Index portfolios track a specific market index, offering broad market exposure, low costs, and diversified risk. These portfolios are designed to replicate the performance of benchmarks like the S&P 500, providing a passive investment strategy that aligns with overall market trends. Discover how an index portfolio can fit into your investment plan by reading the full article.

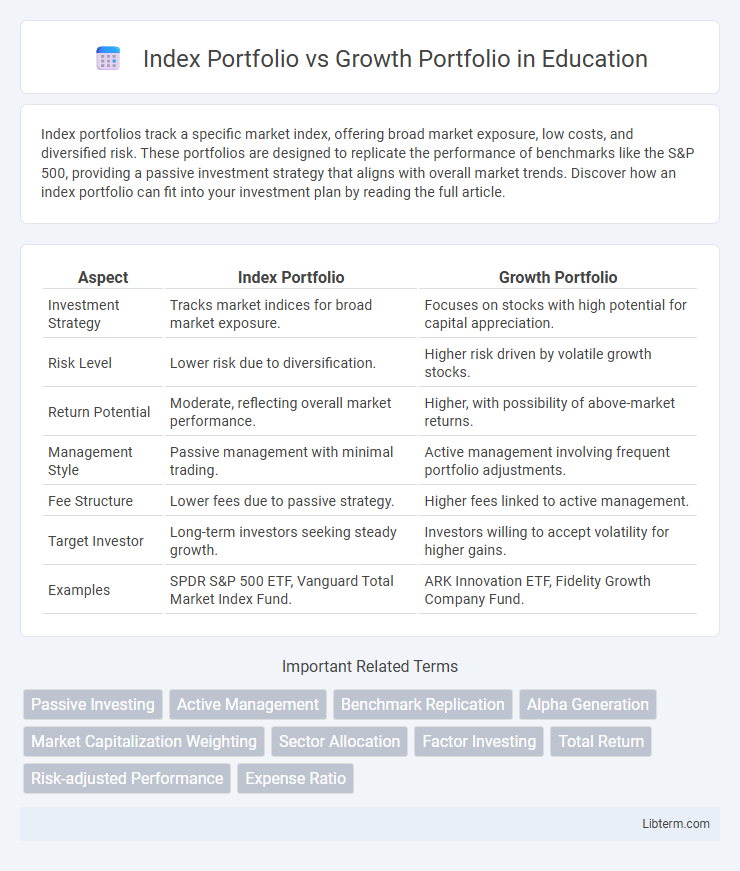

Table of Comparison

| Aspect | Index Portfolio | Growth Portfolio |

|---|---|---|

| Investment Strategy | Tracks market indices for broad market exposure. | Focuses on stocks with high potential for capital appreciation. |

| Risk Level | Lower risk due to diversification. | Higher risk driven by volatile growth stocks. |

| Return Potential | Moderate, reflecting overall market performance. | Higher, with possibility of above-market returns. |

| Management Style | Passive management with minimal trading. | Active management involving frequent portfolio adjustments. |

| Fee Structure | Lower fees due to passive strategy. | Higher fees linked to active management. |

| Target Investor | Long-term investors seeking steady growth. | Investors willing to accept volatility for higher gains. |

| Examples | SPDR S&P 500 ETF, Vanguard Total Market Index Fund. | ARK Innovation ETF, Fidelity Growth Company Fund. |

Introduction to Index and Growth Portfolios

Index portfolios track a specific market index, offering diversified exposure to a broad range of assets that mirror the index's performance, typically with lower costs and reduced risk. Growth portfolios concentrate on stocks with strong potential for above-average earnings and capital appreciation, often involving higher volatility and risk in exchange for greater long-term returns. Investors seeking stable, passive investment strategies prefer index portfolios, while those aiming for aggressive growth often choose growth portfolios to capitalize on expanding companies.

Defining Index Portfolio

An Index Portfolio is designed to replicate the performance of a specific market index, such as the S&P 500, by holding the same securities in identical proportions, providing broad market exposure and lower management fees. This passive investment strategy aims to match index returns rather than outperform them, minimizing tracking errors and reducing transaction costs. Investors seeking steady, market-level growth and diversification often prefer Index Portfolios over actively managed Growth Portfolios, which focus on selecting stocks with higher potential for capital appreciation.

Understanding Growth Portfolio

A growth portfolio primarily targets investments in stocks of companies with high potential for above-average revenue and earnings growth, often in sectors like technology and healthcare. These portfolios tend to have higher volatility due to their focus on emerging markets and innovation-driven firms but offer substantial capital appreciation over time. Investors seeking long-term gains typically prioritize a growth portfolio to capitalize on market trends and evolving industries.

Key Differences Between Index and Growth Portfolios

Index portfolios primarily replicate a specific market index, offering broad market exposure and lower management fees through passive investing. Growth portfolios focus on stocks with high potential for capital appreciation, often involving more active management and higher risk due to investment in emerging or rapidly expanding companies. The key differences lie in investment strategy, risk tolerance, and potential returns, with index portfolios emphasizing diversification and stability, while growth portfolios target higher long-term gains.

Risk and Return Profiles

Index portfolios typically offer lower risk through broad market diversification, tracking benchmark indices like the S&P 500, and tend to deliver steady, market-average returns. Growth portfolios focus on investments in high-potential, often volatile stocks aiming for substantial capital appreciation, which increases the risk but also the potential for higher returns. Investors seeking stability may prefer index portfolios, while those willing to accept greater volatility for possible outsized gains might opt for growth portfolios.

Diversification Benefits

Index portfolios offer broad market exposure by holding a wide range of securities, providing inherent diversification that reduces individual asset risk. Growth portfolios concentrate on high-potential stocks, often leading to higher volatility due to less sector and asset class diversification. Combining both strategies can balance diversification benefits with growth opportunities, enhancing portfolio resilience and long-term returns.

Performance in Various Market Conditions

Index portfolios typically offer stable performance by mirroring the overall market, making them resilient during market downturns due to diversified holdings. Growth portfolios, focused on high-potential stocks, often outperform in bull markets but can experience greater volatility and drawdowns during economic slowdowns. Historical data shows index portfolios deliver steady returns with lower risk, while growth portfolios provide higher growth opportunities at the cost of increased market sensitivity.

Costs and Fees Comparison

Index portfolios typically have lower costs and fees due to passive management, with expense ratios often below 0.2%, making them cost-effective for long-term investors. Growth portfolios usually involve active management, resulting in higher fees that can range from 0.5% to over 1%, reflecting research and transaction costs. Lower costs in index portfolios can enhance net returns, while growth portfolios' higher fees may impact overall performance despite potential for higher gains.

Suitability for Different Investor Types

Index portfolios suit risk-averse investors seeking broad market exposure with lower fees and steady returns, emphasizing passive investment strategies. Growth portfolios appeal to aggressive investors aiming for higher returns through capital appreciation by investing in high-potential stocks, accepting increased volatility. Selecting between these portfolios depends on individual risk tolerance, investment horizon, and financial goals.

Choosing the Right Portfolio for Your Goals

Selecting between an Index Portfolio and a Growth Portfolio depends on your investment goals and risk tolerance; Index Portfolios offer broad market exposure with lower fees, ideal for long-term, stable growth. Growth Portfolios target companies with high potential for capital appreciation but come with increased volatility and risk, suitable for investors seeking higher returns over time. Understanding your time horizon, risk appetite, and financial objectives helps in tailoring a portfolio that aligns with your wealth-building strategy.

Index Portfolio Infographic

libterm.com

libterm.com