Tax records document your income, expenses, and tax payments, serving as essential proof for tax compliance and financial auditing. Maintaining organized and accurate tax records helps you file returns efficiently and supports claims during audits or disputes. Explore the full article to understand how to manage and protect your tax records effectively.

Table of Comparison

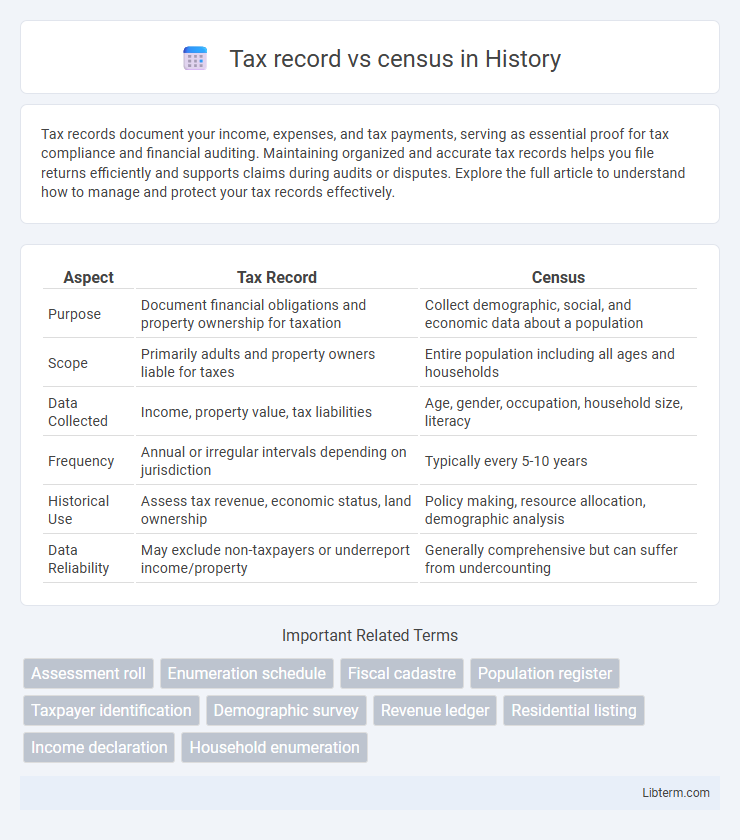

| Aspect | Tax Record | Census |

|---|---|---|

| Purpose | Document financial obligations and property ownership for taxation | Collect demographic, social, and economic data about a population |

| Scope | Primarily adults and property owners liable for taxes | Entire population including all ages and households |

| Data Collected | Income, property value, tax liabilities | Age, gender, occupation, household size, literacy |

| Frequency | Annual or irregular intervals depending on jurisdiction | Typically every 5-10 years |

| Historical Use | Assess tax revenue, economic status, land ownership | Policy making, resource allocation, demographic analysis |

| Data Reliability | May exclude non-taxpayers or underreport income/property | Generally comprehensive but can suffer from undercounting |

Understanding Tax Records: Definition and Purpose

Tax records are official documents that detail the amount of taxes paid by individuals or businesses, serving as proof of income and financial obligations for governmental purposes. These records provide critical data for audits, legal proceedings, and verifying compliance with tax laws. Unlike census data, which aims to capture demographic information across a population, tax records focus specifically on economic activity and revenue collection.

What is a Census? Scope and Significance

A census is a comprehensive data collection process conducted by governments to count every individual within a defined population, gathering demographic, social, and economic information. Its scope includes detailed attributes such as age, gender, occupation, and housing conditions, providing critical insights for public policy, resource allocation, and electoral districting. The significance of a census lies in its role as the most accurate and inclusive dataset, enabling informed decisions in urban planning, healthcare, education, and infrastructure development.

Key Differences Between Tax Records and Census Data

Tax records primarily capture financial information such as income, tax payments, and deductions used by government agencies to assess tax liabilities. Census data offers comprehensive demographic details including population size, age distribution, ethnicity, and household composition, collected every ten years for policy and planning purposes. Unlike census data's broad population coverage, tax records focus specifically on individuals and entities obligated to file taxes, resulting in differing scopes and applications.

How Tax Records Are Collected and Maintained

Tax records are collected through systematic reporting of income, property, and financial transactions by individuals and businesses to government tax authorities, ensuring accurate assessment and collection of taxes. These records are maintained in secure databases by tax agencies, updated regularly through filings, audits, and cross-referencing with other financial data sources. Robust data management practices and legal frameworks guarantee the integrity, confidentiality, and accessibility of tax records for ongoing tax administration and compliance verification.

Methods of Census Data Collection

Census data collection employs methods such as household surveys, interviews, and digital questionnaires to gather comprehensive demographic, social, and economic information. Unlike tax records, which primarily capture financial data for taxation purposes, census methods ensure a broader representation by including non-filers and underreported populations. The use of geographic information systems (GIS) and mobile data collection tools enhances accuracy and coverage in modern census operations.

Accuracy and Reliability: Tax Record vs Census

Tax records offer high accuracy for financial and property-related data due to mandatory reporting and regular updates, ensuring reliability for economic analysis. Census data provides comprehensive demographic information, but accuracy may vary due to undercounts or self-reported responses, impacting reliability in population estimates. Combining tax records with census data enhances overall data accuracy and reliability for socio-economic research.

Legal Implications Surrounding Tax and Census Data

Tax records hold legally binding financial information used for income verification and tax compliance, often subjected to strict confidentiality under tax laws. Census data, while collected under legal mandates, primarily supports demographic analysis and public policy without directly affecting individual legal liabilities. Misuse or unauthorized disclosure of tax records can lead to severe legal penalties, whereas census data breaches typically result in administrative sanctions focused on privacy protection.

Common Uses of Tax Records in Demographic Analysis

Tax records provide detailed financial information about individuals and households, making them valuable for assessing economic status, income distribution, and wealth patterns within a population. Researchers use tax data to analyze trends in property ownership, employment, and taxable income, which help in understanding socioeconomic disparities and economic mobility. Unlike census data, which offers broad demographic counts, tax records deliver granular insights into fiscal behavior and regional economic conditions essential for targeted policy development.

The Role of Census Data in Public Policy and Planning

Census data provides comprehensive demographic, social, and economic information critical for public policy formulation and urban planning, offering a broad population overview unmatched by tax records. Unlike tax records, which focus primarily on income and financial transactions, census data captures diverse variables such as age, education, housing, and employment status, enabling policymakers to identify community needs and allocate resources effectively. This rich dataset supports informed decision-making in sectors like healthcare, education, transportation, and social services, driving equitable development and enhancing public welfare.

Data Privacy Concerns: Tax Records vs Census

Tax records contain sensitive personal financial information that is protected under strict data privacy laws, limiting access and usage primarily to tax authorities and authorized entities. Census data, while also collected confidentially, is aggregated and anonymized to protect individual identities and used broadly for demographic research and public policy planning. The key difference lies in the stringent legal safeguards placed on tax records due to their detailed monetary content, compared to the more public aggregation approach of census data.

Tax record Infographic

libterm.com

libterm.com