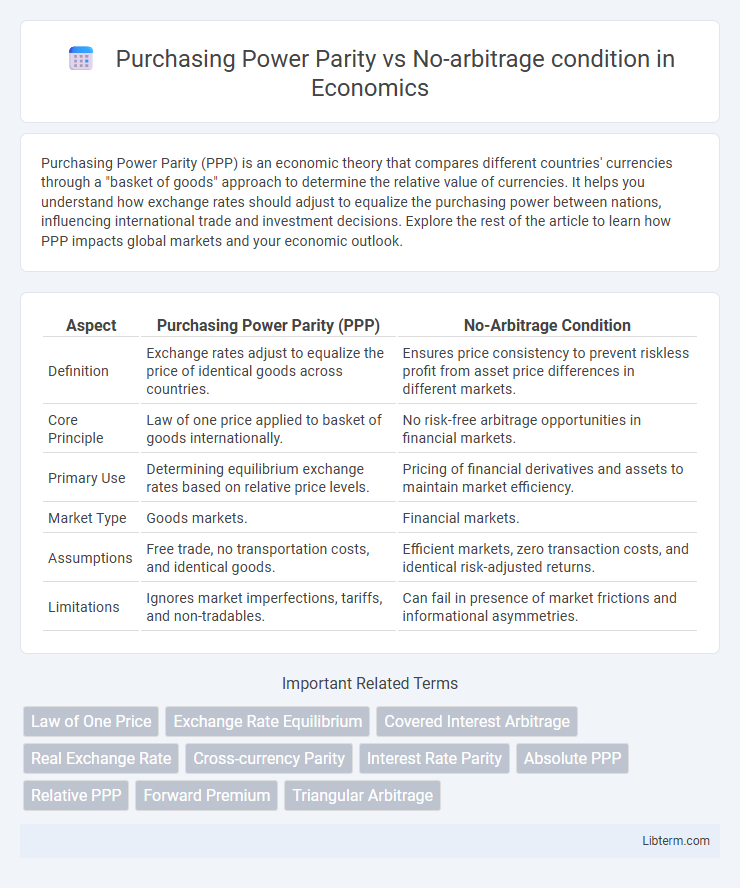

Table of Comparison

| Aspect | Purchasing Power Parity (PPP) | No-Arbitrage Condition |

|---|---|---|

| Definition | Exchange rates adjust to equalize the price of identical goods across countries. | Ensures price consistency to prevent riskless profit from asset price differences in different markets. |

| Core Principle | Law of one price applied to basket of goods internationally. | No risk-free arbitrage opportunities in financial markets. |

| Primary Use | Determining equilibrium exchange rates based on relative price levels. | Pricing of financial derivatives and assets to maintain market efficiency. |

| Market Type | Goods markets. | Financial markets. |

| Assumptions | Free trade, no transportation costs, and identical goods. | Efficient markets, zero transaction costs, and identical risk-adjusted returns. |

| Limitations | Ignores market imperfections, tariffs, and non-tradables. | Can fail in presence of market frictions and informational asymmetries. |

Understanding Purchasing Power Parity (PPP)

Purchasing Power Parity (PPP) asserts that over time, exchange rates adjust to equalize the price of identical goods in different countries, reflecting inflation rate differentials. This economic theory serves as a fundamental basis for comparing currency values by linking price levels and exchange rates. Unlike the no-arbitrage condition, which focuses on riskless profit opportunities in financial markets, PPP provides a long-term equilibrium framework rooted in price level comparisons across countries.

Defining the No-Arbitrage Condition

The no-arbitrage condition ensures that there are no opportunities for riskless profit in financial markets by requiring that asset prices reflect all available information, making arbitrage impossible. It plays a crucial role in pricing derivatives, foreign exchange rates, and interest rate parity by enforcing equilibrium conditions that prevent price discrepancies. Unlike Purchasing Power Parity, which relates exchange rates to relative price levels of goods, the no-arbitrage condition is a fundamental principle underpinning market efficiency and fair valuation.

