Income tax is a mandatory financial charge imposed by governments on individuals and businesses based on their earnings to fund public services and infrastructure. Understanding income tax regulations, deductions, and credits can help you minimize liabilities and maximize refunds. Explore the rest of the article to learn how to effectively manage your income tax obligations.

Table of Comparison

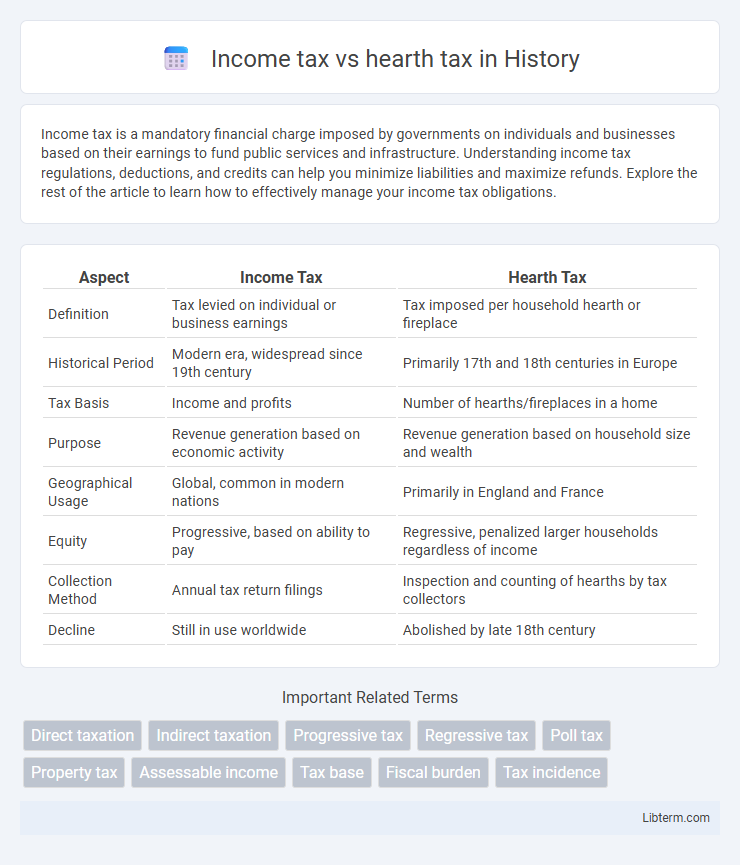

| Aspect | Income Tax | Hearth Tax |

|---|---|---|

| Definition | Tax levied on individual or business earnings | Tax imposed per household hearth or fireplace |

| Historical Period | Modern era, widespread since 19th century | Primarily 17th and 18th centuries in Europe |

| Tax Basis | Income and profits | Number of hearths/fireplaces in a home |

| Purpose | Revenue generation based on economic activity | Revenue generation based on household size and wealth |

| Geographical Usage | Global, common in modern nations | Primarily in England and France |

| Equity | Progressive, based on ability to pay | Regressive, penalized larger households regardless of income |

| Collection Method | Annual tax return filings | Inspection and counting of hearths by tax collectors |

| Decline | Still in use worldwide | Abolished by late 18th century |

Introduction: Understanding Income Tax and Hearth Tax

Income tax is a government levy imposed on individuals' and businesses' earned income, calculated as a percentage of wages, salaries, or profits, and serves as a primary source of national revenue. Hearth tax, historically implemented in medieval England, was a property tax based on the number of hearths or fireplaces in a dwelling, reflecting household wealth and influencing local taxation practices. Understanding the distinct purposes and assessment methods of income tax and hearth tax reveals their roles in fiscal policy and social equity.

