Private equity involves investing capital directly into private companies or buying out public companies to delist them from stock exchanges. This strategy aims to improve a company's performance and profitability before eventually selling it for a substantial return. Discover how private equity can transform businesses and what it means for your investment portfolio in the rest of this article.

Table of Comparison

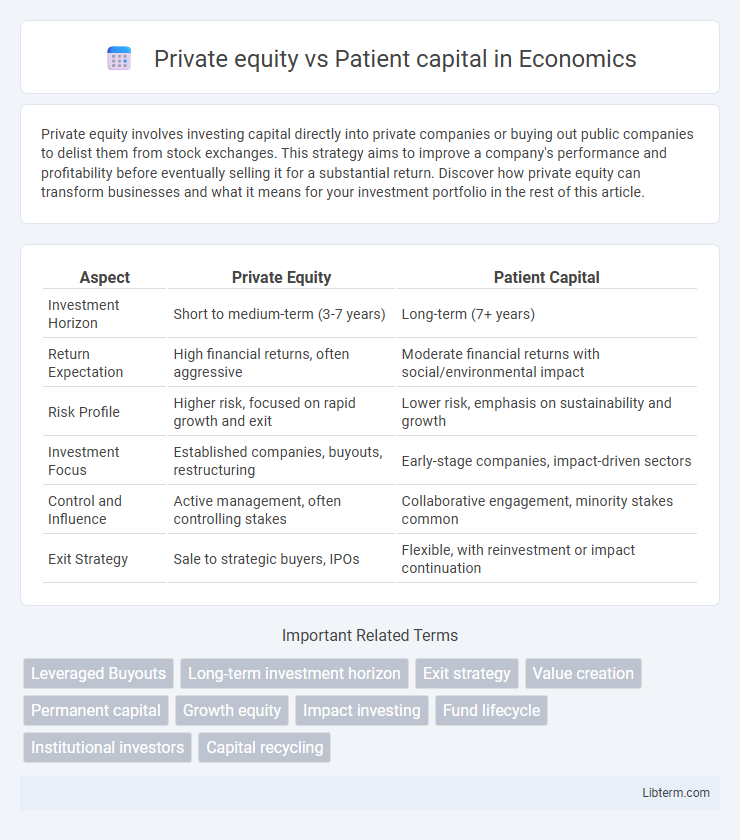

| Aspect | Private Equity | Patient Capital |

|---|---|---|

| Investment Horizon | Short to medium-term (3-7 years) | Long-term (7+ years) |

| Return Expectation | High financial returns, often aggressive | Moderate financial returns with social/environmental impact |

| Risk Profile | Higher risk, focused on rapid growth and exit | Lower risk, emphasis on sustainability and growth |

| Investment Focus | Established companies, buyouts, restructuring | Early-stage companies, impact-driven sectors |

| Control and Influence | Active management, often controlling stakes | Collaborative engagement, minority stakes common |

| Exit Strategy | Sale to strategic buyers, IPOs | Flexible, with reinvestment or impact continuation |

Defining Private Equity and Patient Capital

Private equity involves investments made by firms or funds directly into private companies, often aiming for significant returns within a fixed timeframe through active management and eventual exit strategies. Patient capital refers to long-term investments typically characterized by flexible timelines and a focus on sustainable growth, often supporting social or environmental objectives alongside financial returns. While private equity seeks accelerated value creation, patient capital emphasizes enduring impact and stability in businesses.

Key Investment Strategies Compared

Private equity primarily focuses on acquiring majority stakes in established companies to drive rapid growth and operational improvements, often targeting a profitable exit within 3 to 7 years. Patient capital emphasizes long-term investments in early-stage or mission-driven enterprises, prioritizing sustainable impact and business resilience over immediate financial returns. Key strategies in private equity include leveraged buyouts and strategic restructuring, whereas patient capital leverages flexible funding structures and active support to nurture innovation and social value creation.

Sources of Funding and Investor Profiles

Private equity funding typically comes from institutional investors, high-net-worth individuals, and private equity firms seeking high returns within a 3 to 7-year time horizon. Patient capital is often sourced from impact investors, development finance institutions, and family offices prioritizing long-term social impact alongside financial returns over a decade or more. Investor profiles in private equity emphasize risk tolerance and exit strategies, whereas patient capital investors focus on sustainability and gradual value creation.

Time Horizons: Short-term vs Long-term Commitments

Private equity typically involves short-term commitments ranging from 3 to 7 years, focusing on rapid growth and exit strategies like IPOs or acquisitions. Patient capital emphasizes long-term investments, often spanning 10 to 20 years, prioritizing sustained value creation in sectors such as infrastructure and social enterprises. The contrasting time horizons affect portfolio management, risk tolerance, and return expectations between these two financing approaches.

Risk Appetite and Return Expectations

Private equity typically involves a high risk appetite with investors seeking substantial returns within a shorter time horizon, often targeting double-digit annualized gains through aggressive growth strategies and operational improvements. Patient capital, by contrast, adopts a lower risk tolerance, prioritizing sustainable long-term value creation over immediate profits, often accepting modest returns for extended investment periods to support innovation and social impact. The fundamental difference lies in private equity's focus on rapid value extraction versus patient capital's emphasis on resilience and gradual value appreciation.

Impact on Portfolio Companies

Private equity typically drives aggressive growth and operational efficiency in portfolio companies through active management and short- to medium-term exit strategies, often prioritizing financial returns. Patient capital offers long-term investment horizons, enabling portfolio companies to focus on sustainable growth, innovation, and social impact without immediate pressure for rapid financial gain. The impact on portfolio companies varies as private equity fosters swift value creation and restructuring, while patient capital supports organic development and resilience-building over extended periods.

Governance and Management Involvement

Private equity typically emphasizes active governance through board control and performance-driven management involvement to accelerate growth and maximize returns within a defined timeline. Patient capital adopts a more hands-off governance style, prioritizing long-term value creation by supporting management with strategic guidance rather than operational control. This approach allows patient capital to foster sustainable business development without the pressure of immediate financial exits.

Exit Strategies and Liquidity

Private equity typically pursues exit strategies such as initial public offerings (IPOs), trade sales, or secondary buyouts within a 3 to 7-year horizon to maximize liquidity and returns. Patient capital, by contrast, emphasizes long-term investments with flexible exit timelines, often favoring gradual divestitures, dividend recaps, or strategic buybacks aligned with sustained growth rather than immediate liquidity. The differing liquidity profiles reflect private equity's focus on quicker capital recycling versus patient capital's commitment to enduring value creation.

Real-world Examples and Case Studies

Private equity investments often target rapid growth and exit strategies, exemplified by Blackstone's acquisition of Hilton Worldwide, which achieved substantial returns within five years. Patient capital, characterized by longer investment horizons and social impact goals, is illustrated by the Chan Zuckerberg Initiative's funding in education technology startups, focusing on sustained development rather than immediate financial gains. Real-world case studies highlight how private equity maximizes short-term financial performance, while patient capital prioritizes long-term value creation and community benefits.

Choosing the Right Model for Business Growth

Private equity provides businesses with substantial funding and strategic guidance for rapid growth, typically expecting high returns within a defined timeframe. Patient capital offers flexible, long-term investment without immediate pressure for returns, supporting sustainable development and innovation. Selecting the right model depends on a company's growth stage, financial goals, and tolerance for control and exit timelines.

Private equity Infographic

libterm.com

libterm.com