Tallage was a medieval tax imposed by lords on their tenants for various purposes, often collected without consent and varying widely in amount. This form of taxation influenced the economic structure of feudal societies and shaped the relationship between rulers and subjects. Explore the rest of the article to understand how tallage impacted medieval governance and everyday life.

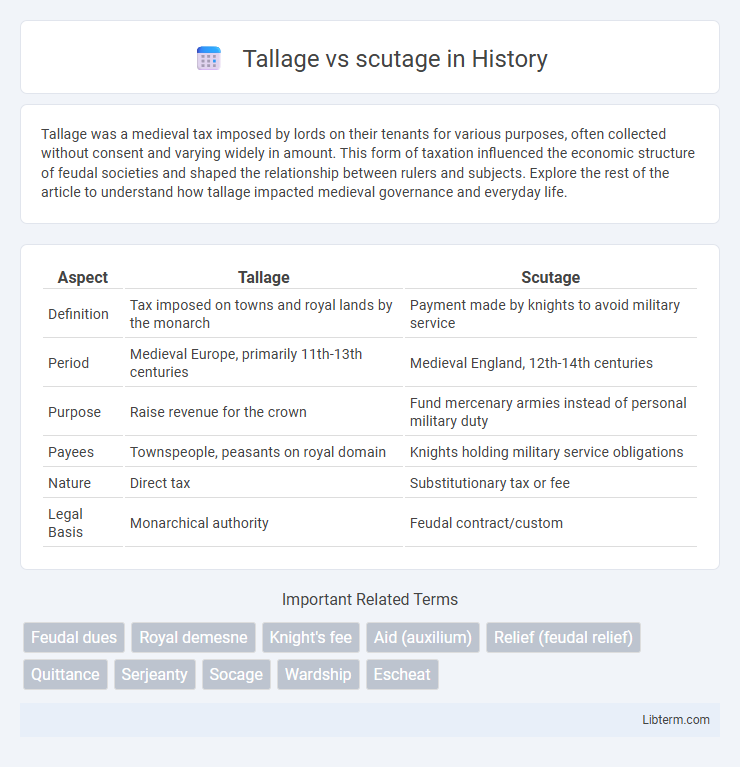

Table of Comparison

| Aspect | Tallage | Scutage |

|---|---|---|

| Definition | Tax imposed on towns and royal lands by the monarch | Payment made by knights to avoid military service |

| Period | Medieval Europe, primarily 11th-13th centuries | Medieval England, 12th-14th centuries |

| Purpose | Raise revenue for the crown | Fund mercenary armies instead of personal military duty |

| Payees | Townspeople, peasants on royal domain | Knights holding military service obligations |

| Nature | Direct tax | Substitutionary tax or fee |

| Legal Basis | Monarchical authority | Feudal contract/custom |

Introduction to Tallage and Scutage

Tallage was a medieval English tax imposed primarily on towns and royal lands, often levied without parliamentary consent, reflecting the Crown's direct authority in raising revenue. Scutage, in contrast, was a fee paid by knights to avoid military service, allowing them to outsource their feudal duty in exchange for money to the Crown. Both tallage and scutage illustrate early forms of fiscal extraction in feudal society, with tallage targeting urban and royal estates and scutage linking military obligations to monetary payments.

Historical Origins of Tallage and Scutage

Tallage, originating in medieval England, was a tax imposed by the king on towns and royal domains, primarily targeting tenants and villeins for fiscal revenue. Scutage emerged later as a feudal levy allowing knights to pay a monetary fee instead of military service, reflecting the evolving relationship between lords and vassals during the Norman and Plantagenet periods. Both taxes illustrate early forms of fiscal obligation tied to land tenure and service in the medieval feudal economy.

