Aides play a crucial role in supporting professionals across various sectors, ensuring smooth operations and enhanced productivity. They often handle administrative tasks, provide essential assistance, and contribute to effective communication within organizations. Discover how aides can transform your workflow by exploring the rest of the article.

Table of Comparison

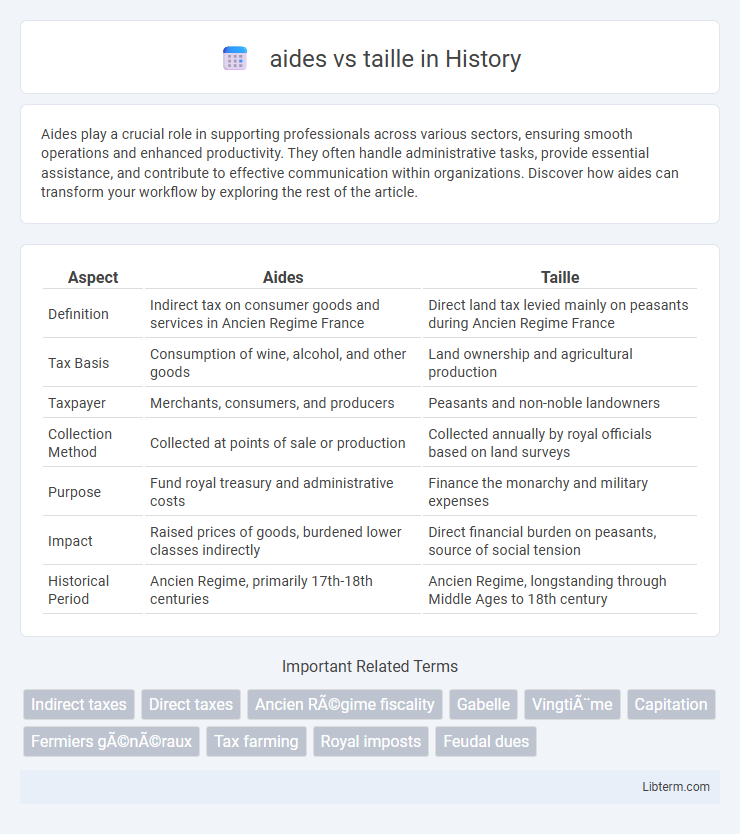

| Aspect | Aides | Taille |

|---|---|---|

| Definition | Indirect tax on consumer goods and services in Ancien Regime France | Direct land tax levied mainly on peasants during Ancien Regime France |

| Tax Basis | Consumption of wine, alcohol, and other goods | Land ownership and agricultural production |

| Taxpayer | Merchants, consumers, and producers | Peasants and non-noble landowners |

| Collection Method | Collected at points of sale or production | Collected annually by royal officials based on land surveys |

| Purpose | Fund royal treasury and administrative costs | Finance the monarchy and military expenses |

| Impact | Raised prices of goods, burdened lower classes indirectly | Direct financial burden on peasants, source of social tension |

| Historical Period | Ancien Regime, primarily 17th-18th centuries | Ancien Regime, longstanding through Middle Ages to 18th century |

Understanding Aides and Taille: Definitions

Aides were indirect taxes levied on goods such as wine and tobacco in pre-revolutionary France, primarily collected at regional borders and trading points, whereas the Taille was a direct land tax imposed mainly on the peasantry and non-noble classes. Both taxes played crucial roles in the Ancien Regime's fiscal system, with Aides reflecting consumption-based revenue and Taille representing territorial fiscal burdens. Understanding the distinctions between these taxes is essential for grasping the economic pressures on different social groups under the monarchy.

Historical Origins of Aides and Taille

The taille originated in medieval France as a direct land tax imposed on peasants to fund royal armies and administration, establishing a crucial revenue stream for the monarchy. Aides, on the other hand, were indirect taxes primarily levied on goods such as wine and salt, evolving from local tolls and market fees to become standardized fiscal tools under the Ancien Regime. Both taxes reflect the socio-economic structure of pre-revolutionary France, where fiscal burdens disproportionately affected commoners while exempting the nobility and clergy.

