A tithe is traditionally understood as giving one-tenth of your income or produce as a form of religious offering or support to a faith community. This practice has historical roots in many cultures and is often seen as a way to express gratitude and sustain religious institutions. Discover more insights about the significance and application of tithing in various traditions by reading the rest of the article.

Table of Comparison

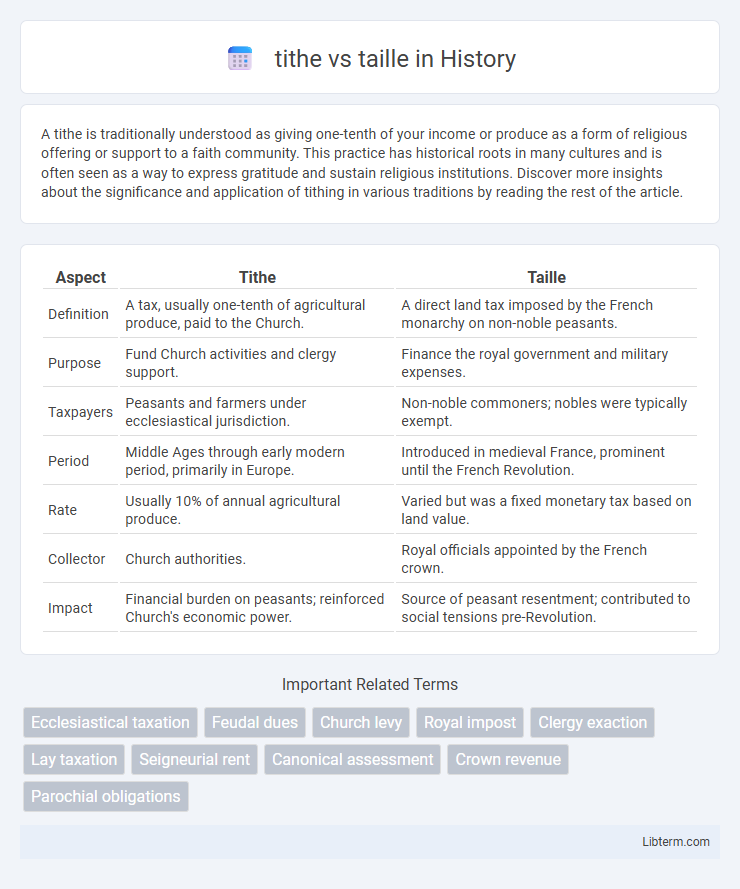

| Aspect | Tithe | Taille |

|---|---|---|

| Definition | A tax, usually one-tenth of agricultural produce, paid to the Church. | A direct land tax imposed by the French monarchy on non-noble peasants. |

| Purpose | Fund Church activities and clergy support. | Finance the royal government and military expenses. |

| Taxpayers | Peasants and farmers under ecclesiastical jurisdiction. | Non-noble commoners; nobles were typically exempt. |

| Period | Middle Ages through early modern period, primarily in Europe. | Introduced in medieval France, prominent until the French Revolution. |

| Rate | Usually 10% of annual agricultural produce. | Varied but was a fixed monetary tax based on land value. |

| Collector | Church authorities. | Royal officials appointed by the French crown. |

| Impact | Financial burden on peasants; reinforced Church's economic power. | Source of peasant resentment; contributed to social tensions pre-Revolution. |

Introduction to Tithe and Taille

The tithe was a compulsory tax in medieval Europe, typically requiring one-tenth of agricultural produce to support the Church and clergy. The taille, on the other hand, was a direct land tax imposed by the French monarchy primarily on peasants and commoners, exempting the nobility and clergy. Both taxes played crucial roles in the socio-economic structure of pre-revolutionary France, reflecting the influence of religious and royal authorities.

Historical Overview of Tithe

The tithe, a historic tax typically amounting to one-tenth of agricultural produce, was imposed primarily by the Church across medieval Europe to support clergy and religious institutions. Originating in the early Middle Ages, the tithe became a crucial source of ecclesiastical revenue, deeply influencing rural economies and social structures. In contrast, the taille was a royal direct tax imposed mainly in France on non-noble subjects, reflecting differing fiscal roles between ecclesiastical and state authorities.

