Zamindari was a traditional land revenue system in India where zamindars acted as intermediaries between the British colonial government and peasants. Zamindars collected taxes from farmers and retained a portion while forwarding the rest to the administration, often leading to exploitation and hardships for tenant farmers. Explore this article to understand how Zamindari shaped agrarian relations and its impact on rural society.

Table of Comparison

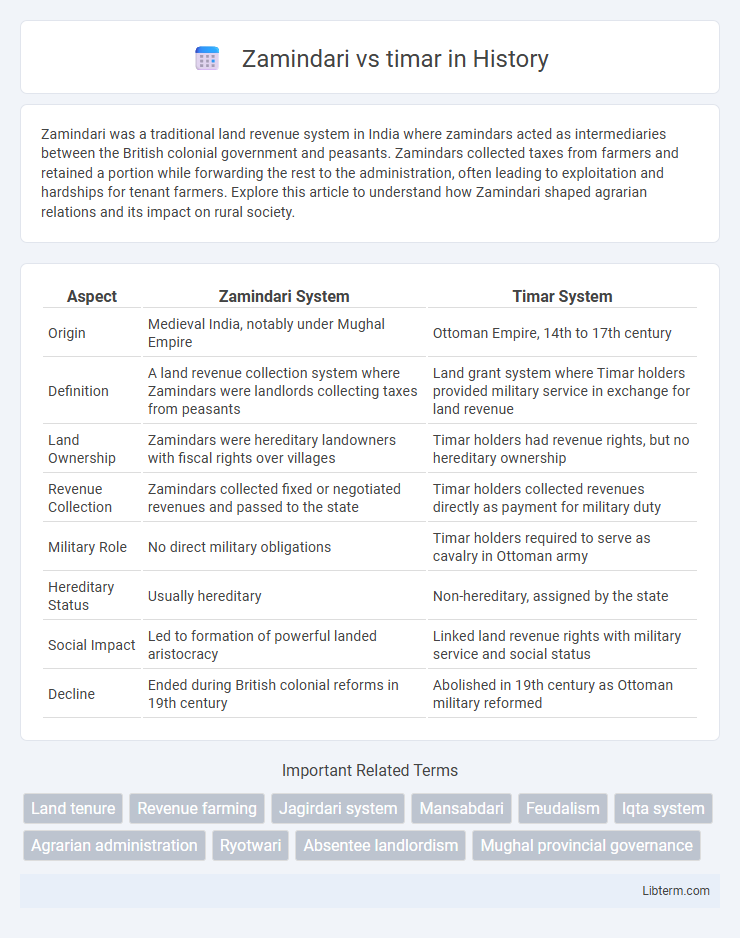

| Aspect | Zamindari System | Timar System |

|---|---|---|

| Origin | Medieval India, notably under Mughal Empire | Ottoman Empire, 14th to 17th century |

| Definition | A land revenue collection system where Zamindars were landlords collecting taxes from peasants | Land grant system where Timar holders provided military service in exchange for land revenue |

| Land Ownership | Zamindars were hereditary landowners with fiscal rights over villages | Timar holders had revenue rights, but no hereditary ownership |

| Revenue Collection | Zamindars collected fixed or negotiated revenues and passed to the state | Timar holders collected revenues directly as payment for military duty |

| Military Role | No direct military obligations | Timar holders required to serve as cavalry in Ottoman army |

| Hereditary Status | Usually hereditary | Non-hereditary, assigned by the state |

| Social Impact | Led to formation of powerful landed aristocracy | Linked land revenue rights with military service and social status |

| Decline | Ended during British colonial reforms in 19th century | Abolished in 19th century as Ottoman military reformed |

Introduction to Zamindari and Timar Systems

Zamindari and Timar systems were land revenue collection methods implemented in South Asia during different historical periods. The Zamindari system, primarily used under Mughal and British rule, involved zamindars who acted as intermediaries responsible for collecting taxes from peasants and paying fixed revenue to the state. In contrast, the Timar system was prevalent in the Ottoman Empire, where land revenues were assigned to military officers called timariots in exchange for their service, combining administrative and military functions.

Historical Origins and Evolution

Zamindari originated during the Mughal Empire as a land revenue system where zamindars acted as intermediaries collecting taxes from peasants, evolving into hereditary landlords under British colonial rule. Timar was a feudal land grant system in the Ottoman Empire, where timariots received land revenues in exchange for military service, with the system declining by the 17th century due to centralization of power. Both systems reflect distinct historical governance models tied to land revenue and military obligations, shaping agrarian relations in South Asia and the Ottoman Empire respectively.

