Taille refers to size or measurement in French, commonly used in fashion, tailoring, and various industries to indicate dimensions. Understanding your exact taille ensures proper fitting clothes, precise crafting, or accurate product selection, enhancing your overall satisfaction. Explore the rest of this article to discover how to determine and use your taille effectively.

Table of Comparison

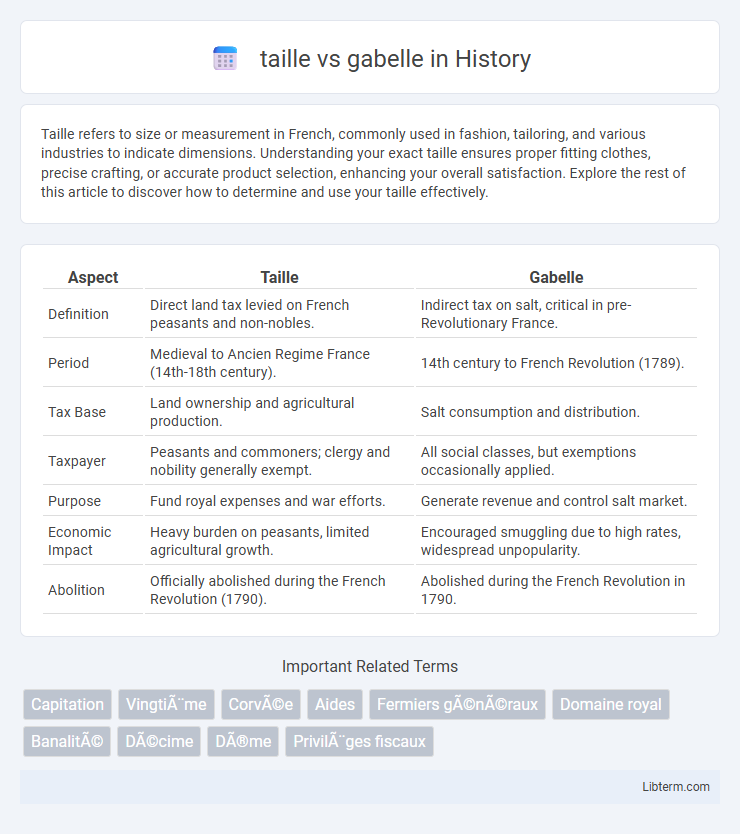

| Aspect | Taille | Gabelle |

|---|---|---|

| Definition | Direct land tax levied on French peasants and non-nobles. | Indirect tax on salt, critical in pre-Revolutionary France. |

| Period | Medieval to Ancien Regime France (14th-18th century). | 14th century to French Revolution (1789). |

| Tax Base | Land ownership and agricultural production. | Salt consumption and distribution. |

| Taxpayer | Peasants and commoners; clergy and nobility generally exempt. | All social classes, but exemptions occasionally applied. |

| Purpose | Fund royal expenses and war efforts. | Generate revenue and control salt market. |

| Economic Impact | Heavy burden on peasants, limited agricultural growth. | Encouraged smuggling due to high rates, widespread unpopularity. |

| Abolition | Officially abolished during the French Revolution (1790). | Abolished during the French Revolution in 1790. |

Introduction to Taille and Gabelle

Taille and Gabelle were two significant taxes in pre-revolutionary France, with the Taille being a direct land tax imposed primarily on peasants and non-nobles, while the Gabelle was a highly unpopular salt tax affecting all social classes. The Taille generated substantial revenue for the monarchy, contributing to fiscal pressure on commoners, whereas the Gabelle's regulation of salt sales created widespread smuggling and resentment. Both taxes exemplify the fiscal inequalities that fueled social discontent leading up to the French Revolution.

Historical Background of Taille and Gabelle

The Taille was a direct land tax imposed primarily on French peasants during the Ancien Regime, established in the Late Middle Ages to fund royal expenses and military campaigns. The Gabelle, originating in the 14th century, was a salt tax that became notorious for its heavy burden on commoners and its complex regional variations across France. Both taxes exemplified the economic inequalities and fiscal policies that fueled social unrest leading up to the French Revolution.

