Land tax is a government-imposed charge on the ownership of land, calculated based on the property's assessed value. It affects property owners by influencing the cost of holding land and can vary depending on location and land use. Discover how land tax impacts your finances and property decisions by reading the full article.

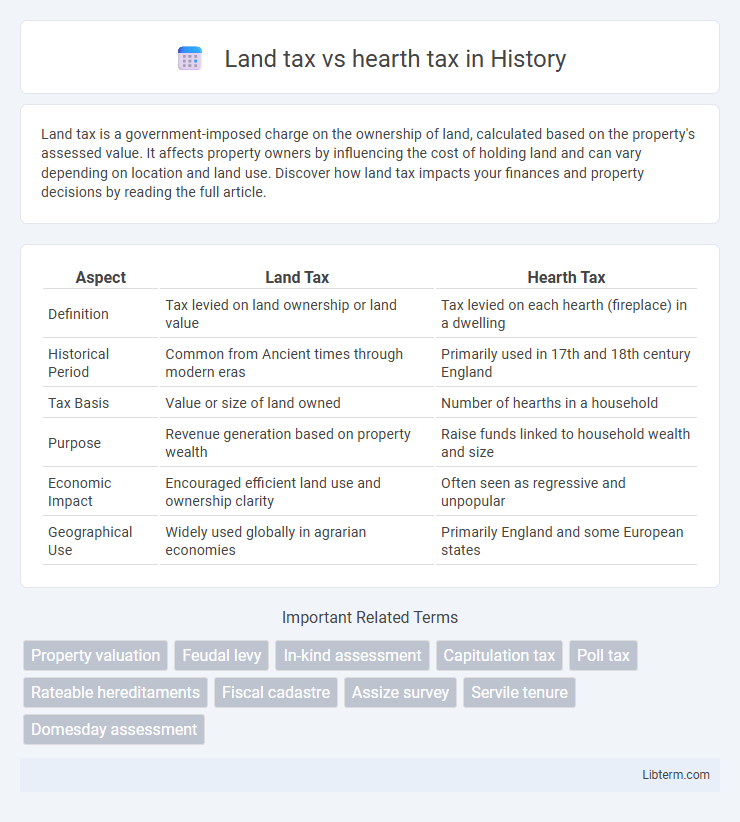

Table of Comparison

| Aspect | Land Tax | Hearth Tax |

|---|---|---|

| Definition | Tax levied on land ownership or land value | Tax levied on each hearth (fireplace) in a dwelling |

| Historical Period | Common from Ancient times through modern eras | Primarily used in 17th and 18th century England |

| Tax Basis | Value or size of land owned | Number of hearths in a household |

| Purpose | Revenue generation based on property wealth | Raise funds linked to household wealth and size |

| Economic Impact | Encouraged efficient land use and ownership clarity | Often seen as regressive and unpopular |

| Geographical Use | Widely used globally in agrarian economies | Primarily England and some European states |

Understanding Land Tax and Hearth Tax

Land tax is a property-based tax levied on the ownership or value of land, often calculated as a percentage of the land's assessed value, making it a recurring source of revenue for local governments. Hearth tax, historically imposed in England from 1662 to 1689, was based on the number of hearths or fireplaces in a dwelling, serving as a proxy for household wealth and size. Understanding land tax involves analyzing its impact on property ownership and local economies, while hearth tax sheds light on past fiscal policies targeting residential households based on fire usage.

Historical Background of Land Tax

Land tax originated in ancient civilizations as a means for rulers to fund public projects and maintain armies by taxing land ownership or usage, reflecting land's central role in wealth and power distribution. In medieval England, land tax evolved significantly during the Tudor period, becoming a key revenue source to support the monarchy without requiring parliamentary consent. Unlike hearth tax, which was based on the number of fireplaces in a dwelling and introduced in the 17th century to target household wealth, land tax focused directly on land value and ownership, illustrating different approaches to fiscal policy in historical tax systems.

Origins and Development of Hearth Tax

The hearth tax originated in 17th-century England as a property tax based on the number of hearths or fireplaces in a dwelling, reflecting household wealth and size. Introduced in 1662 under Charles II, it aimed to raise revenue by taxing visible signs of prosperity, marking a shift from broader land taxes to more targeted fiscal measures. This tax evolved alongside earlier land taxes but focused specifically on domestic hearths, influencing subsequent taxation systems by linking tax liability to household amenities rather than land ownership alone.

Key Differences Between Land Tax and Hearth Tax

Land tax is primarily levied on the value or ownership of land, reflecting property size or location, whereas hearth tax is a historical levy based on the number of hearths or fireplaces in a dwelling, indicating household size and wealth. Land tax is typically assessed annually and applies to landowners regardless of occupancy, while hearth tax was collected per fire used as a heat source and often targeted domestic comfort levels. The core difference lies in the tax base: land tax targets land assets, while hearth tax focused on living conditions within a property.

Economic Impact of Land Tax

Land tax directly influences economic development by encouraging efficient land use and generating stable government revenue, which can be reinvested in infrastructure and public services. In contrast, hearth tax historically burdened households without promoting productive land utilization, often leading to social resistance and limited economic growth. The economic impact of land tax is generally positive due to its ability to promote equitable resource distribution and stimulate investment in property improvements.

Social Implications of Hearth Tax

Hearth tax, imposed based on the number of fireplaces in a dwelling, disproportionately burdened poorer households, as it indirectly taxed domestic comfort and living conditions, intensifying social inequities. Unlike land tax, which targeted property ownership broadly, hearth tax scrutinized household resources, leading to evasion tactics such as blocking chimneys or underreporting hearths, thereby fostering mistrust between taxpayers and authorities. The social implications included heightened class tensions and contributed to resistance movements against perceived intrusive fiscal policies targeting everyday life.

Administration and Collection Methods

Land tax was typically administered by local government officials who assessed property values and collected payments directly from landowners through annual or periodic notices. Hearth tax relied on enumerators who conducted on-site inspections to count hearths or fireplaces within households, often collecting payments in person or through appointed collectors. Both taxes required detailed record-keeping but differed in that land tax assessments used property surveys, while hearth tax depended on physical verification of household features.

Exemptions and Controversies

Land tax exemptions often applied to agricultural properties, religious institutions, and low-income households, aiming to support economic stability and social welfare. Hearth tax controversies stemmed from its perceived invasiveness and inequality, as it disproportionately burdened poorer households based on the number of hearths, leading to widespread evasion and resentment. Both taxes faced criticism for their administrative complexity and fairness, influencing subsequent tax reforms to address social equity and compliance challenges.

Relevance of Land and Hearth Taxes Today

Land tax remains relevant today as a primary source of local government revenue, directly tied to property ownership and land value, influencing urban planning and development. Hearth tax, historically levied on each fireplace, has largely become obsolete but offers insight into early taxation methods and social stratification. Modern fiscal policies favor land taxes due to their ability to promote efficient land use and sustainable economic growth.

Conclusion: Comparing Effectiveness and Fairness

Land tax offers a stable revenue source based on property value, promoting fairness by taxing wealth tied to land ownership, whereas hearth tax targets households based on hearths or fireplaces, often disproportionately burdening lower-income families. The land tax system aligns better with economic efficiency and equity principles, minimizing tax evasion and encouraging productive land use. In contrast, hearth tax's regressive nature and administrative challenges reduce its effectiveness and fairness in modern fiscal policies.

Land tax Infographic

libterm.com

libterm.com