The Role of Aides in French Taxation

Aides in French taxation refer to the various financial incentives, such as grants, subsidies, and tax credits, designed to support businesses and individuals in reducing their overall tax burden. Taille, historically a direct land tax in pre-revolutionary France, has been replaced by modern tax mechanisms but remains integral to understanding the evolution of tax obligations. The role of aides is crucial in promoting economic development and social equity by alleviating tax pressures and encouraging investment across sectors.

Taille: Characteristics and Evolution

Taille, a direct land tax imposed primarily on the peasantry and non-nobles in France, was characterized by its uneven application and significant burden on commoners, especially during the Ancien Regime. Over time, the taille evolved from a simple fiscal tool into a symbol of social inequality, sparking widespread resentment that contributed to revolutionary sentiments. Reforms attempted to standardize its assessment and collection, but persistent exemptions for nobility and clergy entrenched its role as a contentious fiscal instrument until its abolition during the French Revolution.

Key Differences Between Aides and Taille

Aides and taille are distinct French tax forms used for different purposes: aides primarily target subsidies and financial assistance verification, whereas taille refers to a direct land tax historically imposed on commoners. Aides involve documentation related to government aid programs with eligibility criteria, while taille calculations depend on property size and land value assessments. Understanding these differences is crucial for accurate tax compliance and effective resource allocation in historical and modern financial contexts.

Social Impact of Aides vs Taille

The social impact of aides versus taille reveals significant differences in societal equity and community welfare. Aides, as voluntary contributions or subsidies, often enhance social cohesion by supporting vulnerable populations and fostering economic inclusivity. In contrast, the taille, historically a mandatory tax primarily levied on peasants, frequently exacerbated social inequalities and contributed to economic disparity within pre-revolutionary societies.

Regional Variations in Aides and Taille Collection

Regional variations in the collection of aides and taille taxes reflect distinct administrative practices and economic conditions across France. In northern provinces, aides--excise taxes on goods like salt and tobacco--were rigorously collected by specialized tax farmers, while southern regions often faced inconsistent taille assessments due to irregular cadastral surveys. These disparities influenced local fiscal burdens, contributing to economic unevenness and social unrest prior to the French Revolution.

Reforms and Abolition of Aides and Taille

The aides and taille were pivotal fiscal components in pre-revolutionary France, with the aides representing indirect taxes on goods like tobacco and wine, and the taille being a direct tax on commoners' income or land. Reforms in the 18th century sought to standardize and rationalize taxation, diminishing exemptions and increasing state revenue, but deep social inequities persisted, fueling discontent. The French Revolution led to the abolition of both aides and taille in 1790, replacing them with more egalitarian tax systems aligned with revolutionary ideals of fairness and citizenship.

Aides and Taille in Literature and Culture

Aides and taille were pivotal forms of taxation in medieval France, deeply influencing literature and cultural narratives by symbolizing royal authority and social hierarchy. Aides, indirect taxes on goods and sales, frequently appear in literary depictions highlighting merchant life and economic tension, while the taille, a direct tax on peasantry, often represents feudal oppression and class struggle in cultural works. Their representation in texts from the Renaissance to the Enlightenment reveals evolving attitudes toward fiscal policy and governance in French society.

Legacy of Aides and Taille in Modern Tax Systems

The legacy of aides and taille significantly shaped modern tax systems by introducing early forms of indirect and direct taxation, respectively. Aides were customs duties on goods, influencing contemporary value-added taxes (VAT), while the taille, a direct land tax, laid groundwork for property and income taxes. These fiscal tools exemplify the evolution from feudal levies to structured state revenue mechanisms essential for modern public finance.

aides Infographic

libterm.com

libterm.com