A levy is a legal tool used by governments to collect funds for public services by imposing taxes or fees on individuals and businesses. It ensures the necessary resources for infrastructure, education, and healthcare are funded efficiently. Explore the rest of the article to understand how levies impact your financial planning and community development.

Table of Comparison

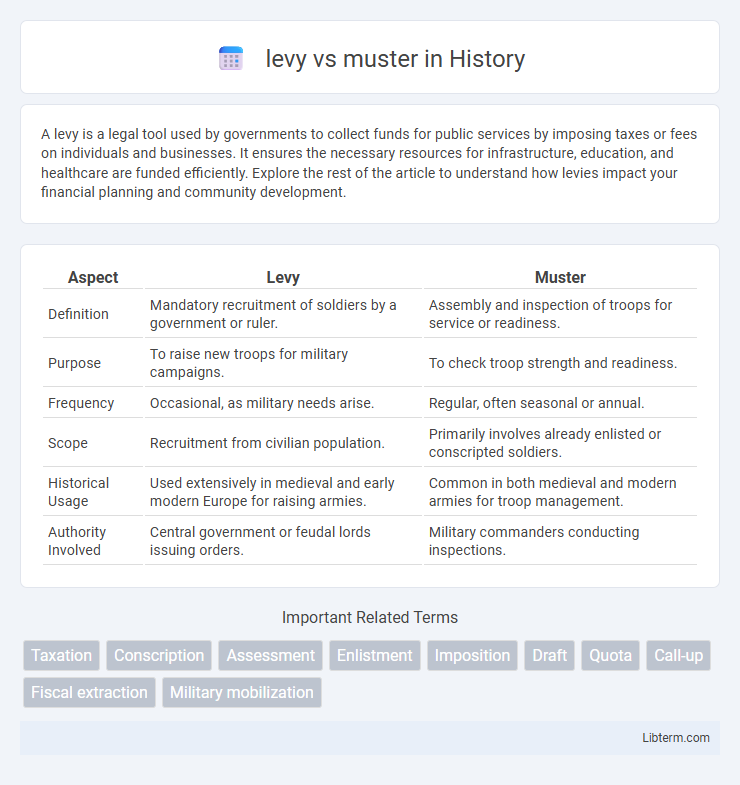

| Aspect | Levy | Muster |

|---|---|---|

| Definition | Mandatory recruitment of soldiers by a government or ruler. | Assembly and inspection of troops for service or readiness. |

| Purpose | To raise new troops for military campaigns. | To check troop strength and readiness. |

| Frequency | Occasional, as military needs arise. | Regular, often seasonal or annual. |

| Scope | Recruitment from civilian population. | Primarily involves already enlisted or conscripted soldiers. |

| Historical Usage | Used extensively in medieval and early modern Europe for raising armies. | Common in both medieval and modern armies for troop management. |

| Authority Involved | Central government or feudal lords issuing orders. | Military commanders conducting inspections. |

Introduction to Levy vs Muster

Levy and muster are distinct military terms with specific roles in troop mobilization and organization. Levy refers to the compulsory enlistment of soldiers or resources by a government during wartime, often involving conscription or forced recruitment. Muster involves assembling and inspecting troops to assess readiness, equipment, and numbers before deployment or training.

Definition of Levy

Levy refers to the legal process by which authorities impose taxes, fines, or fees, or seize property to satisfy a debt or obligation. Typically executed by government agencies, levy involves the collection of funds through official channels such as wage garnishment, bank account seizure, or property liens. The definition of levy emphasizes its role as a compulsory financial claim enforced to fulfill statutory obligations.

Definition of Muster

Muster refers to the formal process of assembling troops or personnel for inspection, roll call, or preparation for duty in military or organizational contexts. It involves gathering individuals at a specific time and place to verify presence, ensure readiness, and communicate orders or information. Unlike levy, which denotes the act of conscripting or imposing a tax, muster emphasizes the organized collection and accountability of existing members.

Key Differences Between Levy and Muster

Levy refers to the legal imposition or collection of taxes, fines, or other financial charges by an authority, often involving compulsory contributions. Muster involves assembling or gathering troops, personnel, or resources for inspection, roll call, or readiness assessment, primarily in a military context. The key difference lies in levy being a financial action related to taxation or enforcement, while muster is an organizational process focused on personnel or resource accountability and readiness.

Historical Context of Levy and Muster

Levy and muster played crucial roles in military organization during medieval and early modern periods, with levy referring to the compulsory recruitment of troops from the general population or specific regions under feudal obligations. Musters were systematic assemblies where these levied troops were inspected, armed, and organized before deployment, ensuring readiness and discipline. Historical records from England and continental Europe highlight musters as essential for assessing military strength and enforcing feudal duties during times of war and political unrest.

Practical Applications of Levy

Levy enables direct seizure of assets to satisfy a debt, commonly used by tax authorities to collect unpaid taxes or by creditors to enforce court judgments. It provides a practical mechanism for garnishing bank accounts, wages, or property, ensuring immediate access to funds without prolonged litigation. In contrast, muster primarily refers to assembling personnel, making levy the operative tool in financial enforcement contexts.

Practical Applications of Muster

Muster involves the organized assembly and inspection of personnel or resources, primarily used in military, emergency response, and event management settings to ensure readiness and accountability. Practical applications of muster include conducting roll calls during emergencies to verify the presence and safety of individuals, coordinating workforce deployment in construction or large-scale projects, and facilitating efficient resource allocation in disaster relief operations. Unlike levy, which emphasizes compulsory gathering often for conscription or taxation, muster focuses on systematic verification and management to optimize operational efficiency.

Legal Implications: Levy vs Muster

Levy involves the legal seizure of property to satisfy a debt, often initiated by court order or government authority, which directly impacts the debtor's assets and legal rights. Muster, in a legal context, typically refers to the formal gathering or assembling, such as military personnel or juries, without immediate seizure implications, focusing instead on compliance and accountability. Understanding the difference is crucial in law enforcement and civil obligations, as levy enforces payment through asset control while muster ensures organized participation without property forfeiture.

Comparative Analysis: Levy vs Muster in Modern Context

Levy and muster serve distinct roles in modern organizational and military contexts, with levy primarily referring to the imposition of taxes or conscription, while muster focuses on the formal assembly and inspection of personnel. Levy processes enable governments to secure resources or personnel efficiently for specific purposes, whereas muster ensures operational readiness and accountability through systematic roll calls and inspections. Comparative analysis highlights that levy affects broader resource acquisition strategies, whereas muster emphasizes immediate tactical verification and management of forces.

Conclusion: Choosing Between Levy and Muster

Levy offers a systematic approach for securing funds or resources through legal or financial obligations, making it ideal for ensuring compliance and generating revenue. Muster emphasizes organization and assembly, particularly in military or group settings, facilitating coordinated action and readiness. Choosing between levy and muster depends on whether the priority is enforcement and resource collection or structured gathering and preparation.

levy Infographic

libterm.com

libterm.com