Iqta was a land grant system used in medieval Islamic empires, where rulers assigned revenue from certain lands to military officers and officials in exchange for their services. This system helped maintain a stable administration and military by ensuring officers were compensated through local tax collection rather than direct payment. Explore the full article to understand how Iqta shaped governance and society in historical Islamic states.

Table of Comparison

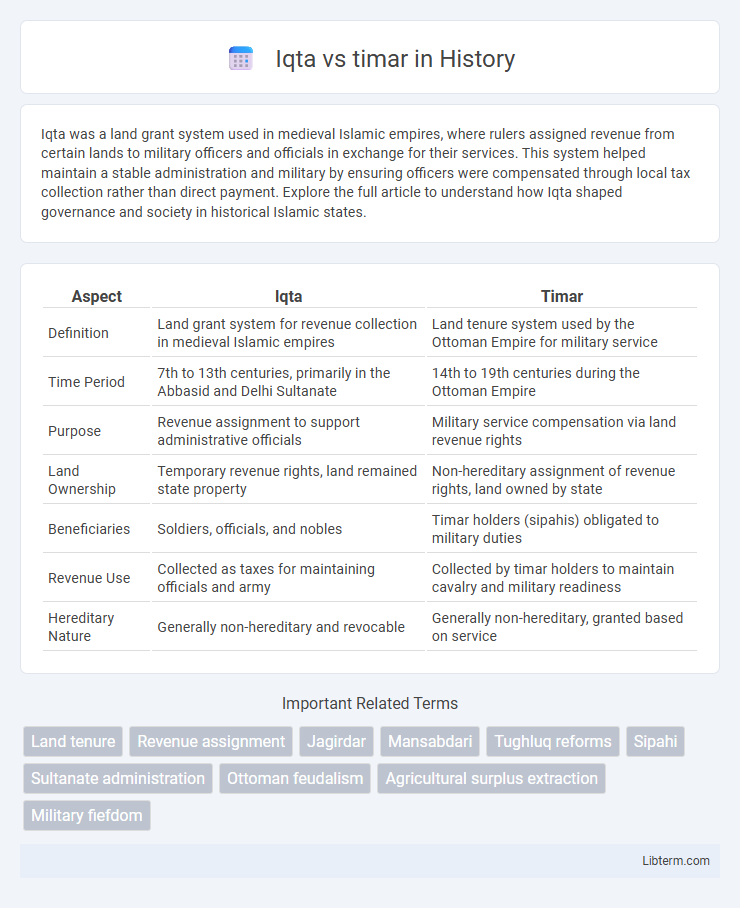

| Aspect | Iqta | Timar |

|---|---|---|

| Definition | Land grant system for revenue collection in medieval Islamic empires | Land tenure system used by the Ottoman Empire for military service |

| Time Period | 7th to 13th centuries, primarily in the Abbasid and Delhi Sultanate | 14th to 19th centuries during the Ottoman Empire |

| Purpose | Revenue assignment to support administrative officials | Military service compensation via land revenue rights |

| Land Ownership | Temporary revenue rights, land remained state property | Non-hereditary assignment of revenue rights, land owned by state |

| Beneficiaries | Soldiers, officials, and nobles | Timar holders (sipahis) obligated to military duties |

| Revenue Use | Collected as taxes for maintaining officials and army | Collected by timar holders to maintain cavalry and military readiness |

| Hereditary Nature | Generally non-hereditary and revocable | Generally non-hereditary, granted based on service |

Introduction to Iqta and Timar Systems

The Iqta and Timar systems were land grant practices used in medieval Islamic and Ottoman empires to manage agricultural revenues and military service. Iqta referred to a system where land revenues were assigned to military officers or officials as a form of payment instead of a salary, making them responsible for tax collection and local governance. Timar, specific to the Ottoman context, was a similar arrangement granting land revenues to cavalrymen (sipahis) in exchange for military service, ensuring the empire's military and administrative needs were met through decentralized land administration.

Historical Origins of Iqta and Timar

The concept of iqta originated in the Abbasid Caliphate during the 9th century as a land grant system to support military officers by allocating revenues from specific territories. Timar, developed later in the Ottoman Empire around the 14th century, was a modified form of iqta designed to maintain a cavalry-based military system by granting land revenues to sipahis (feudal cavalrymen). Both systems historically functioned as means of state revenue collection and military funding, but timar institutionalized a more structured feudal hierarchy within the Ottoman administrative framework.

