Rhodium is a rare, silver-white transition metal known for its exceptional corrosion resistance and high reflectivity, making it invaluable in catalytic converters and jewelry plating. Its scarcity and unique properties contribute to its status as one of the most expensive precious metals in the world. Discover more about rhodium's applications, market value, and how it can impact your investments in the full article.

Table of Comparison

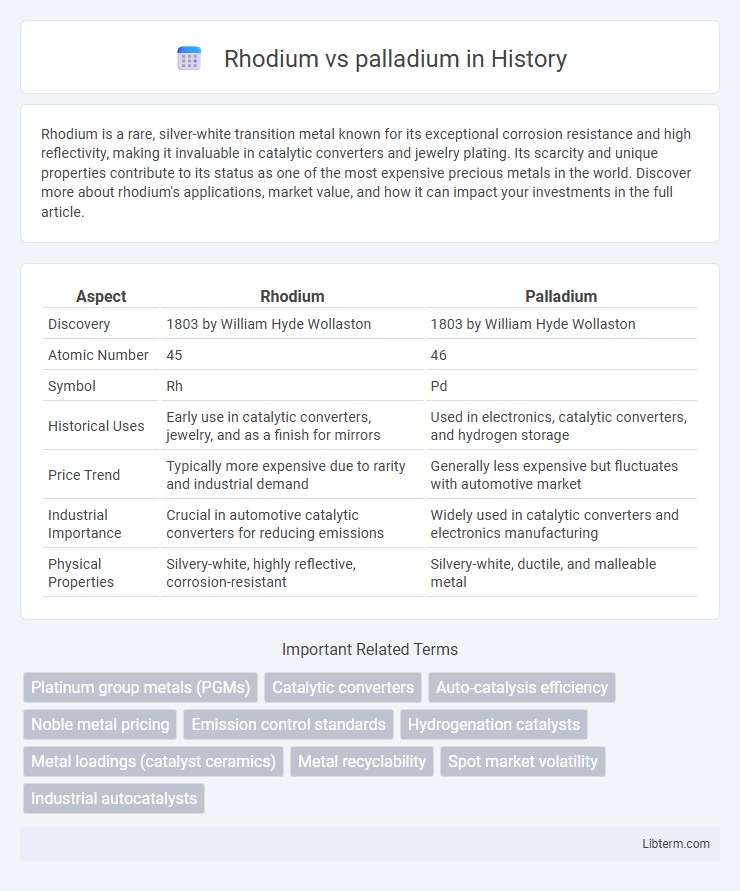

| Aspect | Rhodium | Palladium |

|---|---|---|

| Discovery | 1803 by William Hyde Wollaston | 1803 by William Hyde Wollaston |

| Atomic Number | 45 | 46 |

| Symbol | Rh | Pd |

| Historical Uses | Early use in catalytic converters, jewelry, and as a finish for mirrors | Used in electronics, catalytic converters, and hydrogen storage |

| Price Trend | Typically more expensive due to rarity and industrial demand | Generally less expensive but fluctuates with automotive market |

| Industrial Importance | Crucial in automotive catalytic converters for reducing emissions | Widely used in catalytic converters and electronics manufacturing |

| Physical Properties | Silvery-white, highly reflective, corrosion-resistant | Silvery-white, ductile, and malleable metal |

Introduction to Rhodium and Palladium

Rhodium and palladium are rare, silvery-white metals belonging to the platinum group, widely valued for their exceptional catalytic properties and resistance to corrosion. Rhodium is primarily used in automotive catalytic converters to reduce harmful emissions and in jewelry for its reflective finish, while palladium is essential in electronics, hydrogen purification, and also automotive catalysts. Both metals exhibit excellent chemical stability and high melting points, making them critical in industrial applications and investment portfolios.

Chemical and Physical Properties

Rhodium and palladium are both members of the platinum group metals with high resistance to corrosion and excellent catalytic properties. Rhodium has a higher melting point of 1964degC compared to palladium's 1554degC and exhibits greater hardness and reflectivity, making it ideal for catalytic converters and jewelry plating. Palladium is lighter, with a density of 12.0 g/cm3 versus rhodium's 12.4 g/cm3, and is more ductile, often used in hydrogen storage and electronics due to its superior absorption capacity.

