Poll tax, a fixed amount levied on every adult regardless of income, has historically sparked controversy due to its regressive nature, disproportionately impacting low-income individuals. The implementation of poll taxes often led to widespread public dissent and social unrest, highlighting the tension between taxation fairness and government revenue needs. Explore the article to understand the origins, implications, and legacy of poll tax policies throughout history.

Table of Comparison

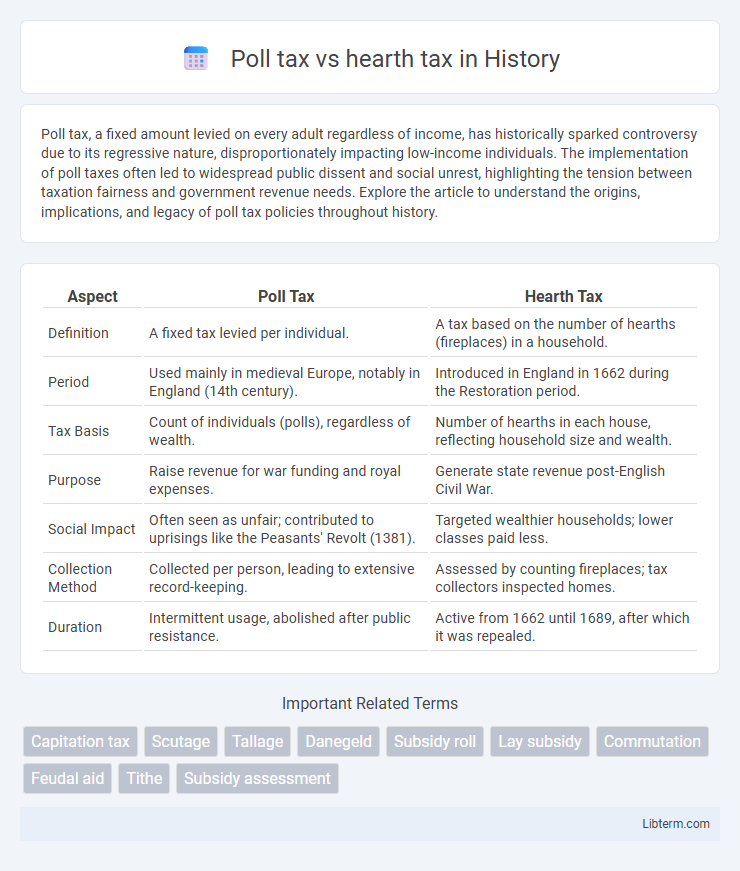

| Aspect | Poll Tax | Hearth Tax |

|---|---|---|

| Definition | A fixed tax levied per individual. | A tax based on the number of hearths (fireplaces) in a household. |

| Period | Used mainly in medieval Europe, notably in England (14th century). | Introduced in England in 1662 during the Restoration period. |

| Tax Basis | Count of individuals (polls), regardless of wealth. | Number of hearths in each house, reflecting household size and wealth. |

| Purpose | Raise revenue for war funding and royal expenses. | Generate state revenue post-English Civil War. |

| Social Impact | Often seen as unfair; contributed to uprisings like the Peasants' Revolt (1381). | Targeted wealthier households; lower classes paid less. |

| Collection Method | Collected per person, leading to extensive record-keeping. | Assessed by counting fireplaces; tax collectors inspected homes. |

| Duration | Intermittent usage, abolished after public resistance. | Active from 1662 until 1689, after which it was repealed. |

Introduction to Poll Tax and Hearth Tax

Poll tax, a fixed sum levied on every individual regardless of income or property, functioned as a form of direct taxation primarily used in medieval and early modern England to fund government expenses. Hearth tax, introduced in the 17th century, was a property tax based on the number of hearths or fireplaces within a dwelling, reflecting the relative wealth of households. Both taxes played significant roles in the fiscal policies of their eras, with poll tax targeting individuals uniformly and hearth tax tying tax liability to property size and living conditions.