Geographic Regions of Implementation

The Zamindari system was predominantly implemented in the Indian subcontinent, especially in regions like Bengal, Bihar, and parts of northern India during the Mughal and British periods. In contrast, the Timar system was primarily used in the Ottoman Empire, encompassing vast territories across modern-day Turkey, the Balkans, and parts of the Middle East. These geographic distinctions reflect the different administrative and feudal land tenure structures tailored to their respective imperial contexts.

Administrative Structure and Hierarchy

The Zamindari system featured a hereditary landlord class responsible for tax collection and maintaining law and order within large estates, operating under the Mughal emperor's authority but with significant autonomy at the local level. In contrast, the Timar system, primarily used in the Ottoman Empire, assigned land revenues directly to military officers called timariots, integrating land administration with military service and ensuring a hierarchical chain from the sultan down to the local cavalrymen. Zamindars often exercised fiscal and judicial powers independently, whereas timariots were bound by central Ottoman policies and regulations, reflecting distinct administrative and hierarchical frameworks in land governance.

Land Ownership and Revenue Collection

Zamindari system involved hereditary landlords who owned vast tracts of land and collected fixed revenues from peasants, often acting as intermediaries between the state and cultivators. In contrast, the Timar system assigned land revenues to military officers (timariots) as a form of service payment, without granting original ownership, and these officers collected taxes directly from peasants. Zamindars held proprietary rights and could sell or transfer land, whereas timariots had temporary rights limited to revenue collection during their tenure, reflecting differing state control and land tenure dynamics.

Rights and Responsibilities of Zamindars and Timariots

Zamindars held hereditary land rights and were responsible for collecting taxes from peasants, maintaining local law and order, and providing military support to the empire. Timariots, as feudal cavalrymen in the Timar system, were granted revenue rights from assigned land in exchange for military service and had obligations to maintain soldiers and supply troops during conflicts. Both Zamindars and Timariots exercised administrative authority, but Zamindars had broader estate management roles while Timariots' rights were tied directly to their military duties.

Impact on Peasantry and Society

The Zamindari system, prevalent in Mughal India, imposed heavy tax burdens on peasants, often leading to exploitation and reduced agricultural productivity, whereas the Timar system allowed local Timariots to collect revenue in exchange for military service, promoting a more direct relationship between peasants and administrative authorities. Under Zamindari, intermediaries frequently extracted excessive rents, causing widespread peasant indebtedness and social unrest, while the Timar system's decentralized model provided some stability and incentives for agricultural development. The contrasting impacts on society are evident as Zamindari contributed to rigid feudal hierarchies and economic disparities, while the Timar system supported a more militarized but somewhat equitable rural structure.

Economic Consequences and Efficiency

Zamindari system centralized land revenue collection in zamindars, often leading to inefficient revenue extraction and exploitation of peasants, which hampered agricultural productivity and economic growth. In contrast, the Timar system, prevalent in the Ottoman Empire, linked land revenues to military service, promoting a more direct relationship between cultivators and the state that incentivized efficient land use and stable revenue collection. The economic consequence of the Timar system was greater administrative efficiency and sustained agricultural output compared to the Zamindari system's tendency toward absentee landlordism and economic stagnation.

Comparative Analysis: Strengths and Weaknesses

Zamindari system centralized land revenue collection through hereditary landlords, ensuring steady state income but often leading to exploitation and inefficient land management. Timar system granted land revenue rights to military officers in exchange for service, fostering loyalty and local governance but causing fragmentation and inconsistent tax yields. Zamindari promoted economic stability but hindered agrarian reforms, while Timar emphasized military administration at the cost of long-term agricultural development.

Legacy and Influence on Modern Land Systems

The Zamindari system, rooted in Mughal land revenue practices, established hereditary landlords with significant control over agricultural lands, influencing modern land tenure and revenue collection frameworks in South Asia. The Timar system, utilized by the Ottoman Empire, allocated land revenues to military officers in exchange for service, shaping decentralized administrative and land management models. Both systems left enduring legacies that impacted contemporary property rights, taxation policies, and rural governance structures in their respective regions.

Zamindari Infographic

libterm.com

libterm.com