A negative covenant restricts certain actions or behaviors to protect interests, such as prohibiting a borrower from incurring additional debt or selling assets without consent. It serves as a crucial safeguard in contracts, ensuring compliance and reducing risks for lenders and stakeholders. Discover how understanding negative covenants can benefit your financial agreements by reading the rest of this article.

Table of Comparison

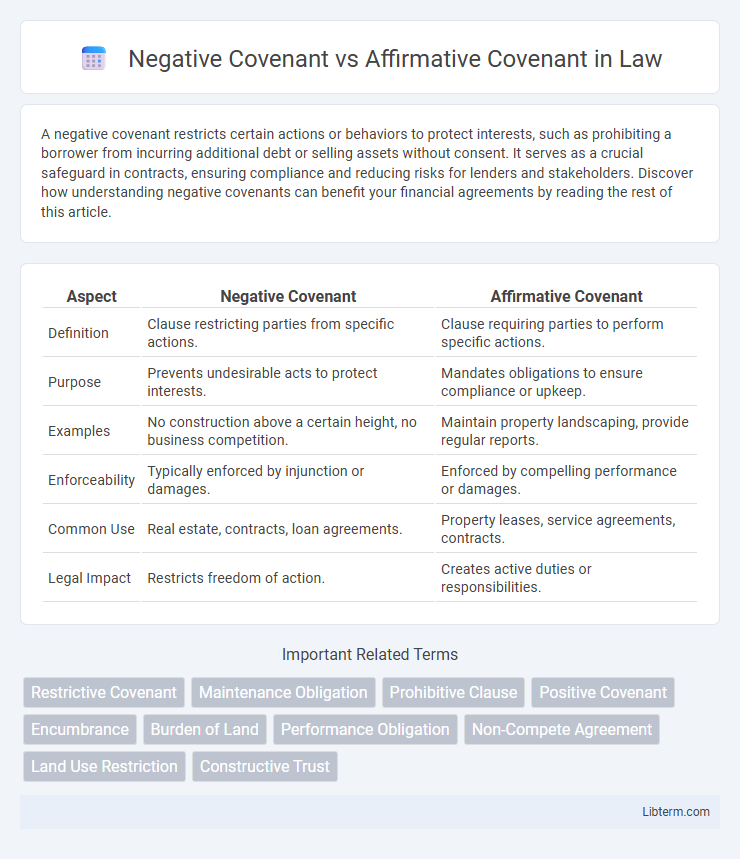

| Aspect | Negative Covenant | Affirmative Covenant |

|---|---|---|

| Definition | Clause restricting parties from specific actions. | Clause requiring parties to perform specific actions. |

| Purpose | Prevents undesirable acts to protect interests. | Mandates obligations to ensure compliance or upkeep. |

| Examples | No construction above a certain height, no business competition. | Maintain property landscaping, provide regular reports. |

| Enforceability | Typically enforced by injunction or damages. | Enforced by compelling performance or damages. |

| Common Use | Real estate, contracts, loan agreements. | Property leases, service agreements, contracts. |

| Legal Impact | Restricts freedom of action. | Creates active duties or responsibilities. |

Introduction to Negative and Affirmative Covenants

Negative covenants restrict specific actions by a party, such as limiting additional debt or asset sales, to protect lenders' interests. Affirmative covenants require the party to perform certain actions, like maintaining insurance or submitting regular financial reports, ensuring ongoing compliance and transparency. Both types of covenants are critical in loan agreements to manage risk and safeguard stakeholders.

Defining Negative Covenant

A negative covenant, also known as a restrictive covenant, is a contractual obligation that prohibits a party from engaging in specific actions, aimed at protecting the interests of the involved parties. It restricts behaviors such as selling property to competitors or altering the use of leased premises, ensuring compliance with agreed-upon terms. This contrasts with an affirmative covenant, which requires a party to perform certain duties or maintain specified conditions.

Defining Affirmative Covenant

An affirmative covenant is a legally binding obligation requiring a party to perform specific actions or uphold certain standards, ensuring compliance with agreed terms in contracts or leases. In contrast, a negative covenant restricts a party from undertaking particular activities, preventing actions that could breach agreements or cause harm. Understanding affirmative covenants is essential for enforcing proactive duties that maintain operational, financial, or environmental conditions.

Key Differences Between Negative and Affirmative Covenants

Negative covenants restrict or prohibit specific actions by a party, such as limiting additional debt or forbidding asset sales, to protect the lender's interests. Affirmative covenants require a party to perform certain actions, like maintaining insurance or providing regular financial reports, ensuring ongoing compliance and operational transparency. The key difference lies in their purpose: negative covenants prevent harmful activities, while affirmative covenants mandate proactive responsibilities.

Legal Framework Governing Covenants

Negative covenants restrict parties from certain actions, such as prohibiting the sale of property without consent, while affirmative covenants require parties to perform specific duties like maintaining common areas. The legal framework governing covenants varies by jurisdiction but typically involves contract law principles, property law regulations, and statutory provisions that enforce or limit the scope of these agreements. Courts often interpret covenants based on intent, explicit terms, and equitable considerations to ensure enforceability and fairness.

Common Examples of Negative Covenants

Negative covenants commonly include restrictions on additional debt issuance, limitations on asset sales, and prohibitions against dividend payments beyond a specified threshold, ensuring borrower financial stability. These covenants prevent actions that might jeopardize a lender's security or reduce collateral value. In contrast, affirmative covenants require the borrower to perform specific actions, such as maintaining insurance or providing regular financial reports.

Common Examples of Affirmative Covenants

Common examples of affirmative covenants include obligations to maintain property insurance, pay real estate taxes promptly, and perform regular property maintenance. These covenants ensure that the borrower upholds specific duties to protect the lender's investment, such as keeping the premises in good condition or providing financial statements regularly. Affirmative covenants contrast with negative covenants, which restrict certain borrower actions like incurring additional debt or selling assets without lender approval.

Implications for Borrowers and Lenders

Negative covenants restrict borrowers from certain actions, limiting financial risk for lenders by preventing behaviors that may threaten loan repayment. Affirmative covenants require borrowers to undertake specific actions, such as maintaining insurance or providing financial reports, ensuring lenders have ongoing assurance of the borrower's operational stability. Both covenants impact credit terms and monitoring intensity, influencing borrower flexibility and lender risk management strategies.

Enforceability and Legal Challenges

Negative covenants restrict parties from specific actions, making their enforceability dependent on clear, unambiguous language and proof of breach, often facing fewer legal challenges due to their preventative nature. Affirmative covenants require parties to perform certain actions, which can complicate enforcement because courts may need to supervise ongoing obligations and assess the adequacy of performance. Legal challenges for affirmative covenants frequently involve determining the standard of performance and potential damages, whereas negative covenants are primarily contested over scope and reasonableness.

Choosing the Right Covenant for Your Agreement

Choosing the right covenant in a legal agreement depends on the specific obligations and restrictions you want to impose. Negative covenants prohibit certain actions, such as selling assets or incurring additional debt, ensuring protection against unwanted behaviors. Affirmative covenants require parties to take specific actions, like maintaining insurance or submitting financial reports, to guarantee ongoing compliance and operational standards.

Negative Covenant Infographic

libterm.com

libterm.com