Tax regulations affect your financial planning and can significantly impact your income and investments. Understanding different types of taxes and available deductions helps you optimize your tax liability and comply with legal requirements. Explore the rest of this article to learn effective tax strategies and expert tips.

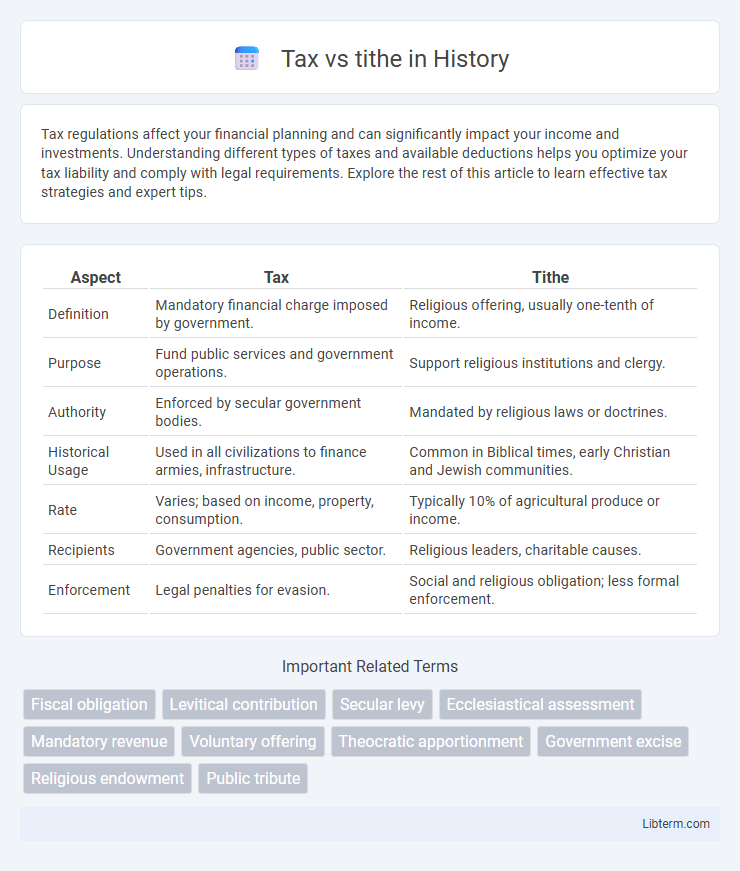

Table of Comparison

| Aspect | Tax | Tithe |

|---|---|---|

| Definition | Mandatory financial charge imposed by government. | Religious offering, usually one-tenth of income. |

| Purpose | Fund public services and government operations. | Support religious institutions and clergy. |

| Authority | Enforced by secular government bodies. | Mandated by religious laws or doctrines. |

| Historical Usage | Used in all civilizations to finance armies, infrastructure. | Common in Biblical times, early Christian and Jewish communities. |

| Rate | Varies; based on income, property, consumption. | Typically 10% of agricultural produce or income. |

| Recipients | Government agencies, public sector. | Religious leaders, charitable causes. |

| Enforcement | Legal penalties for evasion. | Social and religious obligation; less formal enforcement. |

Understanding Tax: Definition and Purpose

Tax is a mandatory financial charge imposed by governments on individuals or entities to fund public services, infrastructure, and administrative functions. It is collected based on legal requirements and varies by income, property, or transactions, ensuring the state's operational capabilities. Unlike voluntary tithes, taxes serve a broader economic purpose, supporting social programs and national development.

Tithe Explained: Origins and Significance

Tithe refers to the practice of giving one-tenth of one's income or produce, originating from ancient religious traditions where it served as a means to support clergy and maintain religious institutions. Rooted in biblical law, the tithe carried significant spiritual and communal implications, symbolizing obedience and gratitude to God. Unlike secular taxes imposed by governments for public services, tithes functioned primarily as voluntary contributions aimed at fostering religious and social welfare.

Historical Background of Taxation

The historical background of taxation traces back to ancient civilizations such as Mesopotamia, Egypt, and Rome, where rulers imposed taxes to fund public projects, armies, and administrative expenses. Unlike tithes, which were religious obligations requiring a fixed portion--typically one-tenth--of income or produce to support the church or clergy, taxes served as secular financial levies mandated by governing authorities to sustain the state. Over time, taxation systems evolved into complex structures involving income, property, and trade taxes, reflecting broader economic and political developments distinct from the spiritual purpose of tithing.

The Biblical Roots of Tithing

Tithing originates from biblical principles where believers give one-tenth of their income to support the Levites, priests, and the poor as outlined in Leviticus 27:30 and Malachi 3:10. Unlike modern taxes imposed by governments to fund public services, tithes are voluntary offerings intended for religious stewardship and community care within the faith context. The biblical tithe emphasizes spiritual obedience and trust in God's provision rather than civic obligation.

Key Differences Between Tax and Tithe

Taxes are mandatory financial charges imposed by governments on individuals and businesses to fund public services, whereas tithes are voluntary religious contributions typically amounting to ten percent of a person's income given to support religious institutions. Taxes apply universally to all applicable entities based on legal statutes, while tithes are specifically tied to religious beliefs and practices, without legal enforcement. The key difference lies in the purpose and authority: taxes are government-mandated payments for civic infrastructure and welfare, whereas tithes are faith-driven offerings for religious purposes.

Legal Obligations: Tax vs. Voluntary Tithing

Taxes are mandatory financial charges imposed by governments to fund public services and legal obligations, whereas tithing is a voluntary contribution, often a percentage of income, given to religious organizations. Legal obligations enforce tax payments with penalties for non-compliance, while tithing relies on personal faith and commitment without legal consequences. Understanding the distinction is crucial for financial planning, as taxes directly impact legal standing and public funding, whereas tithes support religious missions and community aid.

Social and Economic Implications

Taxes fund public infrastructure, social services, and government operations, promoting economic stability and wealth redistribution across society. Tithes, traditionally religious donations amounting to 10% of income, primarily support faith-based institutions and community programs, influencing social cohesion and charity within religious groups. The economic impact of taxes is broader and mandatory, whereas tithes are voluntary, often reflecting individual moral and spiritual commitments that shape social capital in religious communities.

Impact on Communities and Institutions

Taxes provide essential funding for public services such as infrastructure, education, and healthcare, thereby directly supporting community development and institutional stability. Tithes, typically voluntary contributions to religious institutions, primarily sustain faith-based organizations and charitable activities, influencing social cohesion and moral support within communities. The mandatory nature of taxes ensures broad-based resource allocation, while tithes foster localized community engagement and spiritual reinforcement.

Modern Practices: Taxation and Tithing Today

Modern taxation systems are government-mandated financial obligations used to fund public services, infrastructure, and social programs, typically calculated as a percentage of income or sales. Tithing remains a voluntary religious practice where believers contribute a portion, commonly 10%, of their income to their church or faith-based organizations to support clergy, community services, and religious activities. While taxes are legally enforced and standardized across jurisdictions, tithes are driven by personal faith and communal commitment, influencing both individual finances and nonprofit religious institutions.

Tax versus Tithe: Which is More Beneficial?

Tax and tithe serve different purposes; taxes fund public services and infrastructure essential for societal functioning, while tithes are voluntary contributions primarily aimed at supporting religious institutions and community aid. Taxes are mandatory obligations imposed by governments with legal consequences for non-compliance, whereas tithes are discretionary and often considered acts of faith or charity. Evaluating which is more beneficial depends on individual priorities--taxes provide broad societal benefits and public goods, while tithes foster spiritual growth and targeted community support.

Tax Infographic

libterm.com

libterm.com