Historical Overview of Taille

The taille was a direct land tax imposed in France under the Ancien Regime, primarily levied on the peasantry and non-nobles as a major source of royal revenue. Originating in the late Middle Ages, this fiscal obligation evolved from feudal dues to a more formalized state tax that helped fund the monarchy and military expenditures. Unlike the tithe, which was a church-imposed tax on agricultural produce to support the clergy, the taille specifically targeted landowners and tenants, reflecting the socio-political hierarchy of pre-revolutionary France.

Key Differences Between Tithe and Taille

The tithe was a voluntary ecclesiastical tax, typically amounting to one-tenth of a peasant's agricultural produce, paid to support the Church, whereas the taille was a mandatory royal tax imposed primarily on the peasantry and non-nobles by the French monarchy. The tithe was rooted in religious obligation and distributed for church-related expenses, while the taille was a secular fiscal instrument used to fund the state, especially military campaigns. Unlike the tithe, which varied locally and could be negotiated, the taille was standardized by royal decree but heavily resented due to its unequal burden on the lower classes.

Purpose and Usage of Tithe

The tithe was a religious levy, typically one-tenth of a person's income or produce, collected to support the Church and clergy, reinforcing the spiritual and social framework of medieval society. It served to fund charitable activities, maintain church properties, and sustain clergy livelihoods, reflecting its purpose as a sacred obligation tied to faith and community welfare. In contrast, the taille was a secular tax imposed by the monarchy, primarily aimed at financing royal expenditures and military campaigns.

Purpose and Usage of Taille

The taille was a direct land tax imposed on French peasants and non-nobles during the Ancien Regime, primarily used to fund royal expenditures and maintain the king's army. Unlike the tithe, which was a religious tax given to the Church based on agricultural produce, the taille focused on generating state revenue and strengthening centralized authority. Its usage highlighted the economic burden on commoners and contributed to social tensions leading up to the French Revolution.

Social and Economic Impact of Tithe

The tithe, a mandatory payment typically amounting to one-tenth of agricultural produce, heavily burdened peasants and reinforced feudal hierarchies by channeling wealth to the Church, exacerbating social inequality and limiting economic mobility. In contrast, the taille was a direct tax levied primarily on non-noble commoners, intensifying economic strain on lower classes and fueling widespread resentment against the monarchy. The tithe's economic impact contributed to rural impoverishment while the taille's fiscal demands destabilized social order, both taxes instrumental in fomenting pre-revolutionary tensions in France.

Social and Economic Impact of Taille

The taille was a direct land tax imposed mainly on the peasantry and non-nobles in Ancien Regime France, creating significant economic burdens that often deepened rural poverty and social stratification. Unlike the tithe, which funded the Church and was contributed by all social classes, the taille reinforced feudal hierarchies by exempting the nobility and clergy, exacerbating social inequality and fueling resentment among commoners. This tax system hindered economic development by limiting peasants' ability to invest in agricultural improvements, contributing to widespread economic stagnation and social unrest prior to the French Revolution.

Reforms and the Decline of Tithe and Taille

Reforms during the late Ancien Regime aimed to reduce the burdens of the tithe and taille, as these taxes increasingly sparked peasant unrest and financial inefficiency. The tithe, traditionally a tenth of agricultural produce given to the Church, saw a decline due to secularization efforts and increased state control over ecclesiastical revenues. Simultaneously, attempts to reform or replace the taille-- a direct land tax on the peasantry--highlighted the growing demand for a more equitable and rational tax system, contributing to the eventual erosion of both levies before the French Revolution.

Legacy of Tithe and Taille in Modern History

The tithe, a medieval ecclesiastical tax typically amounting to one-tenth of agricultural produce, heavily influenced the development of organized church financing and landownership structures in Europe. The taille, a royal direct tax primarily imposed on peasants in pre-revolutionary France, shaped the fiscal policies and social inequalities that fueled revolutionary movements. Both systems left enduring legacies in modern taxation models and state-church financial relations, highlighting the historic struggle between centralized authority and social equity.

tithe Infographic

libterm.com

libterm.com