Danegeld was a medieval tax levied in England to pay off Viking raiders and prevent their attacks. This historical tribute significantly impacted the English economy and influenced the development of taxation systems. Discover how Danegeld shaped medieval England and affected your understanding of early taxation by reading the full article.

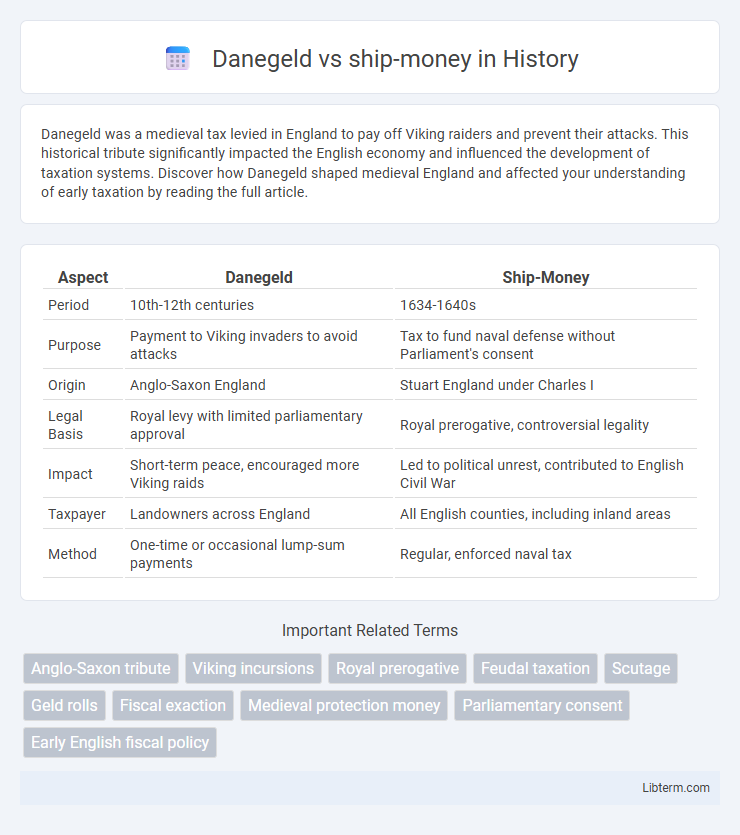

Table of Comparison

| Aspect | Danegeld | Ship-Money |

|---|---|---|

| Period | 10th-12th centuries | 1634-1640s |

| Purpose | Payment to Viking invaders to avoid attacks | Tax to fund naval defense without Parliament's consent |

| Origin | Anglo-Saxon England | Stuart England under Charles I |

| Legal Basis | Royal levy with limited parliamentary approval | Royal prerogative, controversial legality |

| Impact | Short-term peace, encouraged more Viking raids | Led to political unrest, contributed to English Civil War |

| Taxpayer | Landowners across England | All English counties, including inland areas |

| Method | One-time or occasional lump-sum payments | Regular, enforced naval tax |

Introduction: Understanding Danegeld and Ship-Money

Danegeld was a medieval tax levied primarily in England to pay off Viking invaders and ensure protection against further raids. Ship-money was a 17th-century royal tax imposed by King Charles I without parliamentary consent, aiming to fund the navy for national defense. Both forms of taxation sparked significant resistance, shaping the development of English legal and constitutional history.

Historical Context of Danegeld

Danegeld was a medieval tax imposed in England primarily during the 10th and 11th centuries to finance protection against Viking invasions, reflecting the constant threat of Norse raiders. Unlike ship-money, which emerged later under Charles I as a levy on coastal towns to fund naval defense without parliamentary consent, Danegeld was initially a form of tribute or protection money paid to avoid Viking attacks. The historical context of Danegeld underscores its role as a strategic fiscal measure rooted in the era's warfare and diplomacy, highlighting the evolving nature of taxation linked to national security.

