Negative income tax provides a financial safety net by ensuring that individuals earning below a certain threshold receive supplemental income from the government, reducing poverty and simplifying welfare systems. This approach incentivizes work while guaranteeing a minimum income level, making it an effective tool for addressing income inequality. Explore the rest of the article to understand how the negative income tax could transform social welfare and impact your financial future.

Table of Comparison

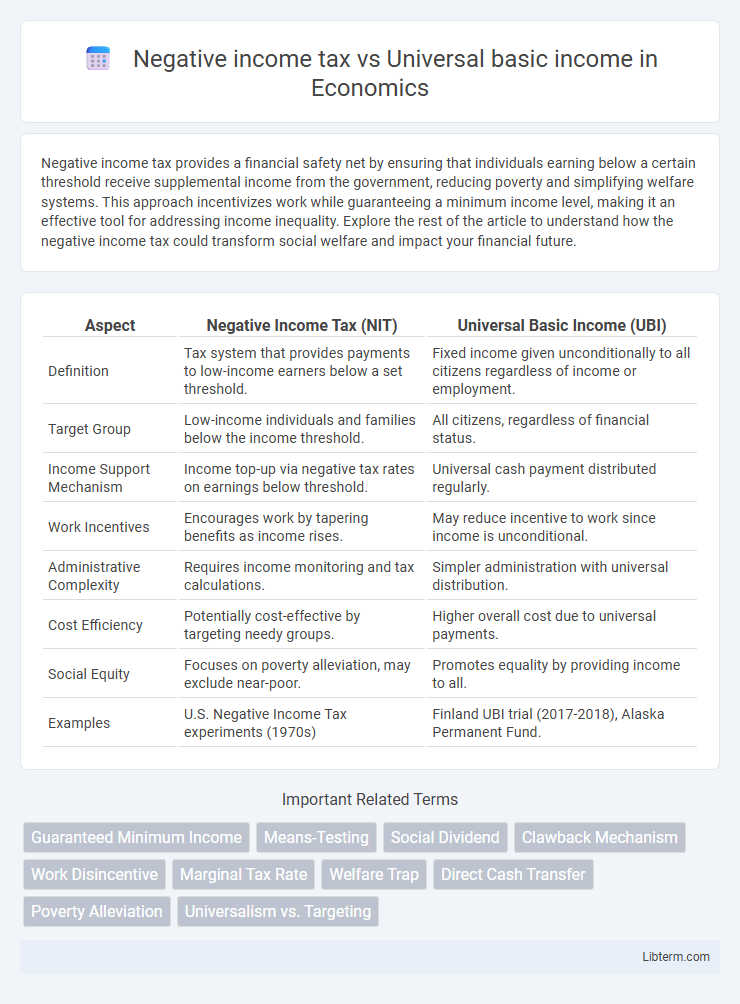

| Aspect | Negative Income Tax (NIT) | Universal Basic Income (UBI) |

|---|---|---|

| Definition | Tax system that provides payments to low-income earners below a set threshold. | Fixed income given unconditionally to all citizens regardless of income or employment. |

| Target Group | Low-income individuals and families below the income threshold. | All citizens, regardless of financial status. |

| Income Support Mechanism | Income top-up via negative tax rates on earnings below threshold. | Universal cash payment distributed regularly. |

| Work Incentives | Encourages work by tapering benefits as income rises. | May reduce incentive to work since income is unconditional. |

| Administrative Complexity | Requires income monitoring and tax calculations. | Simpler administration with universal distribution. |

| Cost Efficiency | Potentially cost-effective by targeting needy groups. | Higher overall cost due to universal payments. |

| Social Equity | Focuses on poverty alleviation, may exclude near-poor. | Promotes equality by providing income to all. |

| Examples | U.S. Negative Income Tax experiments (1970s) | Finland UBI trial (2017-2018), Alaska Permanent Fund. |

Introduction to Negative Income Tax and Universal Basic Income

Negative Income Tax (NIT) provides direct financial support to individuals earning below a certain threshold by supplementing their income through the tax system, aiming to reduce poverty while encouraging work. Universal Basic Income (UBI) ensures a fixed, unconditional cash payment to all citizens regardless of employment status or income level, promoting economic security and simplifying welfare programs. Both models seek to address income inequality but differ fundamentally in conditionality and implementation mechanisms.

Historical Background and Policy Evolution

The concept of a Negative Income Tax (NIT) was first introduced by economist Milton Friedman in the 1960s as a method to provide direct financial support to low-income individuals by taxing negative earnings, aiming to simplify welfare programs. Universal Basic Income (UBI) has roots in early 20th-century philosophical discussions, gaining policy traction with experiments like the 1970s Mincome project in Canada, focusing on unconditional cash transfers to all citizens. Over the decades, NIT influenced welfare reform by promoting targeted assistance, while UBI evolved through debates on economic security and technological unemployment, shaping contemporary policy discussions.