Historical Background of Hearth Tax

The Hearth Tax, introduced in England in 1662 under the reign of Charles II, was a property tax based on the number of hearths or fireplaces within a dwelling, reflecting a household's wealth and capacity to pay. Unlike modern income taxes that focus on individual earnings, the Hearth Tax assessed households as units, offering a window into 17th-century economic and social structures. Historical records show that the Hearth Tax was eventually repealed in 1689 due to its unpopularity and administrative challenges, paving the way for later tax reforms including the development of income tax systems.

The Evolution of Income Tax Systems

The evolution of income tax systems traces back to medieval hearth taxes, which were levied based on the number of hearths or fireplaces in a household, serving as an indirect way to estimate wealth. Over time, income tax systems developed into direct taxation methods based on individual earnings, reflecting economic activities more precisely. Modern income taxation incorporates progressive rates and complex regulations to address economic disparities and fund government programs efficiently.

Key Differences Between Income Tax and Hearth Tax

Income tax is a tax levied on an individual's or entity's earnings, including wages, salaries, and business profits, whereas hearth tax was a historical levy based on the number of hearths or fireplaces in a dwelling. Income tax varies according to the taxpayer's income level and is progressive in many countries, while hearth tax was a fixed amount per hearth and did not consider income or wealth. The primary purpose of income tax is revenue generation proportional to ability to pay, contrasting with hearth tax's role as a property-based, often regressive, means of taxation.

Economic Implications of Both Taxes

Income tax directly affects disposable income and consumer spending, influencing economic growth and income redistribution through progressive rates. Hearth tax, historically levied on households irrespective of income, imposed a regressive burden that often stifled low-income families' economic mobility. Modern economic implications highlight income tax's role in funding public services and reducing inequality, whereas hearth tax models reveal challenges of uniform taxation on diverse populations.

Impact on Society and Households

Income tax primarily funds public services and infrastructure, promoting societal welfare by redistributing wealth based on income levels, which can reduce economic inequality. Hearth tax, historically levied on households based on the number of hearths or fireplaces, imposed a direct financial burden on families regardless of income, often disproportionately affecting lower-income households. The shift from hearth tax to income tax represents a move towards a more equitable taxation system that better aligns tax liability with taxpayers' ability to pay, benefiting social cohesion and household financial stability.

Administration and Enforcement Comparison

Income tax administration involves systematic assessment, filing, and collection processes managed by government tax authorities using advanced auditing and digital technologies to ensure compliance. Hearth tax enforcement relied on local officials conducting physical inspections of households and property hearths, facing challenges in standardization and evasion control due to limited record-keeping. Modern income tax systems employ automated data matching and legal penalties, whereas hearth tax enforcement lacked centralized mechanisms, leading to inconsistent application and reduced efficiency.

Equity and Fairness: Income vs Hearth Tax

Income tax promotes equity by taxing individuals based on their ability to pay, with higher earners contributing a larger share, reflecting progressive taxation principles. Hearth tax, levied uniformly per household or hearth, lacks consideration for income disparities and can disproportionately burden lower-income families. This flat-rate nature of hearth tax undermines fairness by ignoring economic differences and imposing equal financial demands regardless of wealth.

Modern Relevance and Lessons from History

Income tax remains a fundamental fiscal tool in modern economies for funding public services, reflecting progressive taxation principles absent in historical hearth taxes, which were regressive levies based on household fireplaces. Hearth tax, prevalent in 17th-century England, highlights the challenges of taxation fairness and administrative efficiency, lessons that inform contemporary tax policy design to avoid undue burdens on lower-income populations. Modern relevance lies in the balance between equitable revenue generation and minimizing economic distortion, principles learned from the socio-economic impacts of hearth tax systems.

Conclusion: Which System Served Its Purpose Better?

Income tax demonstrated greater efficiency and fairness by adapting to individual earnings and promoting public revenue growth, while hearth tax's fixed household-based method often led to inequities and evasion. Historical evidence indicates income tax better supported expanding state functions and social services. Consequently, income tax served its purpose more effectively in creating a sustainable and equitable fiscal system.

Income tax Infographic

libterm.com

libterm.com