The Origins and Purpose of Ship-Money

Ship-money originated as a medieval tax in England, originally levied on coastal towns to fund naval defense, contrasting with Danegeld, which was imposed primarily to pay off Viking invaders. Unlike Danegeld, which was a one-time tribute collected sporadically during emergencies, ship-money evolved into a regular fiscal tool aimed at strengthening the Crown's naval power. This taxation was extended inland by Charles I in the 17th century, sparking significant political controversy over royal authority and taxation without parliamentary consent.

Key Differences Between Danegeld and Ship-Money

Danegeld was a medieval tax initially imposed on English landowners to pay off Viking invaders, functioning primarily as a one-time or occasional levy for defense purposes. Ship-money evolved into a more regular and controversial tax levied by the English monarchy without parliamentary consent, aimed at funding naval defense by requiring coastal and inland counties to contribute ships or money. Unlike Danegeld's external threat focus, ship-money represented royal authority asserting fiscal power internally, contributing significantly to tensions leading up to the English Civil War.

Economic Impact on Medieval England

Danegeld, a land tax imposed on English territories, strained agricultural productivity and hindered local economies by diverting resources to pay off Viking invaders. Ship-money, initially a levy for naval defense, evolved into a controversial fiscal tool that burdened urban and rural populations, disrupting trade and provoking resistance due to its unpredictable financial demands. Both levies significantly impacted medieval England's economic stability, influencing tax reforms and contributing to social unrest during their periods of enforcement.

Political Motivations Behind Each Levy

Danegeld was a tax imposed by English monarchs primarily to fund payments to Viking raiders, aiming to secure peace and political stability through tribute rather than military confrontation. Ship-money, levied by Charles I, sought to raise emergency naval funds without parliamentary consent, reflecting a political strategy to consolidate royal authority and bypass legislative checks. Both levies illustrate the tension between monarchy and subjects, highlighting divergent approaches to fiscal control and sovereignty in medieval and early modern England.

Public Response and Resistance

The Danegeld, a tax imposed in medieval England to pay off Viking invaders, faced considerable public resentment as it was seen as a forced tribute that drained local resources without clear benefits. In contrast, Ship-Money, levied by Charles I without parliamentary consent to fund naval defenses, sparked widespread legal challenges and outright refusal, exemplified by John Hampden's notable resistance. Both levies incited significant resistance due to their perceived illegitimacy and financial burden on the populace, fueling broader dissent against royal authority.

Legal Controversies and Reforms

Danegeld, a medieval tax initially imposed to pay off Viking invaders, sparked legal controversies as it exemplified royal authority to levy extraordinary taxation without parliamentary consent, leading to demands for greater accountability. Ship-money, a 17th-century levy, intensified constitutional conflicts by extending an emergency maritime tax to inland counties, provoking resistance and landmark legal challenges such as the 1637 John Hampden case, which questioned the king's right to impose taxes without Parliament. These disputes catalyzed reforms emphasizing parliamentary control over taxation, laying groundwork for constitutional principles restricting unilateral fiscal impositions by the monarchy.

Legacy and Influence on English Taxation

Danegeld, a medieval land tax originally imposed to pay off Viking invaders, established one of the earliest forms of organized English taxation, setting a precedent for royal levies on landowners. Ship-money, later levied on coastal towns and counties for naval defense, marked a controversial expansion of royal fiscal authority without parliamentary consent, influencing constitutional debates on taxation. Both taxes underscored evolving tensions between monarchic power and subjects' rights, shaping England's legal framework for taxation and parliamentary approval.

Conclusion: Comparing Danegeld and Ship-Money

Danegeld was a medieval tax imposed primarily on landowners to fund defense against Viking invasions, while Ship-Money was a controversial levy implemented by Charles I to finance the navy without parliamentary consent. Both taxes sparked significant resistance due to their perceived illegitimacy and heavy-handed enforcement, contributing to political unrest and debates over royal authority. Ultimately, Danegeld and Ship-Money exemplify historical tensions between taxation for security purposes and the demands for lawful consent in fiscal matters.

Danegeld Infographic

libterm.com

libterm.com