Definition and Purpose of the Taille

The taille was a direct land tax imposed on the peasantry and non-nobles in pre-revolutionary France, serving as a crucial source of royal revenue. Its purpose was to finance the monarchy's expenses, including military campaigns and administrative costs. Unlike the gabelle, which was a tax on salt, the taille targeted land ownership and was often seen as a burden on agricultural producers.

Definition and Purpose of the Gabelle

The gabelle was a medieval French tax on salt imposed by the monarchy to generate royal revenue and control salt distribution within the kingdom. Unlike the taille, which was a direct tax on land and income predominantly levied on the peasantry, the gabelle specifically targeted an essential commodity, making it a highly unpopular and economically impactful levy. Its enforcement ensured the crown's financial stability while intensifying regional inequalities due to varying salt prices and exemptions.

Key Differences Between Taille and Gabelle

Taille was a direct tax imposed primarily on French peasants and non-nobles, based on land ownership and income, while Gabelle was a specific tax on salt, essential for food preservation and daily consumption. Taille contributed significantly to royal revenue during the Ancien Regime but varied regionally, whereas the Gabelle was enforced uniformly across several salt-producing and salt-consuming regions, causing widespread resentment. The social impact of Taille targeted broader economic classes, whereas the Gabelle directly affected everyday goods pricing, making it a symbol of fiscal injustice and one of the causes of the French Revolution.

Socioeconomic Impact of Taille

The taille was a direct land tax imposed primarily on the peasantry and non-noble classes, significantly burdening rural communities and exacerbating socioeconomic disparities in pre-revolutionary France. Unlike the indirect gabelle tax on salt, the taille's oppressive nature fueled widespread resentment and social unrest, as it disproportionately affected lower-income peasants who lacked exemptions granted to nobility and clergy. This fiscal inequality contributed to deepening economic hardship and sowed seeds of revolt by undermining the peasantry's financial stability and access to resources.

Socioeconomic Impact of Gabelle

The gabelle, a highly unpopular salt tax in pre-revolutionary France, imposed severe economic strain on lower classes by disproportionately increasing the cost of an essential commodity. Unlike the taille, a direct land tax paid mainly by peasants and non-nobles, the gabelle affected all social strata but hit the poor hardest due to its regressive nature and the state's strict enforcement measures. This tax exacerbated socioeconomic inequalities and fueled widespread resentment, contributing significantly to the financial grievances leading up to the French Revolution.

Controversies and Resistance to Taille and Gabelle

The taille and gabelle, two oppressive taxes in pre-revolutionary France, sparked significant controversies and widespread resistance due to their unequal burden on the peasantry and commoners. The taille, a direct land tax, disproportionately impacted the rural poor who often lacked political representation, while the gabelle, a salt tax, provoked smuggling and rebellion because salt was an essential commodity. Both taxes fueled social unrest and contributed to the growing dissatisfaction that eventually led to the French Revolution.

The Abolition and Legacy of Taille and Gabelle

The abolition of the taille and gabelle during the French Revolution marked a significant shift in France's fiscal system, as both taxes were seen as symbols of feudal oppression and inequality. The taille, a direct land tax on the peasantry and non-nobles, and the gabelle, an unpopular salt tax, were officially abolished in 1790 and 1794 respectively, reflecting revolutionary ideals of fairness and equal citizenship. Their legacy influenced modern tax reforms by highlighting the need for equitable taxation and the elimination of privilege-based levies, shaping France's transition towards a more centralized and just fiscal structure.

Lasting Influence on French Taxation History

The taille, a direct land tax imposed on peasants, and the gabelle, a salt tax affecting all social classes, both left a lasting influence on French taxation by exemplifying the inequalities that fueled popular discontent leading to the French Revolution. Their systemic burden highlighted the need for a more equitable tax system, influencing the revolutionary reforms that ultimately abolished these taxes and inspired modern fiscal policies in France. This transformation marked a critical shift toward progressive taxation and centralized state revenue systems.

taille Infographic

libterm.com

libterm.com