Core Principles: How NIT and UBI Work

Negative Income Tax (NIT) provides financial support by guaranteeing a minimum income through tax refunds when earnings fall below a set threshold, effectively supplementing low wages without disincentivizing work. Universal Basic Income (UBI) delivers a fixed, unconditional cash payment to all citizens regardless of income or employment status, promoting economic security and reducing poverty. Both systems aim to alleviate poverty but differ in implementation, with NIT targeting low-income households through the tax system, while UBI offers universal, automatic payments to every individual.

Implementation Structures and Mechanisms

Negative income tax (NIT) implementation relies on the existing tax system, providing targeted cash transfers by reducing tax liabilities for low-income earners, which requires accurate income reporting and effective tax administration. Universal basic income (UBI) involves unconditional cash payments to all citizens regardless of income, necessitating a broad funding mechanism, such as increased taxation or reallocation of social welfare budgets, and a distribution platform capable of handling universal payouts. Both mechanisms demand robust data infrastructure and administrative capacity, but NIT integrates more seamlessly with income tax systems while UBI demands comprehensive funding and delivery frameworks for universal coverage.

Economic Impacts and Redistribution Effects

Negative income tax (NIT) targets low-income households by providing supplemental income up to a certain threshold, effectively reducing poverty while maintaining work incentives through gradual benefit phase-outs. Universal basic income (UBI) guarantees a fixed, unconditional payment to all citizens, promoting income security but potentially discouraging labor participation due to its universal nature. Both systems aim to redistribute wealth and reduce inequality, though NIT offers more precise economic efficiency by focusing resources on those in need, whereas UBI emphasizes simplicity and universality at a higher fiscal cost.

Poverty Reduction: Comparative Effectiveness

Negative income tax (NIT) and Universal Basic Income (UBI) both aim to reduce poverty, but NIT targets low-income households by providing financial support based on income thresholds, ensuring a gradual phase-out of benefits as earnings increase. UBI delivers a fixed, unconditional payment to all individuals regardless of income, promoting broader economic security but requiring higher fiscal resources. Studies show NIT is more cost-effective for poverty alleviation due to its targeted approach, while UBI offers simplicity and reduces stigma but may provide less direct impact on poverty reduction per dollar spent.

Labor Market Incentives and Behavioral Responses

Negative income tax (NIT) directly supplements low-income workers, preserving work incentives by phasing out benefits as earnings rise, which encourages labor participation and gradual income increase. Universal basic income (UBI) provides an unconditional payment regardless of employment, potentially reducing the incentive to work due to guaranteed income, but may also enable greater job flexibility and entrepreneurial activity. Empirical studies suggest NIT tends to sustain labor market engagement better, while UBI's effect varies widely based on design and societal context.

Administrative Complexity and Costs

Negative income tax (NIT) systems involve means-testing and tax filing, leading to moderate administrative complexity and costs related to income verification and benefit adjustments. Universal Basic Income (UBI) programs distribute fixed payments to all citizens regardless of income, minimizing administrative overhead and simplifying implementation, but potentially increasing total fiscal expenditure. While NIT targets support more precisely, UBI's streamlined administration reduces bureaucratic expenses, creating a trade-off between cost efficiency and universality.

Political Feasibility and Public Perception

Negative income tax (NIT) faces higher political resistance due to misconceptions about welfare dependency and administrative complexity, whereas universal basic income (UBI) enjoys broader public appeal for its simplicity and universal eligibility. Public perception favors UBI for promoting dignity and reducing stigma, while NIT is often viewed as a targeted, conditional aid less attractive to voters seeking fairness and ease of implementation. Policymakers debate feasibility with UBI's universal model seen as more transparent, but NIT offers precise fiscal control, influencing political support based on ideological alignment and budget priorities.

Future Prospects and Policy Recommendations

Negative income tax (NIT) offers targeted financial support by adjusting benefits based on earnings, promoting workforce participation and reducing administrative costs, which may enhance fiscal sustainability in future social welfare frameworks. Universal basic income (UBI) provides unconditional cash payments to all citizens, simplifying social programs and potentially stimulating economic demand, but raising concerns about funding and inflation risks. Policy recommendations suggest pilot programs for both systems to evaluate economic impacts, with emphasis on integrating technology-driven monitoring and adjusting benefit levels to ensure equity and efficiency.

Negative income tax Infographic

libterm.com

libterm.com