Occurrence and Natural Sources

Rhodium is a rare, silvery-white transition metal primarily found in platinum ores from South Africa and Russia, often recovered as a byproduct of platinum and nickel mining. Palladium occurs naturally in the Earth's crust in much higher concentrations and is predominantly sourced from deposits in Russia's Norilsk region, South Africa, Canada, and the United States. Both metals are part of the platinum group metals (PGMs) and are typically extracted through complex refining processes due to their close association with other PGMs in sulfide ores.

Industrial and Commercial Applications

Rhodium and palladium both play critical roles in industrial and commercial sectors, primarily in automotive catalytic converters where rhodium efficiently reduces nitrogen oxide emissions and palladium facilitates oxidation of hydrocarbons and carbon monoxide. Rhodium is highly valued in the chemical industry for its exceptional resistance to corrosion and high-temperature stability, making it essential in catalytic processes and electroplating. Palladium's significant demand stems from electronics manufacturing, hydrogen storage, and fuel cells, highlighting its versatility across emerging clean energy technologies and electronic components.

Price Comparison and Market Trends

Rhodium consistently commands higher prices than palladium due to its rarity and critical use in catalytic converters, with rhodium prices often exceeding $10,000 per ounce compared to palladium's $2,000-$3,000 range. Market trends show rhodium prices are highly volatile, driven by limited supply and automotive industry demand, while palladium prices experience steadier growth supported by expanding uses in electronics and hydrogen fuel cells. Analysts anticipate sustained rhodium scarcity will maintain its premium over palladium, despite palladium's broader industrial applications boosting its long-term demand.

Catalytic Efficiency: Rhodium vs Palladium

Rhodium exhibits superior catalytic efficiency compared to palladium in many industrial applications, particularly in automotive catalytic converters where it excels at reducing nitrogen oxides (NOx) emissions. Palladium, while highly effective in catalyzing oxidation reactions such as those involving hydrocarbons and carbon monoxide, generally shows lower activity for NOx reduction than rhodium. The unique electronic structure of rhodium enhances its ability to facilitate complex redox reactions, making it a preferred choice for three-way catalysts in emission control systems.

Environmental Impact and Sustainability

Rhodium and palladium, both members of the platinum group metals, differ significantly in their environmental impact and sustainability. Rhodium extraction typically has a higher ecological footprint due to its rarity, intensive mining processes, and limited recycling rates, leading to greater habitat disruption and energy consumption. Palladium benefits from relatively more established recycling programs and less intensive extraction methods, enhancing its sustainability profile compared to rhodium in automotive catalytic converters and electronics applications.

Investment Potential and Market Demand

Rhodium offers superior investment potential due to its rarity and high demand in the automotive industry for catalytic converters, driving prices well above palladium's. Palladium remains widely used in catalytic converters and electronics, maintaining steady market demand but with a larger supply base, leading to relatively lower price volatility. Investors seeking high-risk, high-reward opportunities often prefer rhodium, while those valuing stability may choose palladium for portfolio diversification.

Extraction and Refinement Processes

Rhodium extraction primarily involves electrolytic refining of platinum-group metal ores, often derived from nickel and copper mining residues, with complex solvent extraction and precipitation techniques to isolate it due to its low crustal abundance. Palladium extraction includes smelting of nickel-copper ores and subsequent hydrometallurgical processes such as flotation, leaching, and solvent extraction, followed by electrochemical refinement to achieve high purity. Both metals require advanced purification methods like chlorination and distillation to remove impurities and obtain commercial-grade material for industrial applications.

Future Outlook: Rhodium vs Palladium

Rhodium and palladium are critical metals in the automotive and electronics industries, with rhodium's scarcity driving its price volatility while palladium benefits from broader industrial applications and supply diversification. Future demand for rhodium is expected to rise with tightening emissions standards globally, boosting its role in catalytic converters for gasoline engines, whereas palladium faces potential substitution by platinum but remains vital for fuel cell technology and electronics manufacturing. Market forecasts project rhodium's price growth due to limited mining output and increasing recycling rates, while palladium may experience moderate price stabilization influenced by evolving automotive technologies and geopolitical supply dynamics.

Rhodium Infographic

libterm.com

libterm.com