Net worth represents the total value of your assets minus liabilities, providing a clear snapshot of your financial health. Tracking net worth over time helps you understand your progress toward financial goals and identify areas for improvement. Explore this article to learn effective strategies for calculating and growing your net worth.

Table of Comparison

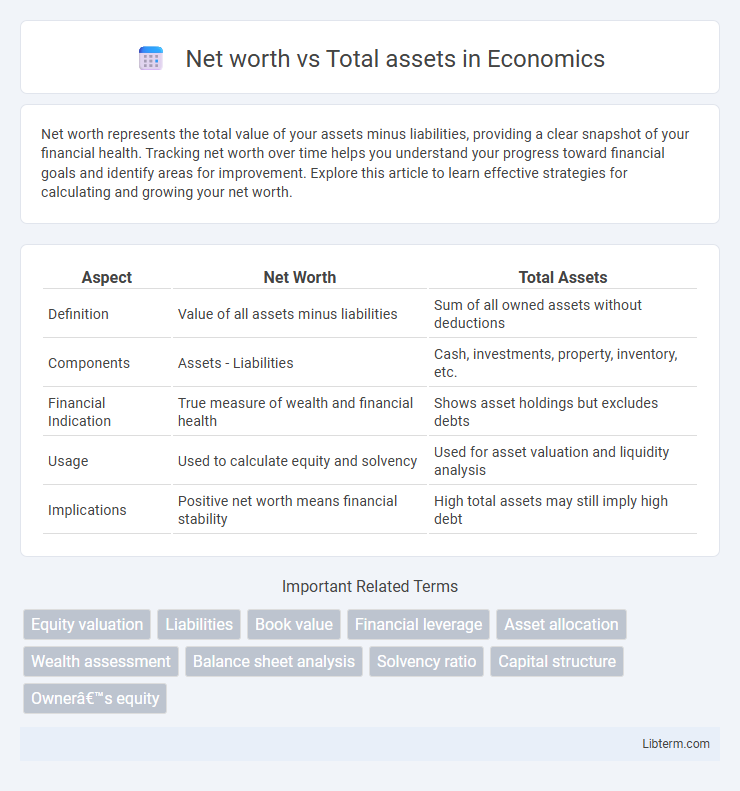

| Aspect | Net Worth | Total Assets |

|---|---|---|

| Definition | Value of all assets minus liabilities | Sum of all owned assets without deductions |

| Components | Assets - Liabilities | Cash, investments, property, inventory, etc. |

| Financial Indication | True measure of wealth and financial health | Shows asset holdings but excludes debts |

| Usage | Used to calculate equity and solvency | Used for asset valuation and liquidity analysis |

| Implications | Positive net worth means financial stability | High total assets may still imply high debt |

Introduction to Net Worth and Total Assets

Net worth represents the difference between an individual's or company's total assets and total liabilities, providing a clear measure of financial health. Total assets encompass everything owned with economic value, including cash, investments, property, and equipment. Understanding the distinction helps in accurately assessing financial stability and making informed decisions.

Defining Net Worth

Net worth is the financial metric that represents the difference between total assets and total liabilities, providing a snapshot of an individual's or company's financial health. Total assets include all owned resources such as cash, property, investments, and equipment, but do not account for any debts or obligations. Defining net worth accurately involves subtracting total liabilities, such as loans and mortgages, from total assets to determine true financial value.

Understanding Total Assets

Total assets represent the complete value of everything a person or company owns, including cash, investments, property, and equipment. They are a crucial indicator of financial strength and liquidity, serving as the foundation for calculating net worth. Understanding total assets helps in assessing the overall resource base available to generate income or settle liabilities.

Key Differences Between Net Worth and Total Assets

Net worth represents the difference between total assets and total liabilities, providing a clear indicator of an individual's or company's financial health. Total assets encompass everything of value owned, including cash, property, investments, and equipment, without accounting for debts. Understanding that net worth reflects equity after liabilities is crucial, while total assets measure the full scope of owned resources regardless of obligations.

How to Calculate Net Worth

Net worth is calculated by subtracting total liabilities from total assets, providing a clear financial snapshot. Total assets include everything owned such as cash, property, investments, and other valuable resources, while total liabilities encompass all debts and obligations. Understanding this distinction allows individuals and businesses to accurately assess financial health by evaluating what is truly owned versus what is owed.

How to Calculate Total Assets

Total assets represent the sum of everything a company or individual owns, including cash, investments, property, and accounts receivable. To calculate total assets, add current assets such as cash and inventory to fixed assets like land, buildings, and equipment. This comprehensive valuation provides a clear picture of financial strength before subtracting liabilities to determine net worth.

Importance of Assessing Net Worth

Assessing net worth provides a comprehensive understanding of an individual's or business's financial health by calculating the difference between total assets and liabilities, offering a clearer picture than total assets alone. Net worth evaluation helps identify financial stability, investment potential, and debt management effectiveness, critical for making informed financial decisions. Monitoring net worth over time supports strategic planning, wealth accumulation, and risk assessment, essential for long-term financial success.

Role of Total Assets in Financial Planning

Total assets represent the complete value of everything a person or business owns, serving as a critical foundation for accurate net worth calculation. In financial planning, total assets provide a comprehensive snapshot of wealth accumulation, helping to identify liquidity and investment potential. Understanding the role of total assets enables better allocation of resources and strategic decision-making for long-term financial growth.

Common Mistakes When Comparing Net Worth and Total Assets

Confusing net worth with total assets is a common mistake that can lead to inaccurate financial assessments. Net worth reflects the difference between total assets and total liabilities, whereas total assets only account for what an individual or company owns without considering debts. Failing to subtract liabilities when evaluating financial health often results in an overestimation of true wealth.

Net Worth vs Total Assets: Which Metric Matters Most?

Net worth and total assets are key financial metrics, but net worth provides a clearer picture of financial health by accounting for liabilities, while total assets only measure the value of owned resources. Investors and analysts prioritize net worth because it reveals the true equity by subtracting debts from total assets, thus indicating solvency and financial stability. A high total asset value with equally high liabilities can mask poor financial conditions, making net worth the more critical metric for evaluating financial strength.

Net worth Infographic

libterm.com

libterm.com