Geographic Distribution and Empires

Iqta systems were predominantly utilized in the Abbasid Caliphate and later adopted by the Delhi Sultanate in South Asia, primarily in regions of the Middle East and the Indian subcontinent. Timar systems flourished within the Ottoman Empire, mainly in Anatolia, the Balkans, and parts of Eastern Europe, serving as a key administrative and military institution. Both systems allocated land revenues to military officers but were tailored to the geographic and political structures of their respective empires.

Structure and Administration of Iqta

Iqta was a land grant system used primarily in medieval Islamic governance, where land revenues were assigned to military officers or state officials without ownership rights, emphasizing centralized control and direct state supervision. The administration of Iqta involved the state retaining ultimate authority over land, and Iqta holders were responsible for collecting taxes, maintaining military forces, and ensuring order, but they could not sell or inherit the land. This system differed from Timar in the Ottoman Empire, which granted limited hereditary rights and had a more decentralized administrative framework, with Timar holders exerting greater local influence and military obligations.

Structure and Administration of Timar

Timar refers to a land grant in the Ottoman Empire given to cavalry soldiers (Sipahis) in exchange for military service, structured to provide income for maintenance and loyalty. The administration of Timar was highly centralized, with the state overseeing the allocation and ensuring that Timar holders maintained local order and collected taxes efficiently. Unlike Iqta, which was often more fragmented and irregular, Timar had a formalized hierarchy and systematic tax collection aimed at sustaining a professional standing army.

Economic Functions and Revenue Collection

Iqta and timar systems both served as land revenue assignments in medieval Islamic and Ottoman administrations but differed in economic functions and revenue collection mechanisms. The Iqta system, prevalent in the early Islamic Caliphates, allocated land revenue rights to military officers or officials in exchange for their service, where revenue collection was centralized, and taxes were used to support the army and administration directly. The timar system in the Ottoman Empire granted smaller land parcels to sipahis (cavalrymen), who collected taxes locally to maintain their military obligations, integrating revenue collection with local governance and incentivizing efficient management of agricultural production.

Military Obligations and Roles

Iqta and timar systems both allocated land revenues to military officials, but differed in scale and administrative structure. Iqta holders were often higher-ranking commanders responsible for maintaining larger contingents of troops and providing extensive military support to the sultan. Timar holders, typically lower-ranking cavalrymen, managed smaller land grants in exchange for personal military service, ensuring rapid mobilization as part of the feudal military hierarchy.

Social and Political Impact

Iqta and Timar systems both shaped medieval Islamic and Ottoman governance by decentralizing land control to military elites, fostering loyalty through land grants tied to service. Iqta, prevalent in the Islamic Caliphates, often led to autonomous local powers that sometimes challenged central authority, affecting political cohesion. Timar in the Ottoman Empire maintained tighter central control by linking land revenues directly to military duties, reinforcing hierarchical structures and facilitating administrative integration within the empire.

Similarities Between Iqta and Timar

Iqta and Timar systems both functioned as land grants in medieval Islamic and Ottoman empires, providing military officers or nobles with revenue in exchange for administrative or military service. Each system linked land revenue rights directly to the obligation of maintaining troops or local governance, ensuring decentralized military and fiscal administration. Both frameworks contributed to sustaining feudal-like structures by delegating authority through land-based compensation rather than direct salary.

Key Differences and Legacy

Iqta and Timar were both land grant systems used in Islamic and Ottoman empires for military and administrative purposes, but differed primarily in scope and administration; Iqta was a broader fiscal assignment of land revenue to military officers or officials often without ownership, whereas Timar was a specific Ottoman feudal system grant tied directly to cavalry service with more structured hereditary rights. The legacy of Iqta influenced subsequent Islamic land tenure practices and administrative divisions, whereas Timar played a foundational role in the development of the Ottoman military and feudal hierarchy, impacting the empire's socio-political structure until its decline in the 17th century. These systems shaped land revenue management and military mobilization strategies, leaving enduring influences on regional governance models in the Middle East and Southeast Europe.

Iqta Infographic

libterm.com

libterm.com