Historical Background of Both Taxes

The poll tax, first introduced in medieval England during the 14th century, was a fixed tax levied on each individual regardless of income or property, often inciting public unrest as seen in the Peasants' Revolt of 1381. The hearth tax, established in 1662 under the reign of Charles II, was a property tax based on the number of hearths or fireplaces in a dwelling, serving as a proxy for household wealth and property size. Both taxes reflect early attempts by governments to systematize revenue collection, with the poll tax targeting individuals uniformly and the hearth tax focusing on property-based wealth assessment.

Definitions: What is a Poll Tax?

A poll tax is a fixed sum levied on every adult individual within a jurisdiction, regardless of income or resources, often used historically as a prerequisite for voting rights. This tax contrasts with assessments based on property or income, requiring uniform payment from all eligible persons. Poll taxes have been criticized for disproportionately affecting lower-income populations and acting as barriers to suffrage.

Definitions: What is a Hearth Tax?

A Hearth Tax was a property tax levied in England during the 17th century, based on the number of hearths or fireplaces within a dwelling. This tax aimed to assess wealth by counting hearths, as more hearths indicated larger, wealthier households. In contrast, a poll tax is a fixed tax imposed on individuals regardless of their property or income.

Key Differences Between Poll Tax and Hearth Tax

Poll tax was a fixed amount levied on every individual, regardless of income or property, designed to generate revenue per person, while hearth tax was based on the number of hearths or fireplaces in a dwelling, reflecting household size and wealth. Poll tax applied uniformly to all eligible persons and often sparked widespread resistance due to its regressive nature. Hearth tax varied by property characteristics, targeting wealthier households with more hearths, making it a form of property tax linked to home size and comfort.

Social and Economic Impacts

Poll tax imposed a uniform fixed sum on every individual, disproportionately burdening the poor and fueling social unrest due to its regressive nature. Hearth tax, levied based on the number of hearths or fireplaces in a household, more accurately reflected wealth distribution, impacting economic behavior by incentivizing smaller households and reduced hearths to lower tax liability. Socially, hearth tax led to increased scrutiny of domestic living standards, while poll tax often intensified class tensions and resistance movements.

Administration and Collection Methods

The poll tax was administered through individual headcounts and required each eligible person to pay a fixed amount, often collected by local officials or tax farmers who directly visited households. In contrast, the hearth tax was assessed based on the number of hearths or fireplaces in a dwelling, with collectors inspecting homes to determine the taxable units, which sometimes led to concealment or disputes over the count. Both taxes relied heavily on physical assessment and direct collection, but the hearth tax's property-based criteria offered a tangible measure, while the poll tax focused solely on population enumeration.

Public Reactions and Resistance

Public reactions to the poll tax were overwhelmingly negative, sparking widespread protests and riots due to its flat-rate design that disproportionately burdened lower-income individuals. In contrast, the hearth tax faced resistance primarily from homeowners who viewed it as an invasion of privacy and a financial strain, leading to evasion and avoidance tactics. Both taxes triggered significant opposition, but the poll tax incited more organized and violent public uprisings, highlighting broader socio-economic tensions.

Lasting Influence on Modern Taxation

Poll tax laid foundational principles for uniform per capita taxation, influencing modern flat tax systems by emphasizing equal individual contribution regardless of income. Hearth tax, based on household property such as fireplaces, introduced early property-based taxation concepts that evolved into contemporary property and wealth taxes. Both taxes shaped the development of equitable tax structures, balancing direct and indirect taxation methods in modern fiscal policies.

Conclusion: Lessons from Historical Taxation

Poll tax and hearth tax highlight the complexities of taxing individuals based on fixed criteria, with poll tax levying a uniform amount per person and hearth tax assessing households by the number of fireplaces. Both systems faced widespread resistance due to perceived unfairness and administrative challenges, demonstrating the importance of equity and efficiency in taxation. Historical lessons emphasize that successful tax policies require careful balance between revenue generation and taxpayer acceptance to ensure long-term sustainability.

Poll tax Infographic

libterm.com

libterm.com