Definition and Purpose of Tallage

Tallage was a medieval fiscal levy imposed by the crown primarily on towns and royal demesne lands to fund royal expenses and military campaigns, reflecting the monarch's authority to extract revenues without parliamentary consent. Unlike scutage, which was a feudal payment allowing knights to avoid military service by paying a tax, tallage targeted the broader population under royal domain and served as a flexible revenue source during periods of financial need. The purpose of tallage was to generate immediate income for the sovereign, often used to support wars or maintain the royal household, highlighting its role as an arbitrary, non-consensual tax distinct from feudal obligations like scutage.

Definition and Purpose of Scutage

Tallage is a medieval tax levied by the crown on towns and royal estates, primarily in England, whereas scutage is a feudal payment made by vassals to their lords in lieu of military service. The purpose of scutage was to allow knights or tenants-in-chief to avoid personal military duty by paying a monetary fee, thereby enabling lords to hire professional soldiers or fund other military expenses. Scutage played a crucial role in the financial and military organization of feudal societies by transforming feudal obligations into cash payments.

Key Differences Between Tallage and Scutage

Tallage was a tax imposed primarily on towns and royal demesne lands in medieval England, while scutage was a feudal payment made by knights to avoid military service. Tallage was typically arbitrary and levied directly by the monarch, whereas scutage was a fixed monetary fee negotiated as an alternative to personal military duty. The key distinction lies in tallage's broader application as a fiscal tool and scutage's specific function within the feudal military system.

Socio-Economic Impact of Tallage

Tallage, a medieval tax imposed primarily on towns and royal lands, significantly influenced socio-economic structures by burdening peasantry and urban dwellers, leading to increased social tensions and constrained economic growth. Unlike scutage, which allowed knights to pay a fee instead of military service, tallage was a direct levy that often disrupted local trade and agricultural productivity by reducing disposable incomes. The frequent imposition of tallage compelled many communities to seek charters or privileges to limit such arbitrary taxation, fostering early legal and economic reforms in medieval society.

Socio-Economic Impact of Scutage

Scutage functioned as a monetary tax paid by knights to avoid military service, creating a more flexible fiscal system that allowed lords to fund professional armies rather than rely solely on feudal levies. This shift reduced the direct military burden on landholders, altering traditional feudal obligations and promoting the monetization of feudal dues, which influenced the development of more centralized governance structures. Economically, scutage enhanced royal revenues and enabled greater investment in state infrastructure, while socially it contributed to the gradual erosion of warrior-based aristocratic power in favor of administrative efficiency and economic modernization.

Tallage and Scutage in Medieval Governance

Tallage was a feudal tax imposed by medieval lords on towns and peasants, primarily in England and France, serving as a flexible revenue source for the crown or local nobility. Scutage, on the other hand, functioned as a monetary payment made by knights in lieu of military service, reflecting the evolving nature of feudal obligations and fiscal policy. Both tallage and scutage were integral to medieval governance, shaping the fiscal relationships between rulers and their subjects while contributing to the centralization of royal authority.

Decline and Abolition of Tallage and Scutage

Tallage, a medieval English tax levied on towns and royal lands, declined significantly after the 13th century due to increasing resistance from subjects and the rise of Parliament asserting control over taxation. Scutage, a feudal payment made by knights in lieu of military service, also saw a decline as military obligations evolved and the crown sought more consistent revenue through parliamentary taxation. Both tallage and scutage were eventually abolished by the Statute of Quia Emptores (1290) and subsequent legal reforms, marking a shift toward more modern fiscal systems based on parliamentary consent.

Legacy of Tallage and Scutage in Modern Taxation

Tallage, a form of feudal tax imposed on towns and royal demesnes, influenced the development of modern property and municipal taxes by establishing precedent for levying taxes based on land and possessions. Scutage, a monetary payment allowed in lieu of military service, contributed to modern concepts of commutation fees and financial substitutes for obligatory service, shaping tax systems that balance fiscal responsibility and individual obligations. The legacy of tallage and scutage is evident in contemporary taxation frameworks that blend land valuation with service commutations to create equitable revenue models.

Tallage Infographic

libterm.com

libterm.com