Choosing the perfect gift involves understanding the recipient's interests and preferences to create a meaningful experience. Thoughtful gifts convey appreciation and strengthen personal connections in both personal and professional relationships. Discover expert tips and creative ideas to help you find the ideal gift for every occasion by reading the full article.

Table of Comparison

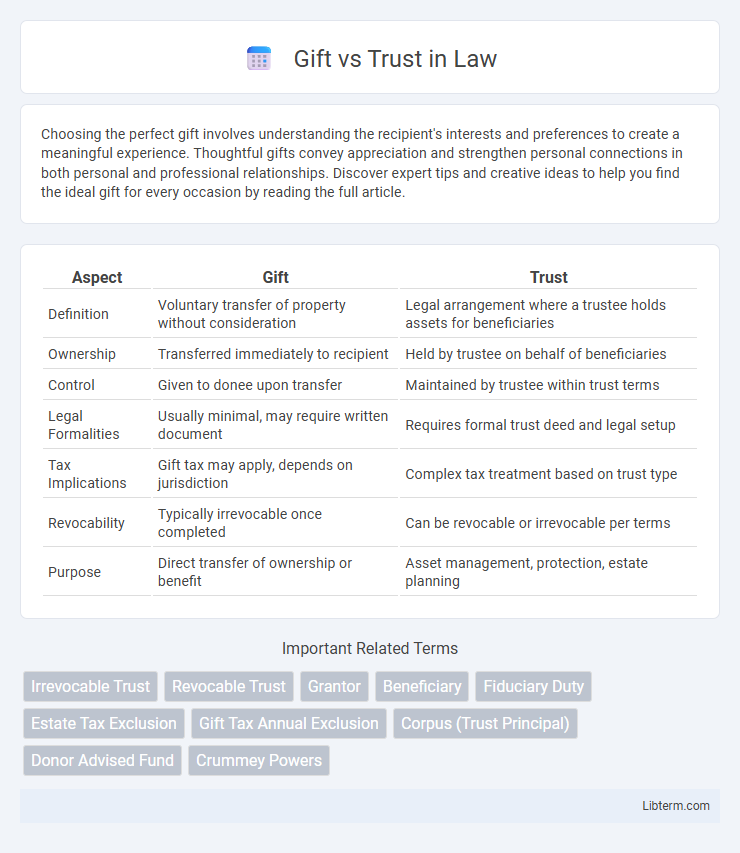

| Aspect | Gift | Trust |

|---|---|---|

| Definition | Voluntary transfer of property without consideration | Legal arrangement where a trustee holds assets for beneficiaries |

| Ownership | Transferred immediately to recipient | Held by trustee on behalf of beneficiaries |

| Control | Given to donee upon transfer | Maintained by trustee within trust terms |

| Legal Formalities | Usually minimal, may require written document | Requires formal trust deed and legal setup |

| Tax Implications | Gift tax may apply, depends on jurisdiction | Complex tax treatment based on trust type |

| Revocability | Typically irrevocable once completed | Can be revocable or irrevocable per terms |

| Purpose | Direct transfer of ownership or benefit | Asset management, protection, estate planning |

Understanding Gifts and Trusts: Key Differences

Gifts transfer ownership of assets outright to the recipient without conditions, resulting in immediate loss of control by the giver. Trusts establish a legal arrangement where a trustee manages assets for beneficiaries under specific terms, allowing for ongoing control and protection. Understanding these key differences helps in choosing the best strategy for estate planning and asset protection.

What is a Gift? Definition and Legal Implications

A gift is the voluntary transfer of property or assets from one person to another without expecting anything in return, legally recognized once delivery and acceptance occur. It requires the donor's clear intent to give, delivery of the gift, and acceptance by the recipient, establishing ownership rights immediately. Legal implications include potential tax consequences, such as gift tax, and irrevocability, meaning the donor cannot reclaim the gift once transferred.

What is a Trust? Types and Purposes

A trust is a fiduciary arrangement where a trustee holds and manages assets on behalf of beneficiaries according to the terms set by the grantor. Common types of trusts include revocable trusts, irrevocable trusts, living trusts, and testamentary trusts, each serving distinct purposes such as estate planning, asset protection, and tax minimization. Trusts are primarily used to ensure the orderly distribution of assets, protect wealth from creditors, and provide for minors or individuals with special needs.

Tax Implications: Gift vs Trust

Gifts are subject to gift tax if they exceed the annual exclusion limit of $17,000 per recipient in 2024, with any excess reducing the lifetime estate and gift tax exemption of $12.92 million. Trusts, depending on their type, may incur income tax on earnings and can offer estate tax benefits by removing assets from the taxable estate, though grantor trusts typically attribute income to the grantor. Understanding the distinct tax treatments is crucial for efficient estate planning and minimizing tax liabilities.

Control and Flexibility: Who Keeps Decision-Making Power?

Gifts transfer ownership immediately, meaning the donor relinquishes all control and decision-making power over the asset, while trusts allow the grantor to retain significant control through the appointment of trustees and specific terms. Trusts provide flexibility by enabling detailed instructions on asset management, distribution, and conditions, whereas gifts offer no such ongoing control once given. The decision-making power in trusts remains with the grantor or trustees under established guidelines, contrasting with gifts where the recipient assumes full control upon receipt.

Protection of Assets: Comparing Gifts and Trusts

Trusts offer superior protection of assets by legally separating ownership from control, shielding assets from creditors, lawsuits, and probate proceedings. Gifts transfer ownership outright, making assets vulnerable to claims from creditors or in divorce settlements. Establishing a trust, particularly irrevocable ones, helps preserve wealth by restricting access and providing structured management over asset distribution.

Transfer of Wealth: Timing and Strategy

Gifting assets during a person's lifetime allows for immediate wealth transfer and potential reduction in estate taxes, making it a strategic choice for early wealth distribution. Trusts, however, enable more controlled and flexible transfer of wealth, often deferring tax consequences and protecting assets from creditors or beneficiaries' mismanagement. Timing of transfers via gifting can reduce the taxable estate incrementally, whereas trusts provide a structured timeline for wealth disbursement aligned with specific goals or events.

Costs and Complexity: Setting Up a Gift vs a Trust

Setting up a gift typically involves minimal legal fees and straightforward documentation, making it a low-cost and simple option for transferring assets. Trusts require more extensive legal work, including drafting trust agreements and possibly ongoing administrative fees, which increases the complexity and initial costs. While gifts incur fewer upfront expenses, trusts offer greater control and protection over assets, justifying their higher setup cost for many estate planning needs.

Common Scenarios: When to Choose a Gift or a Trust

Choosing a gift is ideal for straightforward asset transfers with immediate ownership change, such as passing personal items or cash with minimal legal complexity. Trusts suit more complex scenarios involving asset management over time, protection from creditors, or conditions on inheritance, commonly used for estate planning or providing for minors. Deciding between a gift and a trust depends on factors like control, tax implications, and the need for ongoing administration.

Frequently Asked Questions about Gifts and Trusts

Gifts and trusts differ primarily in control and tax implications, with gifts transferring ownership outright while trusts manage assets on behalf of beneficiaries. Frequently asked questions center on how gifts affect estate taxes, the legal formalities for creating trusts, and the benefits of irrevocable versus revocable trusts. Understanding the differences helps in estate planning, particularly in minimizing taxes and protecting assets for future generations.

Gift Infographic

libterm.com

libterm.com