Theoretical Foundations of PPP

Purchasing Power Parity (PPP) is grounded in the Law of One Price, asserting that identical goods should cost the same across countries when prices are expressed in a common currency, reflecting long-term equilibrium exchange rates. The theoretical foundation of PPP relies on the absence of transportation costs, tariffs, and trade barriers, ensuring that any deviation in price levels across countries is arbitraged away through currency adjustments. Unlike the no-arbitrage condition, which applies more broadly to financial markets ensuring no riskless profit opportunities, PPP specifically addresses price level equalization through exchange rate movements driven by goods arbitrage.

Core Principles of No-Arbitrage

The core principles of the no-arbitrage condition ensure that asset prices in efficient markets prevent riskless profit opportunities by aligning price differentials with underlying economic fundamentals. Unlike Purchasing Power Parity, which focuses primarily on exchange rate equilibrium based on relative price levels between countries, no-arbitrage conditions apply broadly to financial instruments, enforcing consistent pricing through the law of one price. This principle forms the foundation for derivative pricing models and risk-neutral valuation techniques, ensuring market coherence and fairness.

Comparative Analysis: PPP vs No-Arbitrage

Purchasing Power Parity (PPP) asserts that exchange rates adjust to equalize the price levels of identical goods across countries, emphasizing long-term equilibrium in currency values. The no-arbitrage condition focuses on preventing risk-free profit opportunities by ensuring that forward exchange rates reflect expected future spot rates adjusted for interest rate differentials. While PPP centers on fundamental price level parity for currency valuation, the no-arbitrage condition derives exchange rates from financial market consistency and interest rate parity, providing a more short-term, market-driven approach to currency determination.

Practical Applications in International Finance

Purchasing Power Parity (PPP) guides exchange rate predictions by asserting that currency values adjust to equalize price levels across countries, aiding multinational firms in budgeting and long-term investment decisions. The no-arbitrage condition ensures that the forward exchange rates eliminate riskless profit opportunities, vital for currency traders and financial institutions managing hedging strategies. Combining PPP with no-arbitrage frameworks allows international financiers to assess currency misalignments and optimize portfolio allocations in global markets.

Factors Influencing PPP and No-Arbitrage

Purchasing Power Parity (PPP) is influenced by factors such as inflation rate differentials, transaction costs, and trade barriers that affect the price level convergence across countries. The No-arbitrage condition relies on the absence of riskless profit opportunities in financial markets, driven by interest rate differentials, capital mobility, and market efficiency. Both concepts intersect through exchange rates; PPP emphasizes goods market equilibrium, while no-arbitrage ensures alignment in currency forward and spot rates via financial market mechanisms.

Limitations and Critiques of PPP

Purchasing Power Parity (PPP) faces limitations due to factors such as transportation costs, tariffs, and differences in product quality, which prevent price equalization across countries. The no-arbitrage condition in financial markets assumes frictionless trade and perfect capital mobility, conditions often unmet in reality, leading to deviations from PPP. Empirical studies consistently show that PPP holds only in the long run, with short-term exchange rates influenced by monetary policies, market speculation, and structural economic differences.

Challenges in Enforcing No-Arbitrage

Enforcing the no-arbitrage condition faces challenges due to market frictions, transaction costs, and information asymmetry, which create deviations from ideal price equalization. Unlike Purchasing Power Parity (PPP), which primarily addresses price level comparisons across countries, no-arbitrage requires instantaneous and riskless profit opportunities to be eliminated, a condition often violated in real-world markets. The presence of incomplete markets and regulatory constraints further complicates the establishment of strict no-arbitrage conditions, limiting its practical application.

Implications for Investors and Policymakers

Purchasing Power Parity (PPP) suggests exchange rates adjust to equalize price levels across countries, providing investors with a framework to anticipate long-term currency movements and hedge inflation risk. The No-arbitrage condition ensures that no riskless profit can be made from discrepancies in interest rates or asset prices, guiding policymakers in maintaining market equilibrium and preventing speculative currency attacks. Understanding both concepts helps investors optimize international portfolio allocation and enables policymakers to design interventions that stabilize exchange rates without distorting fundamental market signals.

Purchasing Power Parity Infographic

libterm.com

libterm.com